Rising Stars: Report Highlights 5 Solana Projects Set For Success In 2024

26 January 2024 - 9:30AM

NEWSBTC

Solana has been on a downward trend over the past week, following a

surge from multi-year low levels. The token suffered when its

biggest promoter, crypto exchange FTX, fell, but the ecosystem

continued to thrive, leading to the high timeframe recovery.

Related Reading: Solana Price Soars By 11% – Here’s Why As of this

writing, Solana’s native token SOL trades at $87 with a 2% profit

over the past 24 hours. Over the previous seven days, the

cryptocurrency records a 12% correction. Rising Stars In The Solana

Landscape According to a report from Coingecko, the Solana network

is witnessing a resurgence fueled by its recovery in the

cryptocurrency market, notable reductions in network outages, and a

series of positive developments. This rejuvenation has drawn the

attention of investors and developers and led to a surge in the

adoption of existing projects within its ecosystem. Specific

projects stand out among these, poised to shape the future of

decentralized finance (DeFi) and non-fungible tokens (NFTs) on

Solana, Coingecko claims. Decentralized exchanges (DEXs) such as

Jupiter, Orca, and Drift are at the forefront of Solana’s

innovation. Jupiter is “transforming” the landscape with its

limit-order decentralized swap services, offering a DEX aggregator

to ensure users get the optimal price offers. The chart below shows

that its daily trading volume, involving around 90,000 unique

wallets, has reached an average of $400 million. Orca, another DEX,

has a concentrated liquidity feature, Whirlpools, which enhances

returns for liquidity providers and reduces slippage for traders.

With a total value of approximately $185 million, Orca’s

community-driven governance model is another selling point to

attract new users in the coming months. Drift is a decentralized

perpetual trading platform, allowing traders to engage with up to

20x leverage. It integrates a series of features, including a money

market for decentralized lending, offering additional passive

income opportunities through staking and market maker rewards.

Furthermore, Solend, Marginfi, and Kamino are making strides on the

lending front. Solend, a prominent money market, enables users to

lend and borrow crypto assets, with over $165 million locked in its

smart contracts. Marginfi, boasting over $345 million in tokens

locked, enhances the lending experience with advanced risk

management technologies. Kamino, another lending platform, manages

over $242 million in assets. It offers liquidity through CLMM-based

lending vaults, allowing users to deploy tokens in yield-bearing

programs. Emerging Projects: Helium And Render Network In addition

to these platforms, the report identified projects that could

benefit from the surge of interest in Solana over the long run.

These include Marinade Finance and Jito. Marinade Finance, with

over $1 billion in assets, offers maximized returns through liquid

staking and immediate unstaking options. Jito, enhancing staking

yields via MEV rewards, boasts about 6.7 million SOL staked across

its platform. In the world of NFTs, collections like Mad Lads and

Tensorians are gaining popularity. Mad Lads, a unique collection of

10,000 artworks, reached a new all-time high in floor price,

reflecting the increasing interest in Solana-based NFTs. According

to the report, Helium and Render Network are two emerging projects

within the Solana ecosystem worth watching. Helium, a decentralized

connectivity service provider, utilizes Solana’s blockchain to

remit and administer its internet services. Its multi-token system

incentivizes hotspot owners and fosters the expansion of

decentralized internet facilities. Render Network, expanding to

Solana in 2023, offers GPU rendering services for creators. By

renting out excess GPU power, artists can produce high-resolution

graphics with the Render token (RNDR) as the network’s remittance

token. Related Reading: SOL Price Recovery Could Soon Fade If

Solana Fails To Clear This Hurdle The Solana ecosystem, marked by

innovation and rapid growth, solidifies its position in the smart

contract blockchain space. Its diverse projects, from DEXs and

lending protocols to staking solutions and NFT collections,

showcase the network’s dynamic and burgeoning landscape. With the

SOL token climbing the ranks, Solana’s ecosystem is poised for

continued expansion and success in the years ahead. Cover image

from Unsplash, chart from Tradingview

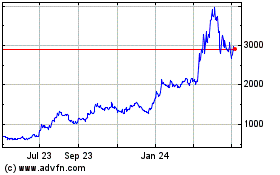

Maker (COIN:MKRUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

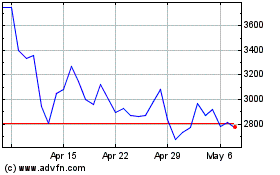

Maker (COIN:MKRUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024