Antin Infrastructure Partners Reports Robust 2021 Financial Results

24 March 2022 - 5:00PM

Business Wire

Regulatory News:

Alain Rauscher and Mark Crosbie, co-founders of Antin

Infrastructure Partners (Paris:ANTIN), declared:

"2021 was a milestone year for Antin, notably marked by our

successful IPO in September. We continued to deliver outstanding

returns to our fund investors while investment and exit activity

was fully on track. We executed on our growth strategy with the

launch of the Mid Cap and NextGen strategies, and we invested in

our platform and talent to position the firm for the next growth

phase. Our 2021 financial results were very robust, demonstrating

continued top-line growth, best-in-class EBITDA margins and

significant dividend distributions to our shareholders. We are

confident that 2022 will be another exciting and strong year."

2021 highlights

- Fee-paying AUM up +14.4%, driven by €2.5bn fundraising across

Mid Cap and NextGen

- Revenue excluding catch-up fees up +17.8%

- Strong investment performance with capital deployment and exit

activity on track

- Underlying EBITDA margin of 60%

- Strong balance sheet following successful IPO with €393m in

cash to support our growth

- Proposed dividend of €0.11 per share; full year dividend payout

ratio of ~90%(1)

- Medium-term guidance remains unchanged

Strong AUM growth supported by fundraising and investment

performance

- AUM increased to €22.7bn, up +23.8%(2) in 2021, driven by

fundraising and investment performance

- Fee-paying AUM increased to €13.8bn, up +14.4% in 2021

- Fundraising stood at €2.5bn across Mid Cap Fund I and NextGen

Fund I

- Strong investment performance with all Antin funds performing

either on or ahead of plan

Investment and exit activity are on track

- Total investments of €1.7bn (€3.3bn including co-investments),

including Origis Energy (Flagship Fund IV), ERR European Rail Rent

partnership (Mid Cap Fund I) and Pulsant (Mid Cap Fund I)

- Flagship Fund IV ~60% invested and Mid Cap Fund I ~16% invested

as of 31 December 2021. Including investment announced post closing

of reporting period, Mid Cap Fund I is ~26% invested

- Gross exits of €1.3bn (€1.6bn including co-investments),

including Amedes (Flagship Fund II) and Almaviva (Flagship Fund

III)

Robust top-line growth with ~95% of revenue from management

fees

- Total revenue increased by +0.5% from €179.6m to €180.6m;

increase of +17.8% excluding 2020 management fee catch-up effects

related to final closing of Flagship Fund IV

- Management fees decreased by (2.7)% from €175.5m to €170.8m;

increase of +14.5% excluding 2020 management fee catch-up effects

related to final closing of Flagship Fund IV

- Carried interest and investment income increased substantially

from €2.4m to €7.2m, primarily due to the revaluation of Fund III-B

investments held on balance sheet, as well as carried interest

related to Flagship Fund II(3) and a gain realised on the transfer

of carried interest related to Fund III-B(4)

Strong profitability with underlying EBITDA margin of

60%

- Underlying EBITDA decreased by (17.9)% from €132.0m to €108.4m,

notably due to the management fee catch-up of €26.4m recorded in

2020 and an increase in operating expenses recorded in 2021.

Excluding the 2020 management fee catch-up, underlying EBITDA grew

by +2.6%

- Total operating expenses increased by +51.6% from €47.7m to

€72.3m. Personnel expenses increased by +45.5%, primarily due to

the hiring of 53 employees related to the launch of the Mid Cap and

NextGen investment strategies and in anticipation of the continued

scale-up of our Flagship Fund Series. Other operating expenses

increased by +68.0% mainly due to professional services fees

related to the execution of our growth plan

- As a result of those effects, our underlying EBITDA margin

decreased from 73% to 60%, consistent with the guidance provided at

the time of the IPO

- Underlying net income decreased by (19.7)% from €92.7m to

€74.4m

Strong balance sheet

- €393m in cash and cash equivalents to support growth plans

- No financial debt following repayment of outstanding credit

facilities in 2021

Dividend payout ratio of ~90%

- Antin’s Board of Directors proposes a dividend of €0.11 per

share for the remainder of 2021. Total dividend of €0.39 per share

for 2021, including €0.28 per share already paid prior to the

IPO

- Dividend payout ratio of ~90% for full-year 2021 based on

underlying net income(5)

