Valeo H1 2023 results

PARISJuly 27, 2023

Valeo records operating

margin of 3.2% forfirst-half 2023 and reaffirms

its full-year objectives

- Sales of

11.2 billion euros, up by 19%

- Valeo's leadership position

consolidated in both areas of innovation: ADAS (up 26%

LFL(1))

and powertrain electrification (up 108% LFL)

- Original

equipment sales up 19 % LFL on an adjusted

basis(2) (up 26% in

Q2)

-

Outperformance versus automotive production of 8 pts LFL on

an adjusted basis (10 pts in Q2)

-

Strong growth in aftermarket sales, up 5% LFL on an

adjusted basis

-

Operating margin of 3.2%, up 200 basis points compared with

first-half 2022 as adjusted, a further step forward in improving

our margins, as set out in our Move Up strategic plan

-

Inflation-related negotiations with customers mostly

complete

- Time lag of

260 million euro inflow resulting from these negotiations – amount

recorded at end-June with cash impact in Q3 – leading to free cash

flow of -156 million euros

- Strong

business momentum: order intake of 18.8 billion euros, with

profitability levels up versus 2022, when profitability was already

above the levels set out in the Move Up plan. More than half of

these orders are linked to innovations in driving assistance,

driven by strong worldwide demand for software defined vehicles

and Valeo's strong position in

this market

-

Financial performance to improve in H2, leading us to

reaffirm our 2023 objectives

“In the first half of 2023, our sales rose by

19% to 11.2 billion euros. This performance reflects strong

momentum in driving assistance (ADAS) and electrification.

At the end of June, our operating margin stood

at 3.2% of sales, an improvement of 200 basis points compared with

the same period in 2022. Our margin was lifted by the strong growth

in our sales, the success of our cost reduction program, the

recovery in our high-voltage electric powertrain business, and the

conclusion of negotiations relating to inflation.

Our first half results and the improvement in

our financial performance in the second half in line with

expectations enable us to reaffirm all of our objectives for

full-year 2023.

Lastly, the Group continued to record an

excellent business performance in the first half, with order intake

reaching 18.8 billion euros. We recorded several particularly

strategic orders in the areas of ADAS and electrification. This

order intake was recorded at a higher level of profitability than

the objective set out in the Move Up strategic plan and the order

intake recorded in 2022. The distribution of these orders across

the three major regions (the United States, Asia and Europe)

reflects Valeo's performance in the global automotive market as a

whole.

Once again, I would like to thank all our teams

for their

commitment.”

Christophe

Périllat,

Valeo’s Chief Executive

Officer

First-half 2023 key figures

|

Order intake |

|

H1 2023 |

|

H1 2022 |

Change |

|

H1 2022 (adjusted)* |

|

Order intake* |

(in €bn) |

|

18.8 |

|

16.0 |

+18

% |

|

- |

|

|

|

|

|

|

|

|

|

|

|

Income statement |

|

H1 2023 |

|

H1 2022 |

Change |

|

H1 2022 (adjusted)* |

|

Sales |

(in €m) |

|

11,212 |

|

9,419 |

+19

% |

|

9,789 |

|

Original equipment sales |

(in €m) |

|

9,544 |

|

7,813 |

+22

% |

|

8,170 |

|

Outperformance** |

(in pts) |

|

+3pts |

|

+3pts |

N/A |

|

- |

|

Aftermarket sales |

(in €m) |

|

1,167 |

|

1,140 |

+2

% |

|

1,153 |

|

R&D expenditure*** |

(in €m) |

|

(1,000) |

|

(893) |

+12

% |

|

(984) |

|

(as a % of sales) |

|

-8.9

% |

|

-9.5

% |

+0.6 pts |

|

10.0

% |

|

EBITDA* |

(in €m) |

|

1,302 |

|

1,111 |

+17

% |

|

1,033 |

|

(as a % of sales) |

|

11.6

% |

|

11.8

% |

-0.2 pts |

|

10.6

% |

|

Operating margin excluding share in net

earnings of equity-accounted companies |

(in €m) |

|

363 |

|

258 |

+41

% |

|

117 |

|

(as a % of sales) |

|

3.2

% |

|

2.7

% |

+0.5 pts |

|

1.2

% |

|

Share in net earnings of equity-accounted companies |

(in €m) |

|

4 |

|

(76) |

N/A |

|

2 |

|

Cost of debt |

(in €m) |

|

(108) |

|

(50) |

+116

% |

|

(66) |

|

Non-controlling interests and other |

(in €m) |

|

(34) |

|

(32) |

+6

% |

|

(30) |

|

Net attributable income (loss) |

(in €m) |

|

119 |

|

(48) |

N/A |

|

(130) |

|

(as a % of sales) |

|

1.1

% |

|

-0.5

% |

+1.6 pts |

|

-1.3

% |

|

Basic earnings per share |

(in €) |

|

0.5 |

|

(0.2) |

N/A |

|

- |

|

|

|

|

|

|

|

|

|

|

|

Statement of cash flows |

|

H1 2023 |

|

H1 2022 |

Change |

|

H1 2022 (adjusted)* |

| Investments in

property, plant and equipment |

(in €m) |

|

(456) |

|

(307) |

+49

% |

|

(345) |

| Investments in

intangible assets |

(in €m) |

|

(480) |

|

(350) |

+37

% |

|

(355) |

|

including capitalized development expenditure |

(in €m) |

|

(461) |

|

(295) |

+56

% |

|

(298) |

|

Change in working capital |

(in €m) |

|

(237) |

|

28 |

N/A |

|

44 |

|

Free cash flow* |

(in €m) |

|

(156) |

|

179 |

-187

% |

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

Financial structure |

|

June 30, 2023 |

|

Dec. 31, 2022 |

Change |

|

Dec. 31, 2022 (adjusted)* |

|

Net debt* |

(in €m) |

|

4,550 |

|

4,002 |

+548 |

|

- |

|

Leverage ratio (net debt to EBITDA) |

N/A |

|

1.76 |

|

1.67 |

N/A |

|

- |

* See financial glossary, page 14. ** Based on

S&P Global Mobility automotive production estimates released on

July 14, 2023. (H1 2023 global production growth: 11%). *** For a

comprehensive view of Research and Development expenditure, see

page 9 of the press release.

