Bitcoin Realized Cap At All-Time High As Price Hits $77,000 For The First Time

10 November 2024 - 1:00AM

NEWSBTC

The Bitcoin price and the entire crypto market have been on a tear

since the outcome of the United States elections was announced in

the early hours of Wednesday, November 6. The premier

cryptocurrency specifically has breached and printed new all-time

high prices over the past few days. Interestingly, the price of BTC

has shown no signs of weakness going into the weekend, with the

market leader forging a new record high above $77,000 on Friday,

November 8. While the hot streak of the Bitcoin price can be

attributed to the latest victory of former president Donald Trump

in the US, on-chain data suggests that this rally has been a long

time coming. BTC’s Realized Cap Experiences Largest Increase In Two

Years One of the latest on-chain metrics to offer an interesting

insight into the meteoric rise of Bitcoin’s price is the realized

cap indicator. In a November 8 post on the X platform, blockchain

analytics firm Glassnode revealed that Bitcoin’s realized cap

recently reached a new all-time high of $656 billion. Related

Reading: Dogecoin Price Forecast: Analyst Says Downside Is

Minimized As 1M, 3M, And 6M Candles Turn Bullish For clarity, the

realized cap metric measured the value of each Bitcoin as at the

last time they were transacted. This offers a more interesting way

to evaluate the cost basis (the time in which the coins changed

hands) as opposed to the regular market capitalization, which is

derived by multiplying the total number of circulating coins by the

current market price. Data from Glassnode shows that the Bitcoin

realized cap witnessed a 3.8% upswing in the past 30 days, which

represents one of the metric’s largest increases since January

2023. As shown in the chart below, this metric has been

experiencing positive growth since the start of the year, as the

30-day net change has mostly been green. It is worth mentioning

that the realized cap metric also represents the amount of capital

flowing in and out of the flagship cryptocurrency. The latest

increase reflects a net capital inflow of over $2.5 billion in the

past month, suggesting the entry of new investors — both retail and

institutional investors. With the realized cap and Bitcoin price

consolidating over the past few months, a sudden increase of the

former to $656 billion suggests that the premier cryptocurrency

might be moving from the “reaccumulation” phase to a markup phase.

Ultimately, a continuation of the capital inflow trend could

sustain the increase in the Bitcoin price over the next couple of

months. Bitcoin Price At A Glance As of this writing, the price of

Bitcoin is valued at around $76,700, having lost its hold above the

historical $77,000 level. According to CoinGecko data, the market

leader is up by an impressive 10% in the past week. Related

Reading: Ethereum Analyst Sees Altseason Potential As BTS Is Still

Outpacing ETH – Time To Buy Altcoins? Featured image created by

Dall.E, chart from TradingView

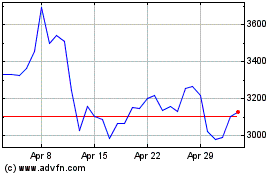

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024