Michelin Warning Drags Down Tire Makers

19 October 2018 - 7:31PM

Dow Jones News

By Nathan Allen

Shares in European tire manufacturers trade lower Friday morning

after Compagnie Generale des Etablissements Michelin (ML.FR)

lowered its outlook for the year, warning that a decline in

European and Chinese sales would continue into the fourth

quarter.

In western Europe, Michelin said demand from original equipment

manufacturers dropped 5% following the introduction of new EU

emissions standards, while Chinese demand also fell 5%, which

Michelin attributed partly to dealers using up existing stocks amid

an uncertain economic environment.

For the rest of the year Michelin expects a slight increase in

volumes and an increase of at least 200 million euros in operating

income from recurring activities, which equates to roughly 5% lower

than consensus estimates, according to Jefferies analyst Ashik

Kurian.

Mr. Kurian said the warning reflects Michelin's poor

communication with the market and failure to monitor consensus

estimates, rather than any issues with execution. The company still

has better price discipline and better potential to deliver cost

savings than its peers, he said.

Analysts at Banca IMI note the drop in Pirelli's share price

should be seen as a buying opportunity, as the Italian company's

business model somewhat insulates it from the headwinds affecting

Michelin and Continental.

At 0752 GMT Michelin was trading 7.2% lower, while Pirelli &

C. SpA (PIRC.MI) was down 1.9% and Continental AG (CON.XE) was

around 3.1% lower.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

October 19, 2018 04:16 ET (08:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

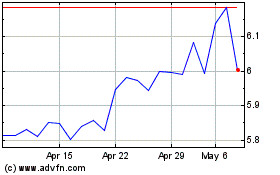

Pirelli & C (BIT:PIRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pirelli & C (BIT:PIRC)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Pirelli & C SpA (Italian Stock Exchange): 0 recent articles

More Pirelli & C News Articles