Order intake of 18.8 billion euros, with a profitability

level significantly higher than the objective set out in the Move

Up strategic plan and that recorded in 2022

In the first half of 2023, Valeo posted an

excellent business performance, with order intake(2) reaching 18.8

billion euros, i.e., double original equipment sales.

This order intake was recorded at a

profitability level significantly higher than that recorded in 2022

(which was already an improvement on the same period in 2021), and

the operating margin objective set out in the Move Up plan, paving

the way for an acceleration in growth and continued improvement in

our margins beyond 2025.

Business momentum was excellent in ADAS, with

order intake representing over half of the orders received by the

Group, including several particularly strategic orders:

-

Thanks to the new, more centralized electrical/electronic vehicle

architecture required for software-defined vehicles (SDVs), the

size of new ADAS orders is increasing sharply;

-

Since 2022, Valeo has received five new orders for high-performance

computing units, including two new major partnership agreements, in

2023, one with Renault and the other with a North American

automaker;

-

The partnership with Renault forms part of the tech ecosystem also

involving Google (software) and Qualcomm (hardware), which aims to

develop the electrical/electronic architecture of next generation

vehicles. As part of the partnership, Valeo will supply key

electrical and electronic components for the SDV, including the

high-performance computing unit (or domain controller), as well as

zone controllers, power distribution modules and ADAS components

including ultrasonic sensors and driving and parking cameras. Valeo

engineers will work close to the Renault sites and collaborate

closely with the Renault Software Factory teams on software

development. Valeo will also provide onboard application software,

such as parking assistance;

-

Along with an Asian automaker and an American robotaxi company,

Stellantis adopted the third-generation Valeo LiDAR (SCALA 3),

whose technical features in terms of resolution and field of vision

enable vehicles to reach a high level of automation (level 3).

Total orders for the Valeo SCALA 3 LiDAR currently stand at 1

billion euros.

In the field of electrification, the Powertrain

Systems Business Group's order intake for high-voltage electrified

vehicles amounts to 5 billion euros:

-

Orders have been placed by both existing and new customers;

-

They concern end-to-end powertrain assemblies and their components

(electric motors, inverters, reducers, onboard chargers and DC/DC

converters) and include the new 800-volt silicon carbide (SiC)

technologies;

-

With these new orders, Valeo demonstrates its aim of supporting its

customers' electrification in Europe, China and, most recently,

North America.

Sales up 19 % to 11,212 million euros in

first-half 2023, lifted by the acceleration in

ADAS and electrification

In the first half of the year, automotive

production was up 11%(3) compared with the same period in 2022,

thanks to a favorable basis of comparison (low production levels in

first-half 2022 due to (i) tensions in the supply chain for

electronic components, (ii) the Russia-Ukraine crisis, and (iii)

lockdown measures in China) and a low level of new vehicle

inventories.

|

Sales(in millions of euros) |

As a % of H1 2023 sales |

|

H1 2023 |

|

H1 2022 |

Change |

FX |

Scope |

LFL* change |

|

H1 2022 (adjusted) |

LFL change (adjusted)** |

|

Original equipment |

85 % |

|

9,544 |

|

7,813 |

+22 % |

-2 % |

+10 % |

+14 % |

|

8,170 |

+19 % |

|

Aftermarket |

10 % |

|

1,167 |

|

1,140 |

+2 % |

-4 % |

+2 % |

+5 % |

|

1,153 |

+5 % |

|

Miscellaneous |

5 % |

|

501 |

|

466 |

+8 % |

-2 % |

+6 % |

+3 % |

|

466 |

+8 % |

|

Total |

100 % |

|

11,212 |

|

9,419 |

+19

% |

-2

% |

+9

% |

+13

% |

|

9,789 |

+17

% |

* Like for like(4)** See financial glossary,

page 14.

Total sales for first-half 2023

came in at 11,212 million euros, up 19 % compared with the same

period in 2022.

Changes in exchange rates had a negative 2%

impact, primarily due to the appreciation of the euro against the

Chinese yuan and the Japanese yen.

Changes in Group structure had a positive 9%

impact. This mainly resulted from the integration of the

high-voltage electric powertrain business within the Powertrain

Systems Business Group as of July 1, 2022. Sales for this business

came in at 847 million euros in the first half, up 118% compared

with the same period in 2022.

On a like-for-like basis, sales advanced by 13

%. On an adjusted basis(4), consolidated sales accelerated, rising

17 % like for like compared with the same period in 2022 (up 23% in

the second quarter).

Original equipment sales were

up 14 % on a like-for-like basis, lifted by (i) the recovery in

global automotive production, (ii) an increase in content per

vehicle, notably in ADAS (original equipment sales up 26% like for

like), and (iii) compensation from customers for the impact of

inflation on our costs. On an adjusted basis(4), original equipment

sales grew 19 % (up 26% in the second quarter), driven by growth in

the high-voltage electrical powertrain business (up 108% over the

period).

Aftermarket sales moved up 5 %

on a like-for-like basis, fueled by the increased number and age of

vehicles on the road, a more attractive offering with a shift

towards more value-added products (transmissions systems kits), and

the impact of price increases. On an adjusted basis(4), aftermarket

sales rose 5 % like for like compared with the same period in

2022.

“Miscellaneous” sales (tooling and customer

contributions to R&D) advanced 3 % like for like.

In first-half 2023, outperformance

of 8 percentage points on an adjusted basis versus

global automobile production

|

Original equipment sales***(in millions of

euros) |

As a % of sales |

|

H1 2023 |

|

H1 2022 |

LFL* change |

Perf.** |

|

Perf. (adjusted)(5) |

|

Europe & Africa |

49 % |

|

4,752 |

|

3,548 |

+16 % |

0 pt |

|

+11 pts |

|

Asia, Middle East & Oceania |

30 % |

|

2,824 |

|

2,485 |

+15 % |

+6 pts |

|

+4 pts |

| of which Asia

(excluding China) |

16 % |

|

1,530 |

|

1,301 |

+21 % |

+9 pts |

|

+12 pts |

|

o/w China |

14 % |

|

1,294 |

|

1,184 |

+8 % |

+1 pt |

|

-5 pts |

|

North America |

19 % |

|

1,784 |

|

1,614 |

+10 % |

-2 pts |

|

-2 pts |

|

South America |

2 % |

|

184 |

|

166 |

+10 % |

0 pts |

|

0 pts |

|

Total |

100 % |

|

9,544 |

|

7,813 |

+14 % |

+3 pts |

|

+8 pts |

* Like for like(5). ** Based on S&P Global

Mobility automotive production estimates released on July 14,

2023.*** Original equipment sales by destination region.

In the first half of 2023, Valeo posted an

outperformance of 8 percentage points (10 percentage points in the

second quarter) including the scope effect related to the

integration of the high-voltage electric powertrain business

(adjusted basis(5)):

-

in Europe and Africa, the Group recorded an

outperformance of 11 percentage points on an adjusted basis, driven

by growth in the Comfort & Driving Assistance Systems Business

Group (strong growth in ADAS, particularly in the area of front

cameras), the Powertrain Systems Business Group on an adjusted

basis(5) thanks to the acceleration in the high-voltage electric

powertrain business, and the Thermal Systems Business Group,

particularly in the field of electrified vehicles (battery cooling

systems, dedicated air conditioning systems for electric vehicles,

heat pumps, etc.);

-

in Asia, the Group outperformed automotive

production by 4 percentage points on an adjusted basis(5):

-

in Asia (excluding China), Valeo delivered an outperformance of 12

percentage points (on an adjusted basis) thanks to the strong

momentum of the Comfort & Driving Assistance Systems, Thermal

Systems and Visibility Systems Business Groups in Japan, where the

Group posted an outperformance of 12 percentage points (on an

adjusted basis);

-

in China, the Group recorded a 5 percentage point underperformance

due to an unfavorable customer mix. Nonetheless, the Comfort &

Driving Assistance Systems Business Group reported strong growth in

its camera business. The Group is implementing a plan to reposition

its customer portfolio over the coming periods to focus on players

offering the best growth

prospects;

-

in North America, original equipment sales

underperformed automotive production by 2 percentage points on a

like-for-like basis, reflecting (i) a temporarily unfavorable

vehicle mix on certain key platforms for North American customers

in the Visibility Systems Business Group, and (ii) the expiry of a

contract with a Japanese automaker in the area of front-end modules

affecting the Thermal Systems Business Group. On the other hand,

the Group benefited from the ramp-up of several projects in the

Comfort & Driving Assistance Systems Business Group (strong

growth in ADAS, particularly in front cameras);

-

in South America, the Group

performed in line with global automotive production.

Segment reporting

In first-half 2023, acceleration of ADAS

and electric powertrain businesses

The sales performance for the Business Groups

reflects the specific product, geographic and customer mix and the

relative weighting of the aftermarket in their activity as a

whole.

|

Sales by Business Group(in millions of

euros) |

H1 2023 |

|

H1 2022 |

Change in sales |

Change in OE sales* |

Perf.** |

|

H1 2022 (adjusted)(5) |

Change in OE sales (adjusted)* |

Perf. (adjusted)** |

|

Comfort & Driving Assistance Systems*** |

2,331 |

|

1,958 |

+19 % |

+20 % |

+9 pts |

|

1,958 |

+20 % |

+9 pts |

|

Powertrain Systems |

3,571 |

|

2,549 |

+40 % |

+14 % |

+3 pts |

|

2,919 |

+29 % |

+18 pts |

|

Thermal Systems |

2,384 |

|

2,171 |

+10 % |

+14 % |

+3 pts |

|

2,171 |

+14 % |

+3 pts |

|

Visibility Systems |

2,816 |

|

2,639 |

+7 % |

+11 % |

0 pts |

|

2,639 |

+11 % |

0 pts |

|

Other |

110 |

|

102 |

+8 % |

-16 % |

-27 pts |

|

102 |

-1 % |

0 pts |

|

Group |

11,212 |

|

9,419 |

+19 % |

+14 % |

+3 pts |

|

9,789 |

+19 % |

+8 pts |

* Like for like(6).** Based on S&P Global

Mobility automotive production estimates released on July 14, 2023.

(H1 2023 global production growth: 11%).*** Excluding the TCM (Top

Column Module) business.

During the first half, all Business Groups

conducted negotiations with customers in an effort to obtain

compensation for the effects of inflation, particularly on wages,

electronic component prices and energy costs. At this stage, most

of the negotiations are complete, with the exception of a few

customers with whom Valeo aims to reach an agreement in the second

half of the year.

