‘More Upside Is Coming’: Crypto Market Set For 350% Growth, Predicts Glassnode Cofounders

23 April 2024 - 1:00PM

NEWSBTC

Negentropic, the official X (formerly Twitter) account of

Glassnode’s cofounders, has offered its own bullish sentiment

for the crypto market. Glassnode Cofounders: There Would Be A

Massive Growth Beyond Recent Corrections According to their

analysis, the market, excluding the top 10 cryptocurrencies, known

as “OTHERS,” is showing signs of a strong uptrend with the

potential for “more upside” growth. Related Reading: Analyst

Reveals Bitcoin’s Bull Market Breakthrough: Here’s What You Need To

Know This observation amidst increased volatility and uncertainty

following the recent Bitcoin Halving event on April 20 reduced

miners’ block subsidy rewards from 6.25 BTC to 3.125 BTC. The

cofounders pointed out an intriguing pattern in the market’s

behavior, comparing the current conditions to the “strong

correction” seen in early 2021, which they identified as “wave 4”

in the market cycle. The #Crypto Bull Market Continues. “OTHERS”

follows Crypto excl. the largest 10 Cryptos. Observe that we in

early 2021 had a strong correction. We believe that was a wave 4.

We now have a similar strong decline. More upside is coming. This

index and our Fibonacci levels… pic.twitter.com/qKtIOSXneP —

𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 22, 2024 Using their index and

Fibonacci levels, Glassnode’s cofounders anticipate approximately a

350% increase from the current market levels, noting: More upside

is coming. This index and our Fibonacci levels gives us, that we

may see ~350% upside from current levels. Notably, this bullish

projection underscores their confidence in the potential for

further market expansion despite recent downturns. Crypto Market

Recovery Amid Bitcoin Criticism And Post-Halving Predictions While

the Glassnode Co-founders have predicted significant growth for the

crypto market, it’s important to note that the overall market

sentiment remains bullish. After a notable decline last week, the

global crypto market is showing signs of recovery, with nearly a 3%

increase in the past 24 hours. This upward movement can be

attributed to major cryptocurrencies like Bitcoin and Ethereum,

which have seen gains of 2.7% and 1.7% over the same period.

Bitcoin, the flagship cryptocurrency, has recently faced criticism

from prominent figures like Peter Schiff, who criticized its high

transaction fees and longer processing times. The cost to complete

a #Bitcoin transaction is now $128 and it takes a half hour to

process. This is another reason why Bitcoin can’t function as a

digital currency. The cost to actually use Bitcoin as a currency is

prohibitively high for almost all transactions. It’s a failure. —

Peter Schiff (@PeterSchiff) April 22, 2024 Due to these challenges,

Schiff labeled Bitcoin as a “failure” in terms of digital currency.

However, it’s worth noting that Bitcoin’s average transaction fee

has significantly decreased to $34.86 on April 21, following a

record high of $128.45 the day before. Meanwhile, analyst and

founder of the Capriole Investment fund Charles Edwards has shared

three possible scenarios for Bitcoin after the Halving. Edwards

highlighted the increase in Bitcoin’s electrical cost to $77,400

per new BTC coin produced, while the overall miner price, including

block rewards and fees, surged to $244,000. Related Reading: 3

Major Metrics To Watch Out For That Can Impact Ethereum Prices He

predicts that Bitcoin’s price may skyrocket, approximately 15% of

miners may shut down their operations, or transaction fees will

remain elevated. Edwards expects a combination of these scenarios

to unfold, ultimately leading to Bitcoin’s price surpassing

$100,000. Featured image from Unsplash, Chart from TradingView

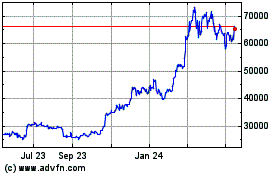

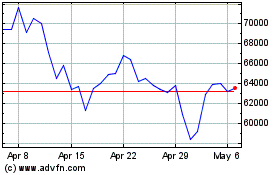

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From May 2023 to May 2024