Bitcoin’s Market Is Still In An ‘Healthy Growth’ Phase, Says Analyst—Here’s Why

19 November 2024 - 5:30PM

NEWSBTC

Last week, Bitcoin saw consistent upward momentum, leading to the

asset breaching multiple resistances to achieve a peak of

$93,477 finally. However, ever since, BTC has seen a price decrease

and appears to maintain stability above $90,000 while showing signs

of controlled market sentiment. Amid this price performance, a

CryptoQuant analyst known as G a a h recently shared his

perspective on Bitcoin’s current market behavior, focusing on an

important metric such as the Short-Term Holders Spent Output Profit

Ratio (STH SOPR) to reveal whether the asset still has more room

for growth. Related Reading: Bitcoin Exchange Reserves Hit 5-Year

Low—What Does This Signal? What The STH SOPR Metric Suggest For

Bitcoin The Short-Term Holders Spent Output Profit Ratio metric,

which tracks the profitability of Bitcoin held by short-term

holders, has revealed a trend of moderate optimism in the market,

according to G a a h. The analyst elaborated that unlike past

cycles marked by euphoric price spikes, the STH SOPR remains within

a “middle region,” far from indicating extreme greed. This suggests

that while some investors are taking profits, the current market

environment remains stable, with room for further upward movement.

The relationship between the SOPR indicator and Bitcoin’s 30-day

moving average further emphasizes this point. According to the

CryptoQuant analyst, short-term holders take measured profits

without overwhelming the market with sell pressure, signaling

“healthy growth.” Historical data shows that when the SOPR enters

the extreme greed range, Bitcoin often encounters significant

market resistance, leading to corrections. Conversely, accumulation

tends to occur when the indicator reflects extreme fear, often

marking key price bottoms. The analyst’s observations suggest that

Bitcoin remains in a transitional growth phase, with investors

carefully adjusting their positions as the price trends upward. G a

a h wrote: At the moment, the behavior of the SOPR suggests a phase

of healthy growth, with moderate optimism. This intermediate

position may reflect a market in transition, where investors

continue to adjust their positions as the Bitcoin price advances.

Key Indicators to Watch in Bitcoin’s Market Behaviour While the

SOPR currently suggests a balanced market, as reported by the

analyst, he also advised investors to monitor the movements of the

indicator closely in the coming weeks. The analyst noted: If it

quickly approaches the extreme greed range, it could be a sign of

more aggressive profit-taking and a possible trend reversal. G a a

h also added that this phase of moderate optimism, if sustained,

could create opportunities for continued upside potential, but risk

management remains a crucial aspect of navigating this market

environment. Related Reading: Binance Dominates As Bitcoin Futures

Volume Hits New Peaks Amid Historic Price Rally The CryptoQuant

analyst concluded: While the SOPR indicates that the top has not

yet been reached, the balance between optimism and caution is key

to maximizing gains and protecting capital from high price

volatility. Featured image created with DALL-E, Chart from

TradingView

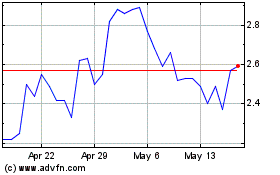

Optimism (COIN:OPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024