Enel Sells 50% Stake in Greek Renewables Business to Macquarie for $381 Million

27 July 2023 - 12:36AM

Dow Jones News

By Adria Calatayud

Enel said Wednesday that it has signed an agreement with

Macquarie Asset Management for the sale of a 50% stake in Enel

Green Power Hellas for 345 million euros ($381.4 million) that will

help the Italian utility to cut debt.

Macquarie and Enel will enter into a shareholder agreement that

will give them joint control of EGPH to continue to develop its

project pipeline and expand its installed capacity, the Italian

company said.

The price of the deal implies a full enterprise value, including

debt, for EGPH of around EUR980 million, Enel said.

Enel expects a reduction of its consolidated net debt of around

EUR345 million and a gain of EUR390 million for its 2023 earnings

before interest, taxes, depreciation and amortization as a result

of the deal, it said.

The sale is expected to be completed by the fourth quarter of

2023, subject to regulatory approval, Enel said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 26, 2023 10:21 ET (14:21 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

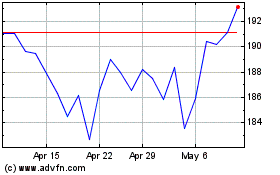

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

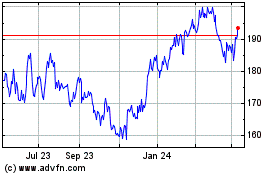

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024