4 Reasons Why Bitcoin Remains Bullish, What Might Bring New ATHs

25 August 2021 - 4:00AM

NEWSBTC

Bitcoin has seen some downside action in the past 24 hours, as it

was rejected north of $50,000. The first cryptocurrency by market

cap trades at $49,207 with a 2.1% loss in the daily chart.

Investors and experts are keeping a close eye on current levels. As

pseudonyms trader CryptoDonAlt said, “this is where the market

decides” if the trend will be to the up or downside. CryptoDontAlt

and other traders believe this to be Bitcoin’s last major

resistance. Therefore, a break and hold above $50,000 could push

the price towards previous highs. The U.S. Federal Reserve

and other major central banks around the world have adopted

monetary policies to mitigate the effects of the lockdowns and the

Covid-19 pandemic. Investors were expecting a change in these

policies for September. However, as QCP Capital said, the FED might

move new decisions to December 2021. Thus, Bitcoin and risk assets

have more room for a rally. On September 14, the U.S. will reveal

new data on their Consumer Price Index (CPI), a metric associated

with inflation. This event is usually preceded and followed by

volatility and will be relevant for the market to decide its trend.

In addition, Bitcoin bulls managed to defeat a strong assault from

the bears accompanied by high levels of FUD news. This included

attacks to crypto exchanges, the DeFi sector, and the industry as a

whole with the infrastructure bills. QCP Capital believes that

there will be less negative news in the medium term. Thus,

Bitcoin’s price action will be less affected by news events:

Headline regulatory risk exhausted in the near-term. We expect any

significant crypto-related regulatory decisions to come only

towards Q1 2022, particularly anything from the Senate Banking

Committee & the SEC. Bitcoin Retail Investors Make A Comeback,

Why This Time Is Different QCP Capital also recorded an increase in

demand with no important changes in the derivatives sector. As the

image below shows, the Bitcoin rally to all-time highs in Q1 2021

was followed by a spike in funding rates for futures perpetual

contracts. In that way, BTC’s price action was dependent on

speculators using leverage. This caused the rally to be

unsustainable. At its current levels, Bitcoin-based derivatives and

funding rates displayed no signs of a similar investors’ behavior:

In spite of today’s mini funding spike on the rally (up to 20%

annualized) funding rates & future premiums in both BTC &

ETH continue to be relatively low & muted. This means most of

the rally has been driven by demand in physical spot rather than

from leveraged speculators. This could change as Bitcoin moves into

its previous highs, but it’s a positive indicator as of now. QCP

Capital expects more consolidation at current levels and believes

the next month, especially towards the end of the year, could see

less appreciation than in 2020.

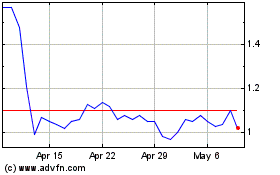

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles