Ethereum Loses $1800 Handle – Will Bear Market Pull ETH Down Deeper?

06 June 2022 - 1:05AM

NEWSBTC

During the previous week, the price of Ethereum has stabilized

between $2,000 and $1,700. Because of this, the ETH price remained

largely unchanged compared to the last seven days and lost 2.5% of

its value. While Bitcoin has fallen below the $29K range, Ether has

lost its hold on the $1800 handle and is approaching the $1700

support level. In addition, ETH’s price behavior indicates a

significant chance of adverse repercussions that might push the

cryptocurrency’s value below $1700. If investors are unable to

defend the crucial support at $1,700, ETH is more likely to drop to

the next major level at $1,450, which is also its January 2018

all-time high. Suggested Reading | Bitcoin Seen Dropping To $22K As

Bear Market May Linger For A While When a triangle is established,

the price of the cryptocurrency will, on average, break away from

the cluster once it has traversed approximately 70 percent of the

triangle. Ethereum Bottom Still A Positive Sign Analysts believe

Ether’s bottom may be between $1700 and $1800, noting that it’s a

positive sign that the cryptocurrency’s local low is so close to

its previous ATH because, according to Former Bitmex CEO Arthur

Hayes, it indicates “a substantial amount of pain was felt.”

Similar to Bitcoin, Ethereum’s price is determined by supply and

demand on a global market. As demand exceeds supply and vice versa,

the price of ether might fluctuate in the short-term. ETH has

traditionally outperformed several traditional assets, like bond

indices and major stocks, over the long term. ETH total market cap

at $216.6 billion on the daily chart | Source: TradingView.com The

market price of Ether has been declining since the $2800 support

level was breached by sellers. In May, buyers found it difficult to

maintain a market value above $2000. In April, the selling pressure

surged tremendously. Bears Can Still Retain Control The current

price of Ether is $1,792.50, representing a movement of 0.97

percent over the past 24 hours, Coingecko charts show. Recent

Ethereum price activity has resulted in a market capitalization of

$212.6 billion dollars. Ether appears weak going forward because it

was unable to convert levels of resistance into support. Despite

the rally at the end of May, buying pressure is waning, and this

could empower bears to seize control. Suggested Reading | Bored Ape

Yacht Club Plunges By 60% Last Month Hayes repeated his optimism

that Ethereum might reach $10,000 by the end of the year,

contingent on a resumption of the bull market, notwithstanding

recent market turmoil. Meanwhile, on Friday Ethereum was

mentioned in 273,530 of 1,876,360 tweets and Reddit posts.

Approximately 157,690 unique persons are actively discussing

Ethereum, placing it in second place in terms of the most mentions

and activity from collated posts. Featured image from

InvestorPlace, chart from TradingView.com

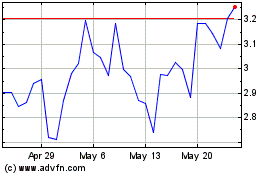

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about BOND (Cryptocurrency): 0 recent articles

More BOND News Articles