Flash Crash, Ethereum Tests Support With 17% Drop And Risks Further Losses

08 September 2021 - 2:36AM

NEWSBTC

After leading the crypto market rally for several weeks, Ethereum

faces the return of the bears. The second cryptocurrency by market

cap was pushing into the $4,000 resistance before a selloff sent it

back to critical support. At the time of writing, ETH trades at

$3,466 with an 11.6% loss in the daily chart. Ethereum bounces back

from the low of its current levels. Some exchange platforms briefly

recorded $3,100 for the cryptocurrency, but the recovery could face

hurdles. As the market crashed, there were over $2,3 billion in

liquidations recorded across exchange platforms. Bitcoin and

Ethereum were performing well during the past weeks, as NewBTC

informed. This attracted short-term sellers that mostly use

perpetual future contracts to speculate on the market. Thus,

leading to an increase in Open Interest and over-leverage

positions. The funding rates for this sector flipped positive in

the past weeks, leaving the market open for another capitulation

event, similar to May, and June. El Salvador implementing its

Bitcoin Law could have been the trigger. When crypto exchange

Coinbase debuted in the stock market, Ethereum and other

cryptocurrencies saw a decline caused by an over-leverage market.

However, invest Daniel Cheung believes this could be healthy for

the market in the long run. Via his Twitter account, Cheung

reported the event as just another day in crypto: $2.3bn in

liquidations was healthy today nothing to be concerned about to be

honest. Liquidations were consistently $7bn + near the end of last

run and think if we get around there that is when I start freaking

out. Just average volatility here and bears doing their thing.

Ethereum Fundamentals Remain Strong Pseudonyms trader Altcoin

Sherpa presented a scenario where Ethereum could repeat a formula

already experience during the Fall of 2020. At that moment,

Ethereum dropped to retest support, entered an accumulation phase,

and then proceed to reclaim new highs. Altcoin Sherpa said: I’m

wondering if we see something like this happen: Some sort of big

move down (30%) followed by accumulation like in 2020. Note: $BTC

was moving in Fall 2020 while $ETHUSD stayed relatively stagnant.

Bitcoin could be the key that will signal up or down for the market

in the short term. Analysts such as Will Clemente believe that the

recent liquidation cascade has no impact on the “macro on-chain

supply dynamics”. Thus, he claims that leverage players needed to

be taken “off our backs for now”. This suggests a potential

opportunity for the bulls. Related Reading | New To Bitcoin? Learn

To Trade Crypto With The NewsBTC Trading Course However, trader

Nebraskan Gooner advised caution. He recommended investors not be

“overly bullish or bearish here” as Ethereum and Bitcoin bounce

back from support. Therefore, he expects the weekly close to

provide more light into future price action.

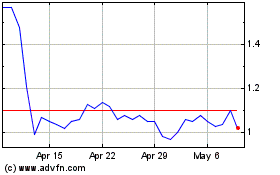

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles