Europe Stocks Inch Lower Before ECB Meeting

21 July 2016 - 8:00PM

Dow Jones News

Stocks in Europe inched lower and U.S. futures were little

changed Thursday as investors paused following a recent rally and

waited for the European Central Bank's first policy meeting since

the U.K. voted to leave the European Union last month.

The Stoxx Europe 600 was down 0.3% recently, weighed down by

falls in airline shares. U.S. futures pointed to a 0.1% opening

loss for the S&P 500. Markets in Asia mostly gained after Wall

Street closed at record highs Wednesday.

Global stocks have been on the rise in recent weeks, fueled by a

series of data releases underlining the strength of the U.S.

economy, corporate earnings and expectations of further central

bank action following the Brexit vote.

Economists don't expect the European Central Bank to boost its

stimulus measures Thursday, but many believe officials will signal

such a move is on the cards at the bank's September meeting.

While the effects of Britain's vote to leave the EU will be

mainly felt in the U.K., a host of issues still put ECB President

Mario Draghi "in a tough position," said Carl Hammer, chief

currency strategist at Swedish bank SEB.

In addition to Brexit, Europe is dealing with a wave of recent

terror attacks, rising populism, a still-fragile economy and

concerns over the health of the Italian banking system, Mr. Hammer

said. He expects the ECB to deliver new measures in the fall.

While investors don't expect fresh measures from the ECB

Thursday, they are watching to see whether the bank loosens some of

the rules governing its quantitative easing, or QE, program amid

concerns it will soon run out of eligible assets to buy.

An asset shortage could prove a problem if the ECB wants to

boost stimulus measures at a later date. Many analysts believe

officials are reluctant to cut rates further into negative

territory over concerns about denting the profitability of Europe's

struggling banking sector.

"I don't think the ECB will cut rates much further. If they

extend easing, they will have to do it through QE," said Gareth

Colesmith, a senior portfolio manager at Insight Investment.

"The problem is they're running out of bonds," he said.

Investors in Europe were also focused on corporate earnings

releases. Airline stocks were under pressure after easyJet PLC

reported a fall in sales and Deutsche Lufthansa AG issued a profit

warning, sending shares in the latter down over 8%.

Mining shares, meanwhile, climbed following declines earlier

this week.

Attention will return later to the U.S. corporate earnings

season, with reports expected from General Motors Co., among

others.

Shares in eBay Inc. were up 6.7% in premarket trade after the

company posted its second straight quarter of sales gains after the

closing bell Wednesday. Shares in chip maker Qualcomm Inc. gained

6.7% in premarket trading after the company reported

better-than-expected sales in the latest quarter.

In currencies, the euro was flat against the dollar Thursday at

$1.1011. The buck fell over 1% against the yen to ¥ 105.9870 after

Bank of Japan Governor Haruhiko Kuroda said there was "no need and

no possibility for helicopter money," government spending funded

directly by the central bank, speaking on a prerecorded radio show

with the British Broadcasting Corporation.

The ICE U.S. Dollar Index, which measures the greenback against

a basket of currencies, fell 0.3% after hitting a four-month high

Wednesday as investors signaled a stronger expectation that the

U.S. Federal Reserve would raise interest rates this year.

The yield on the 10-year U.S. Treasury note fell slightly to

1.577% as prices rose.

Asian bourses mostly ended higher Thursday. Hong Kong's Hang

Seng Index entered bull market territory with a 0.5% rise, taking

gains to just over 20% since its mid-February low. Japan's Nikkei

Stock Average ended 0.8% higher and Australia's S&P ASX 200 was

up 0.4%.

In commodities, Brent crude oil was down 0.1% at $47.12. Gold

rose slightly to $1,321 an ounce.

Write to Christopher Whittall at

christopher.whittall@wsj.com

(END) Dow Jones Newswires

July 21, 2016 05:45 ET (09:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

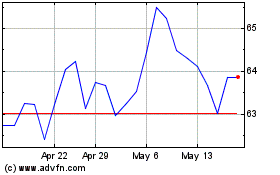

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2024 to Jan 2025

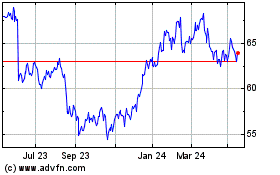

ASX (ASX:ASX)

Historical Stock Chart

From Jan 2024 to Jan 2025