The Comfort & Driving Assistance

Systems Business Group recorded an outperformance of 9

percentage points, thanks to strong growth in the main production

regions (Europe, North America and China) for ADAS, particularly

front cameras, strengthening its position as world leader. In the

first half of the year, like-for-like original equipment sales were

up by 26% for ADAS and 10% for Reinvention of the interior

experience.

The Powertrain Systems Business

Group recorded an outperformance of 18 percentage points

on an adjusted basis (3 percentage points as reported), after

taking into account the high-voltage electric powertrain business,

whose original equipment sales rose by 108% during the period.

The Thermal Systems Business

Group delivered an outperformance of 3 percentage points.

In Europe, the Business Group's performance was powered by the

ramp-up of certain platforms for manufacturing high-voltage

electrified vehicles (battery cooling systems, dedicated air

conditioning systems for electric vehicles, heat pumps, etc.),

despite reduced production volumes for certain customers. In China,

the Business Group was impacted by the expiry of a front-end

modules contract with a Japanese automaker.

The Visibility Systems Business

Group performed in line with automotive production. As

expected, this performance began to improve in the second quarter

(outperforming automotive production by 2 percentage points),

thanks to start of production for lighting projects, particularly

in Europe, and an improved product mix as component supplies

returned to normal.

|

EBITDA(in millions of euros and as a % of

sales by Business Group) |

H1 2023 |

|

H1 2022 |

|

H1 2022 (adjusted)** |

Change (adjusted) |

|

Comfort & Driving Assistance Systems |

343 |

|

300 |

|

300 |

+14 % |

|

14.7 % |

|

15.3 % |

|

15.3 % |

-0.6 pts |

|

Powertrain Systems |

411 |

|

287 |

|

209 |

+97 % |

|

11.5 % |

|

11.3 % |

|

7.1 % |

+4.4 pts |

|

Thermal Systems |

158 |

|

162 |

|

162 |

-2 % |

|

6.6 % |

|

7.5 % |

|

7.5 % |

-0.9 pts |

|

Visibility Systems |

372 |

|

328 |

|

328 |

+13 % |

|

13.2 % |

|

12.4 % |

|

12.4 % |

+0.8 pts |

|

Other* |

18 |

|

34 |

|

34 |

-47 % |

|

Group |

1,302 |

|

1,111 |

|

1,033 |

+26 % |

|

11.6 % |

|

11.8 % |

|

10.6

% |

+1.0 pt |

* Including the Top Column Module business.**

See financial glossary, page 14.

All Business Groups saw their

profitability impacted by inflation (wages, electronic components

and energy) and are in the process of negotiating price

adjustments. At this stage, most of the negotiations are complete,

with the exception of a few customers with whom Valeo aims to reach

an agreement in the second half of the year.

In accordance with the Move Up strategic plan,

the Comfort & Driving Assistance Systems Business

Group is leveraging its leading-edge ADAS technologies,

which are currently seeing robust growth, and higher penetration

rates for its new driving assistance solutions. In this

environment, Comfort & Driving Assistance Systems posted an

EBITDA margin of 14.7%, lifted by sales of ADAS and products

related to the reinvention of the interior experience, which

reported margins of 16.6% and 10.8%, respectively.

The Powertrain Systems Business

Group posted an EBITDA margin of 11.5%, ahead of the

recovery trajectory set out in the Move Up strategic plan, in which

the Group set itself the objective of achieving an EBITDA margin of

11% for the Powertrain Systems Business Group by 2025.

The Thermal Systems Business

Group’s margin came out at 6.6%. The Business Group has

launched a recovery plan that will enable it to improve its EBITDA

margin by around an additional 2 percentage points in the second

half compared to the first half of the year. The plan involves (i)

finalizing customer negotiations and (ii) reducing costs resulting

from multiple production start-ups during the first half of the

year in the front-end module activity.

The Visibility Systems Business

Group saw its margins expand (EBITDA margin up 0.8

percentage points to 13.2%), thanks in particular to the strong

momentum of its aftermarket business.

EBITDA and EBIT margins of 11.6% and

3.2% respectively, up 100 bps and 200 bps respectively compared

with first-half 2022 on an adjusted basis

In an environment impacted by production volumes

below their pre-crisis levels in the Group's two main regions

(Europe and North America), and by rising wages, electronic

component prices and energy costs, EBITDA and EBIT margins stood at

11.6% and 3.2% of sales respectively.

|

|

|

|

H1 2023 |

|

H1 2022 |

Change |

|

H1 2022 (adjusted)* |

|

Sales |

(in €m) |

|

11,212 |

|

9,419 |

+19

% |

|

9,789 |

|

EBITDA* |

(in €m) |

|

1,302 |

|

1,111 |

+17

% |

|

1,033 |

|

(as a % of sales) |

|

11.6 % |

|

11.8 % |

-0.2 pts |

|

10.6 % |

|

Operating margin** |

(in €m) |

|

363 |

|

258 |

+41

% |

|

117 |

|

(as a % of sales) |

|

3.2 % |

|

2.7 % |

+0.5 pts |

|

1.2 % |

|

Net attributable income (loss) |

(in €m) |

|

119 |

|

(48) |

-348

% |

|

(130) |

|

(as a % of sales) |

|

1.1 % |

|

-0.5 % |

+1.6 pts |

|

-1.3 % |

* See financial glossary, page 14. ** Excluding

share in net earnings of equity-accounted companies.

EBITDA(7) came in at 1,302

million euros, or 11.6% of sales, an improvement of 100 basis

points compared with the prior-year period on an adjusted

basis.

Operating margin excluding share in net

earnings of equity-accounted companies came out at

363 million euros, or 3.2% of sales, up 200 basis points

compared with the prior-year period on an adjusted basis.

