Nexus Says Companies Eyeing Crux Stake; Writes Down Longtom

14 March 2012 - 5:48PM

Dow Jones News

Nexus Energy Ltd. (NXS.AU) on Wednesday said several large

companies have expressed interest in buying part of its share of

the Crux gas and liquids joint venture with Royal Dutch Shell PLC

(RDSB) offshore northern Australia.

Nexus said it has also written down the value of its Longtom gas

project offshore Victoria state following a reserves downgrade and

will take a A$163 million impairment charge in its half-year

accounts.

In January, Nexus agreed that Shell would lead an integrated gas

and liquids development of Crux in a deal that would give the

Australian oil company a 17% stake.

Signing of a binding agreement remains on track for late April,

Nexus said Wednesday.

Nexus said it "has been approached by several large energy

companies" expressing an interest in part of its stake to secure

access to long-term liquefied natural gas rights after the deal

with Shell was announced. This indicates the companies are

potential buyers of LNG from Australia, such as Asian utilities or

traders.

Shell intends to pipe gas from Crux to a floating LNG vessel to

be located above its Prelude gas field off the northwest coast of

Australia. The Prelude FLNG development aims to be the world's

first converting raw gas to a liquid at sea rather than at a

multibillion dollar onshore plant.

The downgrade of Longtom's proven and probable reserves to 137

petajoules from an original pre-production estimate of 350 PJ

includes a loss from actual production of 32 PJ. Nexus said that

while the downgrade is disappointing, it has sufficient resources

to meet supply obligations to customers.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

Ross.Kelly@dowjones.com

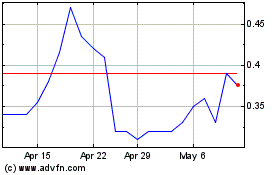

Next Science (ASX:NXS)

Historical Stock Chart

From May 2024 to Jun 2024

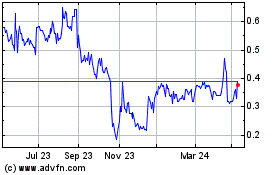

Next Science (ASX:NXS)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Next Science Limited (Australian Stock Exchange): 0 recent articles

More Nexus Energy News Articles