Further advances on our ESG priorities

- Strengthening of ESG governance framework and processes

- Carbon reduction roadmap for all portfolio companies

- Formalised diversity, equity, and inclusion policy

Medium-term guidance confirmed

- Long-term growth above the infrastructure market, with Flagship

Fund V target commitments of ~€10-11bn

- Long-term EBITDA margins >70%

- Majority of underlying profits to be distributed with the

absolute quantum of dividends expected to grow over time

Implementation of a liquidity contract

- Liquidity contract with BNP Paribas Exane starting on 25 March

2022, for a period of one year and tacitly renewable

- Objective to improve the trading of Antin’s shares on the

regulated market of Euronext Paris

- Compliant with the Code of Conduct (Charte de Déontologie)

issued by the French Financial Markets Association (Association

Française des Marchés Financiers), recognised by the AMF (Autorité

des Marchés Financiers)

- Initial €2m allocated to the liquidity account

- Agreement can be terminated at any time and without prior

notice by Antin, and at any time by BNP Paribas Exane subject to

one month’s notice

Situation in Russia/Ukraine

- No direct and indirect exposure to Russia/Ukraine

- No physical locations, no meaningful economic relations

- No Russian or Ukrainian fund investors

- Partners will donate more than €2m to the United Nations High

Commissioner for Refugees (UNHCR)

Post-closing events

- Exit of Roadchef (Flagship Fund II), the UK’s largest motorway

service area operator announced on 3 March 2022. Flagship Fund II

~90% realised as of 24 March 2022 following exit of Roadchef

- Investment in Lake State Railway (Mid Cap Fund I), a leading

regional freight railroad in the US completed on 8 March 2022. Mid

Cap Fund I ~26% invested

Today’s webcast presentation

- Antin’s management will hold a webcast presentation today at

11:00am CET

- To register for the webcast, please click on the following

link:

https://channel.royalcast.com/landingpage/antin-ip/20220324_1/

Notes

- Proposed dividend of €19.2m and €48.1m paid in 2021 (total of

€67.3m); calculated as a % of underlying net income of €74.4m; to

be approved on 24 May 2022 at Annual Shareholders’ Meeting

- Based on new calculation methodology as described on p.10

- €0.9m carried interest revenue for Fund II related to a share

of carried interest repurchased by Antin from an employee departing

the firm

- €0.6m carried interest revenue related to a gain on a share of

carried interest in Fund III-B that was sold by Antin to its

employees

- Proposed dividend of €19.2m and €48.1m paid in 2021 (total of

€67.3m); calculated as a % of underlying net income of €74.4m; to

be approved on 24 May 2022 at Annual Shareholders’ Meeting

About Antin Infrastructure Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With €22.7bn in Assets under Management,

Antin targets majority stakes in the energy and environment,

telecom, transport and social infrastructure sectors. With a

presence in Paris, London, New York, Singapore and Luxembourg,

Antin employs over 160 professionals dedicated to growing,

improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN – ISIN:

FR0014005AL0)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220323005975/en/

Shareholder Relations

Ludmilla Binet, Head of Shareholder Relations Email:

shareholderrelations@antin-ip.com

Media Contacts Antin

Infrastructure Partners Nicolle Graugnard, Communication

Director Email: nicolle.graugnard@antin-ip.com

Brunswick Email: antinip@brunswickgroup.com Tristan

Roquet Montegon +33 (0) 6 37 00 52 57 Gabriel Jabès +33

(0) 6 40 87 08 14

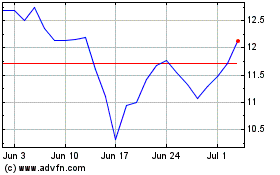

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

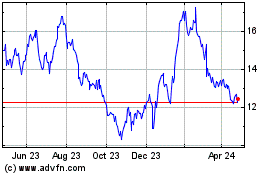

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Apr 2023 to Apr 2024