The increase mainly reflects:

-

the outcome of i) improvements in operating efficiency, ii)

negotiations to offset the impact of inflation, and iii) the impact

of higher sales on operating margin (positive 1.1 percentage point

impact);

- lower Research & Development

expenditure (positive 1.1 percentage point impact);

-

costs resulting from multiple production start-ups during the first

half of the year in the Thermal Systems Business Group’s front-end

module activity (negative 0.2 percentage point impact).

Research and Development

|

|

|

|

H1 2023 |

|

H1 2022 |

Change |

H1 2022 (adjusted) |

|

Sales |

(in €m) |

|

11,212 |

|

9,419 |

+19

% |

9,789 |

|

Gross Research and Development expenditure |

(in €m) |

|

(1,245) |

|

(959) |

+30

% |

(1,042) |

|

(as a % of sales) |

|

-11.1 % |

|

-10.2 % |

-0.9 pts |

-10.6 % |

|

Capitalized development expenditure |

(in €m) |

|

461 |

|

295 |

+56

% |

299 |

|

(as a % of sales) |

|

4.1 % |

|

3.1 % |

+1.0 pt |

3.1 % |

|

Amortization, net of the impact of subsidies and grants, and

impairment losses* |

(in €m) |

|

(272) |

|

(292) |

-7

% |

(302) |

|

(as a % of sales) |

|

-2.4 % |

|

-3.1 % |

+0.7 pts |

-3.1 % |

|

Subsidies and grants, and other income |

(in €m) |

|

56 |

|

63 |

-11

% |

61 |

|

Research and Development expenditure |

(in €m) |

|

(1,000) |

|

(893) |

+12

% |

(984) |

|

(as a % of sales) |

|

-8.9 % |

|

-9.5 % |

+0.6 pts |

10.0 % |

|

Customer contributions to R&D |

(in €m) |

|

268 |

|

224 |

+20

% |

238 |

|

Net R&D expenditure |

(in €m) |

|

(732) |

|

(669) |

+9

% |

(746) |

|

(as a % of sales) |

|

-6.5 % |

|

-7.1 % |

+0.6 pts |

-7.6 % |

* Impairment losses recorded in operating margin only.

In first-half 2023, the Group continued its

Research and Development efforts in order to fulfill the order

intake recorded over recent years and in line with its strategy

geared toward products incorporating innovative technologies. Gross

Research and Development expenditure represented 11.1% of sales (up

0.5 percentage points on 2022 on an adjusted basis), in line with

the Group's business and project momentum.

The IFRS impact (the difference between

capitalized development expenditure and amortization, net of the

impact of subsidies and grants, and impairment losses) increased by

1.8 percentage points year on year on an adjusted basis to a

positive 1.7%, reflecting:

-

a 1 percentage point increase in capitalization, as a result of the

increase in order intake with significantly improved

profitability,

-

a 0.7 percentage point reduction in amortization on an adjusted

basis.

Research and Development

expenditure represented 8.9% of sales versus 10.0% during

the same period in 2022 on an adjusted basis.

Net Research and Development

expenditure (after taking into account customer

contributions in an amount of 732 million euros, versus 746 million

euros for the same period in 2022 on an adjusted basis) represented

6.5% of sales, in line with the Move Up strategic plan, which sets

the objective of around 6.5% of sales in 2025.

The share in net earnings of equity-accounted

companies represented income of 4 million euros.

Operating income came to 349 million euros and

includes other income and expenses for a net negative amount of 18

million euros, or a negative 0.2% of sales.

In an environment marked by a sharp rise in

interest rates, the refinancing of Valeo's debt led to a 108

million euro increase in the cost of debt over the period. Other

financial items represented an expense of 24 million euros.

The effective tax rate came out at 30%.

The Group recorded net attributable

income of 119 million euros for the period, or 1.1% of

sales, after deducting non-controlling interests in an amount of 34

million euros. This represents an improvement of 240 basis points

compared with the prior-year period on an adjusted basis.

Return on capital employed

(ROCE(8)) and return on assets (ROA(8)) stood at

15% and 9%, respectively.

Time lag on 260 million euro inflow

resulting from customer negotiations – amount recorded in the first

half with cash impact at the beginning of the third quarter –

leading to free cash flow of -156 million euros for first-half

2023

|

(in millions of euros) |

H1 2023 |

|

H1 2022 |

|

H1 2022 (adjusted)(9) |

|

EBITDA(9) |

1,302 |

|

1,111 |

|

1,033 |

|

Investment in property, plant and equipment |

(456) |

|

(350) |

|

(345) |

| Investment in

intangible assets |

(480) |

|

(307) |

|

(355) |

|

including capitalized development expenditure |

(461) |

|

(295) |

|

(298) |

|

Change in working capital |

(237) |

|

28 |

|

44 |

|

Income tax |

(97) |

|

(139) |

|

(144) |

|

Other* |

(188) |

|

(164) |

|

(237) |

|

Free cash flow (9) |

(156) |

|

179 |

|

(4) |

|

Net financial expenses |

(119) |

|

(64) |

|

(67) |

|

Dividends |

(114) |

|

(119) |

|

(119) |

|

Other financial items |

(18) |

|

(216) |

|

(216) |

|

Net cash flow(9) |

(407) |

|

(220) |

|

(406) |

* Of which net payments for the principal portion of lease

liabilities (IFRS 16 impact) + restructuring costs + pension

obligations for a total amount of 118 million euros in first-half

2023 (90 million euros in first-half 2022, as adjusted).

