Bullish On Ethereum: Analyst Predicts Crypto’s Imminent Takeoff

14 May 2024 - 10:30PM

NEWSBTC

Ethereum (ETH), the world’s second-largest cryptocurrency by market

capitalization, has been a rollercoaster ride for investors lately.

After dipping below $2,820, it surged to over $3,200, only to

retrace some of those gains. However, analysts remain optimistic,

citing technical indicators and a key regulatory decision on the

horizon as potential catalysts for a near-term price increase.

Related Reading: Investment Firm Makes Bitcoin Its Strategic

Reserve – Impact On Price Ethereum Price Poised For A Breakout?

Technical analysts are pointing to bullish signals suggesting a

potential bounce back for Ethereum. Analyst Titan Of Crypto

believes a successful “Bullish Cypher Pattern” has played out, with

all projected targets met. Currently, Ethereum sits at a pivotal

support level, the 38.2% Fibonacci retracement, often seen as a

springboard for upward momentum in bull markets. #Altcoins

#Ethereum Bounce incoming. The Bullish Cypher Pattern played out

perfectly and all the targets got reached 🎯.#ETH is currently at

the 38.2% Fibonacci retrace level also called “1st stop”. In a bull

market this level holds. I expect a bounce from this level. 🚀

pic.twitter.com/o9e6VLEREz — Titan of Crypto (@Washigorira) May 12,

2024 This level has historically acted as a crucial support zone,

says Titan. An optimistic outlook anticipates a price rebound from

here. Adding to the bullish sentiment, analyst JACKIS emphasizes

the significance of Ethereum’s recent surge above $4,000 in March.

This, according to JACKIS, represents a significant shift in the

market structure towards a long-term uptrend. THE GIGANTIC CRASH

for #ETH isn’t coming Here is a reality check: We are in a big HTF

range for #Ethereum and with the push to 4K in March we have broken

🗝️ market structure to the upside Also, the local Weekly MS leading

into it remains bullish, marked on the chart with HL…

pic.twitter.com/QisXiDUXxr — JACKIS (@i_am_jackis) May 13, 2024 The

SEC Decision: A Potential Game Changer The price of Ethereum could

receive a significant boost from an upcoming decision by the U.S.

Securities and Exchange Commission (SEC). By May 25th, the SEC is

expected to rule on three applications for Ethereum-based

Exchange-Traded Funds (ETFs). A green light from the SEC for these

ETFs would open the door for institutional investment into

Ethereum, potentially leading to a surge in demand and price.

Conversely, a rejection could dampen investor sentiment and trigger

a pullback. Related Reading: On A Tear: Toncoin Outshines Bitcoin

With Price Surge And Social Buzz Local Market Structure Hints At

Underlying Bullishness A closer look at Ethereum’s weekly chart

reveals a bullish undercurrent despite the recent price dip. The

presence of higher lows and higher Highs throughout the past few

weeks indicates a healthy uptrend, with the current pullback seen

as a natural consolidation phase. Featured image from defense.gov,

chart from TradingView

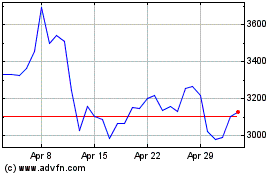

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From May 2023 to May 2024