Curve Finance Announces $1.85 Million Bounty For Stable Pool Exploiter

07 August 2023 - 10:00PM

NEWSBTC

Curve Finance, a popular decentralized (DeFi) protocol, has

recently announced that it was rewarding persons capable of

identifying the exploiters behind the draining of over $61 million

from the platform’s stable pools on July 30. The huge bounty

offer is open to every person who can pinpoint the individual

behind the incident in such a way that would lead to definitive

legal repercussions. Curve Finance Extends Bounty Offer to

the Public Curve Finance announced the public offer using an

Ethereum transaction’s input data, noting that the allowed time for

the voluntary return of the funds connected to the Curve exploit

was 08:00 UTC, and that time is now elapsed. Related Reading:

Crypto Funds Vs Bitcoin Holders: Who Was The Better Performer In H1

2023 Curve and other protocols that were affected by the attack had

previously offered a 10% bug bounty to the hacker on August 3. Upon

agreeing to the offer, the hacker returned part of the stolen

assets to JPEGd and Alchemix but did not refund other affected

pools. Since the time allowed has elapsed, Curve announced

that any person capable of identifying the hacker would receive

assets worth $1.85 million. This recent announcement was extended

in scope to include members of the general public. According

to Curve, while the deadline for the voluntary return of stolen

funds had passed, should the hacker elect to return the stolen

funds, the platform “…will not pursue this further.” While

returning the parts of the funds earlier, the hacker left a message

that was seemingly targeted at Curve and Alchemix teams, noting

their intention to return the funds. However, the hacker stated

that the decision to return such funds was not based on fear of

being recognized but rather out of a desire not to “ruin” the

projects associated with the exploit. CRV price stalls at $0.61

following exploit | Source: CRVUSD on Tradingview.com The $61

Million Reentrancy Attack Members of the Curve Finance community

were left shocked after a hacker utilized vulnerable versions of

the Vyper programming language to implement reentrancy attacks on

stable pools within Curve Finance on the 31st of July. The

attack drained Curve Finance of over $61 million, including $13.6

million from Alchemix’s aIETH-ETH, $11.4 million from JPEGd’s

pETH-ETH, and $1.6 million from Metronome’s sETH-ETH. The event

raised concerns about the likely fallout in the cryptocurrency

ecosystem, especially with respect to the risks posed to every pool

using Wrapped Ether (WETH). Related Reading: Ethereum ETF Race Gets

Hotter As SEC Receives 11 Filings In One Week The DeFi community

rallied around to provide support to Curve Finance and on the 31st

of July, a white hat hacker was able to successfully recover from

the exploiter about 2,879 Ether worth about $5.4 million, which was

later returned to Curve Finance. Another ethical hacker also

recovered about 3,000 ETH and refunded it to Curve Finance’s

deployer address. Featured image from Zipmex, chart from

Tradingview.com

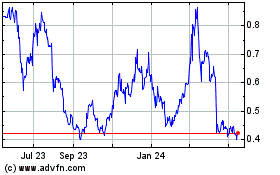

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

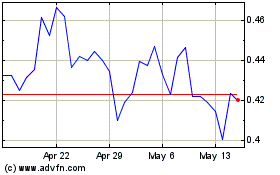

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024