Origin to Sell Oil-and Gas Operations Through IPO

06 December 2016 - 1:40PM

Dow Jones News

MELBOURNE, Australia—Origin Energy Ltd. plans to sell its

conventional oil-and-gas operations and focus on energy markets and

liquefied-natural-gas sales in an effort to further slash debt

built up investing in a massive gas-export plant in eastern

Australia.

Origin said on Tuesday it would bundle its upstream operations

into a company known for now as NewCo and sell them through an

initial public offering next year. The move would accelerate debt

reduction and reduce ongoing spending requirements, while also

lifting earnings per share in the years ahead, the Australian

company said.

Ben Wilson, an analyst at RBC Capital Markets in Sydney,

estimated the business to be floated has an enterprise value of

about A$1.6 billion-A$1.8 billion (US$1.2 billion-US$1.34 billion),

including the oil-sale liability, although there remained questions

over issues such as debt. That would position it in line with

midsize oil-and-gas company Beach Energy Ltd., which has a market

value of close to A$1.6 billion.

Speculation that Origin would split its utility businesses from

its oil-and-gas operations has heightened since former energy

markets boss Frank Calabria took over as chief executive from Grant

King in October. A sale would take advantage of a recovery in oil

prices this year, and a recent jump in prices following an

agreement by Organization of the Petroleum Exporting Countries to

reduce crude output.

"Given Origin's ability to invest capital in the NewCo assets is

constrained, their long-term value will be better supported by them

being an independent business," Chairman Gordon Cairns said.

Origin said it wouldn't retain a stake in NewCo following the

IPO and the proceeds would be used to repay debt, after closing out

of two hedging contracts to sell oil.

Origin, one of Australia's biggest energy producers and

retailers, was badly stretched by its funding of the A$24.7 billion

Australia-Pacific LNG, or APLNG, project on Australia's east coast,

one of three big operations in Queensland state that convert

methane trapped in seams of underground coal into chilled natural

gas that can be exported on tanker ships to meet the anticipated

growth in Asia's energy consumption. The start-up of the plant in

late 2015 coincided with a slump in oil prices, which underpin most

long-term LNG contracts, denting earnings for producers.

Origin had committed to further reducing net debt that was

slashed by A$4 billion to about A$9.1 billion through asset sales

and an equity raising in the year to June 30.

Origin said it has ended a planned sale of its assets in

Australia's western Perth Basin, despite interest in the

operations, and would instead add that to NewCo alongside interests

in the Otway Gas Project, BassGas Project, Kupe Gas Project, and

the Cooper, Bonaparte and Canterbury basins.

That would allow Origin to focus on a portfolio of

power-generation assets and retail businesses in eastern Australia,

as well as the APLNG project and the coal-seam gas operations that

feed it. The APLNG venture, with partners ConocoPhillips and China

Petrochemical Corp., recently began exports from a second

production line. Origin also plans to put contracts in place with

NewCo to give it access to resources to support Origin's east-coast

gas portfolio.

A listing of NewCo on the Australian Stock Exchange next year

will be subject to market conditions but won't need shareholder

approval, Origin said. It plans to release further details on its

plans in due course but said NewCo would have a sound capital

structure and diverse exposure to markets in eastern and western

Australia and in New Zealand. The operations had production in the

year through June of 75 petajoules equivalent, a measure of the

volume of different petroleum products based on energy content.

Origin appointed Macquarie Capital and UBS Group AG as joint

financial advisers and lead managers for the IPO.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 05, 2016 21:25 ET (02:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

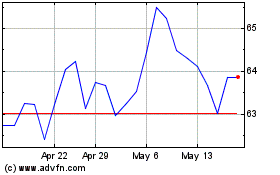

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2024 to Jan 2025

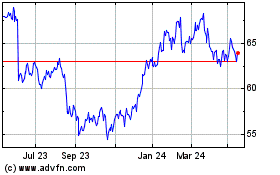

ASX (ASX:ASX)

Historical Stock Chart

From Jan 2024 to Jan 2025