Alameda-Backed Tokens Suffer As FTT Fights To Stay Alive

10 November 2022 - 4:00AM

NEWSBTC

In the wake of the FTX decline, the official token of the crypto

exchange, FTT Token, has suffered a massive blow in the market. In

the three days since Binance’s announced its intention to sell off

its FTT, the token has recorded double-digit losses. However, the

losses have not just been localized to one token, the general

crypto market has suffered for it, but the worst of it has been

reserved for the tokens Alameda Research has invested in. FTT Token

Slumps In what has been a shocking development for the entire

crypto space at large, FTT Token has crashed more than 80% in a

matter of days. The token which was backed by the 2nd largest

crypto exchange has continued to suffer significant setbacks. In

just the last 24 hours alone, the price of FTT is down more than

70%. The token is now trading at levels not seen since 2020. It has

now also hit a new two-year low, making it one of the

worst-performing coins of 2022. Related Reading: Institutional

Outflows From Bitcoin Paints Bearish Picture For Crypto Market The

decline looks eerily similar to that of the LUNA token following

the collapse of the Terra network. In the same vein, the

cryptocurrency has lost billions of dollars off its market cap and

is currently sitting at a fully diluted market cap of $1.5 billion.

FTT token trading at $4.459 | Source: FTTUSD on TradingView.com

Interestingly, the trading volume of FTT is up over 130% in the

last 24 hours as traders try to take advantage of the token. Short

traders have obviously enjoyed the most profit from their

activities as FTT’s price dropped from $19 to $3 in a matter of

hours. Alameda Tokens Not Left Out Alameda Research was one of the

most active firms when it comes to crypto investments, which means

they had their hands in a lot of pots in the space. As FTX is being

brought to its knees, these other tokens have felt the impact of

such a collapse. Solana (SOL) which Alameda is vocally a backer of

has been hit the worst of all tokens besides FTT that the firm

holds. In the last 24 hours alone, SOL price is down more than 34%.

The same is the case for Lido DAO (LDO) which has declined 23% in

the last day. Related Reading: Bitcoin’s Decline Below

$20,000 Proves The Bottom Is Not In Alameda reportedly holds 100

million BitDAO (BIT) tokens and the coin is down 15% in the last 24

hours. 1inch Network has also suffered a similar fate, although to

a lesser extent with only 7% in losses in the last day. All DeFi

protocols that Alameda is invested in including MobileCoin, Serum,

and Liquidity are mostly down double-digits as well. FTX was an

investor in the recently launched Aptos blockchain and the token

has not been left out of the bloodbath. APT is down 30% in the last

day as its price has declined to $4.47 at the time of this

writing. Featured image from Currency.com, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

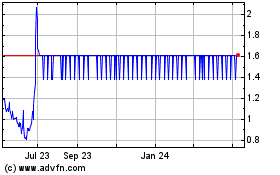

FTX Token (COIN:FTTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

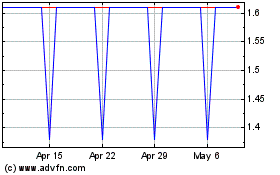

FTX Token (COIN:FTTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024