In first-half 2023, the Group's free

cash flow consumption totaled 156 million euros,

mainly reflecting:

-

the contribution of EBITDA(9) in an amount of 1,302 million euros,

up 269 million euros compared with the prior-year period on an

adjusted basis;

-

456 million euros in investments in property, plant and equipment,

and 480 million euros in investments in intangible assets

(including 461 million euros in capitalized development

expenditure) in connection with strong sales growth;

-

a short-term increase in working capital requirement of

237 million euros, attributable in particular to the time lag

on an inflow resulting from customer negotiations, recorded in the

first half with cash impact in the third quarter;

-

tax payments for 97 million euros.

Net cash

flow(9) amounted to a negative 407 million euros,

mainly reflecting:

-

net interest of 119 million euros;

-

92 million euros in dividends paid to Valeo shareholders and 22

million euros in dividends paid to non-controlling shareholders of

Group subsidiaries.

Capital allocation to reduce

net

debt(10)

Net debt stood at 4,550 million

euros at June 30, 2023 versus 4 billion euros at December 31,

2022.

At June 30, 2023, the

leverage ratio (net debt/EBITDA)

came out at 1.76x EBITDA calculated over a rolling 12-month period

and the gearing ratio (net debt/stockholders'

equity) stood at 127% of equity.

Valeo has a robust financial structure:

-

On January 11, 2023, Valeo redeemed the 500 million euro bond

issued in 2017 under the Euro Medium Term Note (EMTN) financing

program;

-

On April 11, 2023, the Group also redeemed tranches 1 and 2 of the

Schuldschein loan (German private placement) issued in 2019 for

nominal amounts of 115 million euros and 221 million euros,

respectively;

-

At June 30, 2023:

-

the Group had drawn an amount of 3.35 billion euros (down 500

million euros compared with December 31, 2022) under its Euro

Medium Term Note (EMTN) financing program capped at 5 billion

euros;

-

the average maturity of gross long-term debt stood at 3.0 years,

stable compared with December 31, 2022;

-

Valeo had available cash of 1.7 billion euros, undrawn credit lines

totaling 1.7 billion euros, and bridge-to-bond financing in the

form of undrawn credit lines totaling 650 million euros with a

maturity of 12 months (as from July 2022) and two six-month

extension options exercisable at Valeo's discretion. The first

six-month extension option was exercised in June 2023, extending

the maturity of these lines to January 2024.

Divestiture of non-strategic assets

As part of its Move Up strategic plan, Valeo

aims to divest some 500 million euros’ worth of non-strategic

assets.

At June 30, 2023, under this disposal

program:

-

several disposal agreements were signed or concluded for a total

value of around 80 million euros;

-

negotiations are currently at an advanced stage for several

disposals representing a total value of around 120 million

euros;

-

plans have been initiated for other asset disposals worth around

300 million euros.

The Group aims to sign agreements for all of

these disposals by the end of the year.

Continued improvement in operating margin in the second

half in line with expectations, annual objectives

reaffirmed

|

|

2022 |

2022 (adjusted)* |

2023 guidance** |

Move Up 2025 |

|

Sales (in billions of euros) |

20.0 |

20.4 |

22.0 - 23.0 |

~ 27.5 |

|

EBITDA (as a % of

sales) |

12.0% |

11.4% |

11.5 % - 12.3 % |

~ 14.5% |

|

Operating margin (as a % of

sales) |

3.2% |

2.4% |

3.2 % - 4.0 % |

~ 6.5% |

|

Free cash flow |

€388m |

€205m |

> €320m |

~ €0.8bn - €1bn |

* 2022 data has been adjusted to include the

integration of the high-voltage business (formerly Valeo Siemens

eAutomotive) within the Powertrain Systems Business Group as of

January 1, 2022.** Based on S&P Global Mobility automotive

production estimates released on July 14, 2023.

Upcoming events

Third-quarter 2023 sales: October 26, 2023

Highlights

ESG

On March 31, Valeo announced

that it had published its 2022 Universal Registration Document.

Click here

On May 24, Valeo held its 2023

General Shareholders' Meeting. Click here

Industrial partnership

On January 4, NTT Data, Valeo

and Embotech announced that they had formed a consortium to provide

automated parking solutions. Click here

On February 14, BMW and Valeo

announced that they had engaged in a strategic cooperation to

co-develop the next-generation Level 4 automated parking

experience. Click here

On May 17, ZutaCore and Valeo

presented their new solution for cooling of data centers at Dell

Technologies World 2023. Click here

On May 23, Renault Group and

Valeo announced that they had signed a partnership in Software

Defined Vehicle development. Click here

On May 29, Valeo and DiDi

Autonomous Driving announced that they had reached a strategic

cooperation and investment agreement to jointly develop safety

solutions for robotaxis. Click here

On June 14, at VivaTech 2023 in

Paris, Valeo and Equans signed a partnership agreement to meet the

challenges facing cities. Click here

Products/technologies and patents

On January 3, Valeo announced

that it would be taking part in the 2023 Consumer Electronics Show

(CES) in Las Vegas between January 3 and January 8, 2023. Click

here

On January 12, Valeo announced

that it would be taking part in the 16th Auto Expo 2023 Components

at Pragati Maidan in New Delhi, India from January 12 to January

15, 2023. Click here

On March 7, Valeo celebrated

100 years of innovating and constantly striving to make mobility

simpler, safer and more sustainable. Click here

On March 20, Valeo announced

that it would be taking part in the 2023 Taipei Cycle Show in

Taiwan between March 22 and March 25, 2023. Click here

On March 23, Valeo received an

Innovation award in the "Infrastructure and Vehicle Improvement"

category from Sécurité routière – the French national road safety

authority – for its new EverguardTM silicone wiper blades. Click

here

On March 27, Valeo announced

that it had been named Supplier of the Year in the Advanced Driver

Assistance Systems (ADAS) category by General Motors at a ceremony

held on March 23, 2023. Click here

On March 28, Valeo announced

that it was the number one French patent filer with the European

Patent Office (EPO), with 588 patent applications filed in 2022.

