Alarm Bells Ring For Dogecoin: Bearish Signal Points To 40% Crash

29 April 2024 - 5:50PM

NEWSBTC

Crypto analyst Josh Olszewicz is once again warning of a looming

Dogecoin price crash. The analysis hinges on the Ichimoku Cloud, a

comprehensive indicator that provides information on

support/resistance levels, momentum, and trend

direction. Olszewicz’s analysis points to two specific

technical phenomena on the 1-day (1D) chart of DOGE against the US

dollar (DOGE/USD). Via X, he remarked “1D DOGE: bearish TK cross +

bearish Kumo breakout. Bearish Signals For Dogecoin The bearish TK

cross refers to the bearish crossover between the Tenkan-Sen

(conversion line) and the Kijun-Sen (baseline) within the Ichimoku

Cloud system. The Tenkan-Sen, which is a faster-moving line

typically calculated as the midpoint of the highest high and lowest

low over the last nine periods, crossing below the Kijun-Sen, a

slower line computed as the midpoint of the highest high and the

lowest low over the past 26 periods, is considered a bearish

signal. It suggests that short-term prices are falling below the

base level of prices over the last month, indicating potential

further downward movement. The Bearish Kumo breakout: The ‘Kumo’,

which translates to ‘cloud’, is part of the Ichimoku Cloud

indicator and is formed between two other lines: the Senkou Span A

and the Senkou Span B. It represents a key area on the chart that

can act as support or resistance. In the context of Olszewicz’s

analysis, a ‘bearish Kumo breakout’ implies that the price has

broken through the cloud downwards. This breakout is seen as a

confirmation of a bearish trend. The fact that the price is below

the Kumo suggests that the overall market sentiment for DOGE is

negative, with the Kumo now likely acting as resistance to any

upward price movement. The chart by Olszewicz shows DOGE trading at

$0.15 with the cloud plotted behind the price action, appearing

green above and red below the price lines. The cloud turning green

represents a bullish future potential, but the price below both the

cloud and the Tenkan-Sen/Kijun-Sen crossover indicates bearish

current circumstances. A 40% Price Crash Looming? This gives weight

to Olszewicz previous DOGE price analysis. As NewsBTC reported, the

crypto analyst warned of a potential Head and Shoulders (H&S)

formation on the DOGE/USD 12-hour chart which could be validated

soon. The formation is characterized by two shoulders flanking a

distinctive head, with the neckline at approximately $0.14 being

pivotal. Should Dogecoin’s price break below this critical support,

the prophecy of the H&S pattern would likely manifest,

potentially triggering a sell-off towards the $0.10 to $0.09

region. This target area aligns with the 1.618 and 2.0 Fibonacci

extension levels, suggesting a price crash of around 40% from the

neckline. While the pattern has not yet been confirmed, with the

price still above the crucial $0.14 support level, its presence

serves as a cautionary signal to the market. The technical

confluence of the bearish TK cross and the bearish Kumo breakout in

Olszewicz’s recent analysis only reinforces the possible bearish

scenario that lies ahead for Dogecoin. Market participants are

recommended to keep a close watch on the $0.14 level, as a decisive

break below could validate the bearish outlook and set the stage

for the anticipated decline. At press time, DOGE traded at $0.1413.

Featured image created with DALL·E, chart from TradingView.com

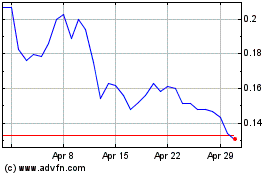

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024