Bitcoin Flows To Binance Hit Historic Lows—Is Market Confidence Soaring?

30 November 2024 - 9:30PM

NEWSBTC

The Bitcoin market continues to sees major shift, with recent data

showing significant changes in trader behaviour. A CryptoQuant

analyst, Joao Wedson, has recently highlighted an important trend

concerning Bitcoin (BTC) flows between exchanges. Specifically,

Bitcoin transfers from other exchanges to Binance have reached

historic lows. This shift, as seen in the Exchange to Exchange Flow

metric, marks a potentially positive transformation in the market,

reflecting “increased stability and confidence.” Related Reading:

Pantera’s Vision: Bitcoin Fund Forecasts $740,000 Price Tag By

April 2028 Bitcoin Exchange Flows Hit Historic Lows: What This

Means for the Market It is worth noting that this trend of reduced

flow of Bitcoin into an exchange like Binance is quite notable

given Binance’s position as the largest cryptocurrency exchange by

global trading volume. Wedson attributed this trend to several key

factors. Firstly, the analyst mentioned that “liquidity

consolidation” on Binance is a major driver. As the dominant

exchange in terms of trading volume, Binance eliminates the need

for traders to transfer assets from other platforms to access

liquidity. Wedson noted that this simplification appeals to many

market participants who now prefer to operate directly on Binance

without inter-exchange movements. Secondly, the rise of stablecoins

like Tether (USDT) and USD Coin (USDC) has reduced Bitcoin’s role

as an intermediary asset for exchange transfers. In the past, BTC

was commonly used as a bridge currency. However, stablecoins,

offering lower volatility and transaction costs, are now the

preferred choice for such transactions, further decreasing the

reliance on Bitcoin. Lastly, the analyst attributed the reduced

flow of Bitcoin to Binance to “growing confidence in both Binance

and the broader cryptocurrency market.” Wedson wrote: Historically,

during dump scenarios, large amounts of BTC were sent to Binance,

signaling panic and mass selling. Today, this reduced flow likely

reflects greater investor confidence in Binance and the market

overall. Why Is This Positive? The historic low in Bitcoin exchange

flows to Binance has broader implications for the crypto ecosystem.

As the crypto analyst highlighted, the reduced movement of BTC

during price drops suggests less panic-driven activity among

investors. $BTC Flow from All Exchanges to Binance Hits Historic

Lows “This drop in the indicator is not a sign of weakness but

rather a reflection of market stability and confidence in Binance

as the leading global exchange.” – By @joao_wedson Read more

👇https://t.co/3mHT5OhsvH pic.twitter.com/EH3jAXZpM1 —

CryptoQuant.com (@cryptoquant_com) November 29, 2024 This behavior

may indicate a more informed and experienced investor base, which

bodes well for the long-term stability of the cryptocurrency

market. Related Reading: Bitcoin Price Rejection At $99,000:

Temporary Or End Of The Bull Rally? Wedson added another point,

noting: Strengthening the Ecosystem: Binance is solidifying its

position as a hub for traders, reducing the need for inter-exchange

transfers. Featured image created With DALL-E, Chart from

TradingView

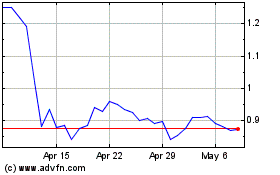

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024