How Bitcoin On-Chain Signals Present A Solid Case For A Market Bottom

20 October 2022 - 12:51AM

NEWSBTC

Bitcoin price remains stuck below its former all-time high set five

years ago. The shocking decline has been one of the worst crypto

winters on record, and the market is bracing for continued

meltdown. However, a series of on-chain indicators in BTC could

provide clues to how close we are to a bottom. Let’s take a look. A

Series Of Six On-Chain Indicators Shout: Bitcoin Bottom Is In Bear

markets are brutal in Bitcoin or otherwise, because the bottom is

only known in hindsight. The feeling that markets will fall

forever, creates a fear that freezes investors from buying at

long-term lows. Technical analysis is one tool that can be used to

find oversold conditions or other signals that support the idea of

a bottom. Unique to cryptocurrencies, is a subset of quantitative

fundamental analysis that focuses on on-chain signals. Several such

tools are potentially suggesting a bottom is in. Here we have the

Puell Multiple. The Puell Multiple is calculated by dividing the

daily issuance value of bitcoins (in USD) by the 365-day moving

average of daily issuance value. Puell Multiple | Source: glassnode

Bitcoin Reserve Risk is currently demonstrating the most attractive

risk/reward setup ever. Reserve Risk is defined as price / HODL

Bank. It is used to assess the confidence of long-term holders

relative to the price of the native coin at any given point in

time. Bitcoin Reserve Risk | Source: glassnode In this chart, we

have MVRV Z-Score. The MVRV Z-Score is used to assess when Bitcoin

is over/undervalued relative to its “fair value”. MVRV Z-Score |

Source: glassnode Net Realized Losses are the largest ever. Net

Realized Profit/Loss is the net profit or loss of all moved coins,

and is defined by the difference of Realized Profit – Realized

Loss. Net Realized Profit/Loss | Source: glassnode

The Realized Profits-to-Value Ratio is also in the bottom

zone. The Realized Profits-to-Value Ratio is defined as the ratio

of Realized Profits and Realized Cap. This metric compares

profit-taking in the market with its overall cost basis on a

dollar-to-dollar basis. Realized Profits-to-Value Ratio | Source:

glassnode Finally, Net Unrealized Profit/Loss shows capitulation.

Interestingly, BTC never quite reached a state of euphoria and

greed during the last market top. The dataset is also becoming less

volatile over time, much like Bitcoin price itself. Net Unrealized

Profit/Loss is the difference between Relative Unrealized Profit

and Relative Unrealized Loss. Net Unrealized Profit/Loss | Source:

glassnode While none of these signals confirm the bottom is in for

Bitcoin price action, each tool is in a zone that historically has

been where past bear markets ended. Should the top cryptocurrency

by market cap bottom here, it would be the smallest maximum

drawdown in Bitcoin history. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

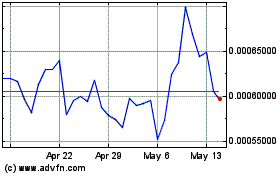

OMI Token (COIN:OMIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

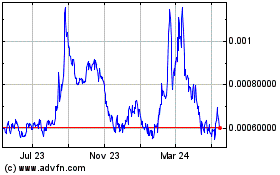

OMI Token (COIN:OMIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about OMI Token (Cryptocurrency): 0 recent articles

More ECOMI News Articles