Click here

On March 30, Valeo announced it

had signed two new major contracts for its third-generation LiDAR.

Click here

On April 11, Valeo announced it

would be participating for the first time, from April 12 to April

14, 2023, in the Laval Virtual trade show, during which it

presented its innovations in the field, both for accelerating the

design of solutions and for in-vehicle applications. Click here

On April 14, Valeo announced it

would be participating in Auto Shanghai 2023, where presented its

latest technologies for smarter, safer and greener mobility. Click

here

On April 21, Valeo announced it

would be presenting its composite solutions at JEC World 2023, from

April 25 to 27, for the third consecutive year. Click here

On May 4, at the Car Symposium

2023 (May 3-4, 2023) in Bochum, Germany, leading market

participants discussed the key trends in the automotive industry.

Christophe Périllat, Valeo Chief Executive Officer, was invited to

give a keynote on the “Next Steps to the Green Car”. Click here

On May 11, Valeo received

awards from three major customers for its aftermarket business.

Click here

On May 16, Valeo's LiDAR

technology received two new awards. Click here

On June 8, Valeo announced that

it would be presenting its solutions for greener, safer and

affordable mobility at the SIA Powertrain show, held in Paris on

June 14 and 15. Click here

On June 15, Valeo announced it

would be presenting at the Eurobike 2023 trade show, held from June

21 to 25 in Frankfurt. Click here

On June 21, Valeo received an

award from Auto Plus for Ineez, a simple electric charging solution

adapted to every use. Click here

On June 22, Valeo announced it

would be taking part in Rematec, the world's leading

remanufacturing trade show for industry professionals, which took

place from June 27 to 29 in Amsterdam. Click here

On June 29, Valeo announced the

launch of Canopy, the first wiper blade designed to reduce CO2

emissions. Click here

Financial glossary

Order intake corresponds

to business awarded by automakers during the period to Valeo, and

to joint ventures and associates based on Valeo’s share in net

equity, (except Valeo Siemens eAutomotive, for which 100% of orders

are taken into account), less any cancellations, based on Valeo’s

best reasonable estimates in terms of volumes, selling prices and

project lifespans. Unaudited indicator.

Like for like (or LFL): the

currency impact is calculated by multiplying sales for the current

period by the exchange rate for the previous period. The Group

structure impact is calculated by (i) eliminating, for the current

period, sales of companies acquired during the period, (ii) adding

to the previous period full-year sales of companies acquired in the

previous period, and (iii) eliminating, for the current period and

for the comparable period, sales of companies sold during the

current or comparable period.

Operating margin including share in net

earnings of equity-accounted companies corresponds to

operating income before other income and expenses.

Adjusted data: data for

first-half 2022 has been adjusted as though the high-voltage

electrification business (formerly Valeo Siemens eAutomotive) had

been consolidated in the Group's financial statements as of

January 1, 2022. To calculate year-on-year changes in sales on

an adjusted basis, first-half 2022 figures have been adjusted as

though the high-voltage electric business had been consolidated in

the Group's financial statements as of January 1, 2022.

ROCE, or return on capital

employed, corresponds to operating margin (including share in net

earnings of equity-accounted companies) divided by capital employed

(including investments in equity-accounted companies), excluding

goodwill.

ROA, or return on assets,

corresponds to operating income divided by capital employed

(including investments in equity-accounted companies), including

goodwill.

EBITDA corresponds to (i)

operating margin before depreciation, amortization and impairment

losses (included in the operating margin) and the impact of

government subsidies and grants on non-current assets, and (ii) net

dividends from equity-accounted companies.

Free cash flow corresponds to

net cash from operating activities (excluding changes in

non-recurring sales of receivables and net payments for the

principal portion of lease liabilities) after taking into account

acquisitions and disposals of property, plant and equipment and

intangible assets.

Net cash flow corresponds to

free cash flow less (i) cash flows in respect of investing

activities, relating to acquisitions and disposals of investments

and to changes in certain items shown in non-current financial

assets, (ii) cash flows in respect of financing activities,

relating to dividends paid, treasury share purchases and sales,

interest paid and received, and acquisitions of equity interests

without a change in control, and (iii) changes in non-recurring

sales of receivables.

Net debt comprises all

long-term debt, liabilities associated with put options granted to

holders of non-controlling interests, short-term debt and bank

overdrafts, less loans and other long-term financial assets, cash

and cash equivalents and the fair value of derivative instruments

hedging the foreign currency and interest rate risks associated

with these items.

Appendices

Second-quarter 2023 figures

Sales by type

|

Sales(in millions of euros) |

As a % of Q2 2023 sales |

|

Q2 2023 |

|

Q2 2022 |

Change |

FX |

Scope |

LFL* change |

|

Q2 2022 (adjusted) |

LFL* change (adjusted) |

|

Original equipment |

86 % |

|

4,907 |

|

3,881 |

+26 % |

-4 % |

+11 % |

+19 % |

|

4,038 |

+26 % |

|

Aftermarket |

10 % |

|

552 |

|

561 |

-2 % |

-6 % |

+2 % |

+3 % |

|

567 |

+4 % |

|

Miscellaneous |

4 % |

|

271 |

|

224 |

+21 % |

-3 % |

+10 % |

+15 % |

|

225 |

+22 % |

|

Total |

100 % |

|

5,730 |

|

4,666 |

+23

% |

-4

% |

+10

% |

+17

% |

|

4,830 |

+23

% |

* Like for like.

