Ripple Report Foresees Blockchain Saving Financial Institutions $10 Billion By 2030

30 July 2023 - 10:54PM

NEWSBTC

Blockchain technology is continually reshaping the financial

industry, offering promising transformations in transaction

processing. Its potential is immense, as outlined in a recent

report by digital payment network Ripple in collaboration with the

United States Faster Payments Council (FPC). The report presents a

robust case for blockchain’s role in expediting payment systems and

the ensuing cost savings. But is the financial sector ready to

embrace this emerging technology on a large scale? Related Reading:

Ripple Attorney Withdraws From SEC Lawsuit, Will It Affect XRP?

Financial Institutions To Embrace Faster Payment Systems With

Blockchain The survey, which received inputs from 300 finance

professionals spanning 45 countries, sheds light on the growing

consensus about the advantages of blockchain. It illustrates a

palpable shift in the perception of this technology across sectors

including fintech, banking, retail, consumer technology, and media.

Results show that global payments leaders are dissatisfied with

legacy rails for cross-border payments. Learn why 97% believe

#blockchain and #crypto will transform the way money moves in our

latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR

pic.twitter.com/ForjM05Wbb — Ripple (@Ripple) July 28, 2023 The

majority of the surveyed professionals, comprising analysts,

directors, and CEOs, strongly assert the potential of

blockchain. Approximately 97% are confident that blockchain

technology will be instrumental in expediting payment processes

over the upcoming three years This widely-held conviction

underscores the positive outlook toward blockchain, indicating a

readiness to welcome its disruptive capabilities. A Catalyst For

Cost-Efficiency In Cross-Border Transactions? Furthermore, the

report highlights the cost-saving potential of cryptocurrencies.

More than half of the respondents agreed that cryptocurrencies

could significantly reduce payment costs, both domestically and

internationally. The report predicts that blockchain’s application

in global transactions could save financial institutions an

estimated $10 billion in cross-border payment costs by 2030,

substantiated by findings from fintech analysis firm, Juniper

Research. With the rapid growth of e-commerce and businesses

looking to penetrate international markets, the report anticipates

a surge in cross-border payments. It estimates global cross-border

payment flows could reach roughly $156 trillion by 2030, buoyed by

a compound annual growth rate (CAGR) of 5%. Despite the optimistic

views, the survey revealed a divide in opinions regarding the

timeline for widespread merchant adoption of digital currency

payments. About 50% of the respondents were optimistic about

significant merchant adoption within the next three years. However,

predictions varied for the likelihood of adoption within the next

year, with the Middle East and African regions exhibiting the most

confidence and Asia-Pacific the least. Related Reading: XRP

Overtakes Bitcoin In Highest Weekly Trading Volume Following Legal

Triumph Particularly, 27% of respondents from the Middle East

and African regions anticipate that a majority of vendors will

adopt cryptocurrency payments in the following year. While a

mere 13% of the Asia-Pacific (APAC) region forecasted the same

transition period. Regardless, over the past 24 hours, XRP

has shown a slight uptrend up by 0.7% with a trading price of

$0.71, at the time of writing. This price action comes after the

asset experienced a 4.1% decline in the past week. Featured image

from iStock, chart from TradingView

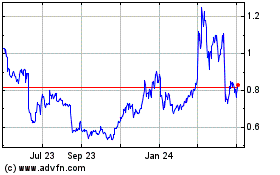

EOS (COIN:EOSUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOS (COIN:EOSUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024