Australia ACCC Chairman Samuel Steps Aside From AXA APH/NAB Merger Case

18 August 2010 - 10:48AM

Dow Jones News

Australian Competition & Consumer Commission Chairman Graeme

Samuel on Wednesday stood aside from deliberations on National

Australia Bank Ltd.'s (NABZY) bid for AXA SA's (AXAHY) Asia Pacific

unit to avoid perception of conflict of interest in relation to his

family's investment in the DFO shopping center chain.

The ACCC said NAB and target AXA Asia Pacific Holdings Ltd.

(AXA.AU) have been consulted and expressed no concern at Samuel's

continuing involvement.

"However, the commission accepted Mr. Samuel's position that he

would cease to be involved in any further Commission deliberations

on the NAB/AXA merger proposal," the regulator said in a

statement.

"Mr. Samuel advised that he considered this course of action

necessary to remove any perception of a conflict of interest

arising from current issues concerning his family's investment in

the DFO shopping center chain."

The DFO shopping empire owes A$450 million to a lending

syndicate comprising NAB, St. George Bank Ltd. (SGB.AU),

Suncorp-Metway Ltd. (SUN.AU) and Bank of Scotland International,

people familiar with the situation told Dow Jones Newswires

Tuesday. The banks could appoint Korda-Mentha as receiver after

refusing to pay further credit to DFO and on Monday serving notices

expiring at midday Tuesday calling in the company's loans, one

person said.

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8272-4679;

rebecca.thurlow@dowjones.com

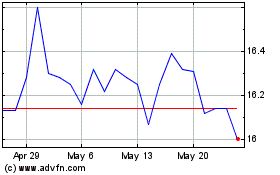

Suncorp (ASX:SUN)

Historical Stock Chart

From Apr 2024 to May 2024

Suncorp (ASX:SUN)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Suncorp Group Limited (Australian Stock Exchange): 0 recent articles

More Suncorp-Metway News Articles