Avalanche Rebounds: Eyes $29.35 Breakout And Further Gains

13 October 2024 - 4:00AM

NEWSBTC

Avalanche (AVAX) has regained traction, showing signs of a

potential bullish resurgence as it approaches a key resistance

level at $29.35. After a period of consolidation, AVAX’s price

action hints at a possible breakout, which could trigger a strong

upward movement. With technical indicators showing signs of

strength, the market’s focus now shifts to whether Avalanche can

sustain this upward momentum and push past the $29.35 barrier for a

sustained move higher. This analysis aims to evaluate Avalanche’s

recent price rebound and assess whether it has the momentum to

break through the key $29.35 resistance level. By examining

technical indicators, market sentiment, and price trends, we seek

to determine if the token is poised for further gains, setting the

stage for a sustained rally in the coming sessions. AVAX’s Strong

Bounce: Will Momentum Continue? Following the bullish comeback at

$25, AVAX’s price on the 4-hour chart has continued to gain

strength to surge toward the $29.35 resistance level. AVAX is also

trading above the 100-day Simple Moving Average (SMA), suggesting a

positive upward trend that could lead to a potential breakout. An

analysis of the 4-hour Relative Strength Index (RSI) reveals that

the signal line has risen above the 50% mark and is currently

sitting at 74%, indicating strong bullish momentum. As long as the

RSI remains elevated and buyers maintain control, the asset could

experience additional gains with the possibility of reaching new

highs. Related Reading: Can Avalanche (AVAX) Reclaim $30? Top

Analyst Predicts A Dip Before A Bounce Additionally, the daily

chart illustrates that AVAX is showcasing a significant upward

push, characterized by a positive candlestick pattern following its

rebound above the 100-day SMA. The asset is currently attempting to

breach the critical resistance level at $29.35. Successfully

overcoming this barrier would reinforce the prevailing upward trend

and boost market sentiment, signaling heightened buying interest.

Finally, on the 1-day chart, a detailed examination of the RSI

formation indicates that Avalanche may maintain its optimistic

trajectory. The indicator’s signal line after dropping to 44% is

rising again and is currently positioned at 59%, indicating

that buying pressure could remain strong and potentially drive

further price appreciation in the near term. What’s Next For

Avalanche If $29.35 Is Breached? If Avalanche successfully breaches

the critical resistance level of $29.35, it could set the stage for

a significant rally toward the $42 resistance mark. A breakout

above this level could lead to a series of upward targets, pushing

the price toward new highs as market confidence grows. Related

Reading: Avalanche (AVAX) Ready To Target $28: Investors Expect A

Reversal However, if Avalanche fails to maintain this strength and

breaks above the $29.35 resistance level, it could result in a

pullback, with the price sliding back toward the $18.85 support

zone. A breakdown below this level could lead to more losses,

possibly targeting lower support areas. Featured image from

Shutterstock, chart from Tradingview.com

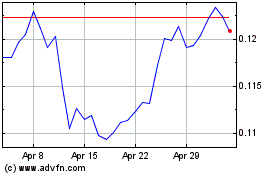

TRON (COIN:TRXUSD)

Historical Stock Chart

From Sep 2024 to Oct 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024