Sales by destination region

|

Original equipment sales***(in millions of

euros) |

As a % of sales |

|

Q2 2023 |

|

Q2 2022 |

LFL* change |

Perf.** |

|

Perf.** (adjusted) |

|

Europe & Africa |

50 % |

|

2,459 |

|

1,781 |

+17 % |

+3 pts |

|

+20 pts |

|

Asia, Middle East & Oceania |

29 % |

|

1,415 |

|

1,184 |

+25 % |

+8 pts |

|

+4 pts |

| of which Asia

(excluding China) |

15 % |

|

753 |

|

638 |

+24 % |

+10 pts |

|

+12 pts |

|

o/w China |

13 % |

|

662 |

|

546 |

+27 % |

+7 pts |

|

-4 pts |

|

North America |

19 % |

|

937 |

|

824 |

+16 % |

+1 pt |

|

+1 pt |

|

South America |

2 % |

|

96 |

|

92 |

+7 % |

0 pts |

|

0 pts |

|

Total |

100 % |

|

4,907 |

|

3,881 |

19 % |

+3 pts |

|

+10 pts |

* Like for like.** Based on S&P Global

Mobility automotive production estimates released on July 14,

2023.*** By destination region.

Sales by Business Group

|

Sales by Business Group (in millions of

euros) |

Q2 2023 |

|

Q2 2022 |

Change in sales |

Change in OE sales |

Perf.** |

|

Q2 2022 (adjusted) |

Change in OE sales (adjusted)* |

Perf.** (adjusted) |

|

Comfort & Driving Assistance Systems*** |

1,172 |

|

983 |

+19 % |

+24 % |

+8 pts |

|

983 |

+24 % |

+8 pts |

|

Powertrain Systems |

1,830 |

|

1,238 |

+48 % |

+19 % |

+3 pts |

|

1,402 |

+42 % |

+26 pts |

|

Thermal Systems |

1,239 |

|

1,092 |

+13 % |

+21 % |

+5 pts |

|

1,092 |

+21 % |

+5 pts |

|

Visibility Systems |

1,440 |

|

1,283 |

+12 % |

+18 % |

+2 pts |

|

1,283 |

+18 % |

+2 pts |

|

Other |

49 |

|

70 |

-30 % |

-24 % |

+40 pts |

|

70 |

-24 % |

+40 pts |

|

Group |

5,730 |

|

4,666 |

+23 % |

+19 % |

+3 pts |

|

4,830 |

+26 % |

+10 pts |

* Like for like. ** Based on S&P Global

Mobility automotive production estimates released on July 14, 2023.

(Q2 2023 global production growth: 16%)*** Excluding the TCM (Top

Column Module) business.

First-half 2023 figures

Original equipment sales by customer

|

Customers |

H1 2023 |

|

H1 2022 |

|

German |

33 % |

|

30 % |

|

Asian |

31 % |

|

31 % |

|

American |

17 % |

|

19 % |

|

French |

13 % |

|

14 % |

|

Other |

6 % |

|

6 % |

|

Total |

100 % |

|

100 % |

Original equipment sales by region

|

Production regions |

H1 2023 |

|

H1 2022 |

|

Western Europe |

31 % |

|

31 % |

|

Eastern Europe & Africa |

18 % |

|

15 % |

|

China |

16 % |

|

16 % |

|

Asia excluding China |

15 % |

|

16 % |

|

United States & Canada |

7 % |

|

8 % |

|

Mexico |

11 % |

|

12 % |

|

South America |

2 % |

|

2 % |

|

Total |

100 % |

|

100 % |

| Asia and

emerging countries |

62 % |

|

61 % |

Safe Harbor Statement

Statements contained in this document, which are

not historical fact, constitute “forward-looking statements”. These

statements include projections and estimates and their underlying

assumptions, statements regarding projects, objectives, intentions

and expectations with respect to future financial results, events,

operations, services, product development and potential, and

statements regarding future performance. Even though Valeo’s

Management feels that the forward-looking statements are reasonable

as at the date of this document, investors are put on notice that

the forward-looking statements are subject to numerous factors,

risks and uncertainties that are difficult to predict and generally

beyond Valeo’s control, which could cause actual results and events

to differ materially from those expressed or projected in the

forward-looking statements. Such factors include, among others, the

Company’s ability to generate cost savings or manufacturing

efficiencies to offset or exceed contractually or competitively

required price reductions. The risks and uncertainties to which

Valeo is exposed mainly comprise the risks resulting from the

investigations currently being carried out by the antitrust

authorities as identified in the Universal Registration Document,

risks which relate to being a supplier in the automotive industry

and to the development of new products and risks due to certain

global and regional economic conditions. It is also exposed to

environmental and industrial risks, risks associated with the

Covid-19 epidemic, risks related to the Group’s supply of

electronic components and the rise in raw material prices, risks

related to the Russia-Ukraine conflict, as well as risks and

uncertainties described or identified in the public documents

submitted by Valeo to the French financial markets authority

(Autorité des marchés financiers – AMF), including those set out in

the “Risk Factors” section of the 2022 Universal Registration

Document registered with the AMF on March 30, 2023 (under number

D.23-0200).

The Company assumes no responsibility for any

analyses issued by analysts and any other information prepared by

third parties which may be used in this document. Valeo does not

intend or assume any obligation to review or to confirm the

estimates issued by analysts or to update any forward-looking

statements to reflect events or circumstances which occur

subsequent to the date of this document.

As a technology company and partner to all

automakers and new mobility players, Valeo is innovating to make

mobility cleaner, safer and smarter. Valeo enjoys technological and

industrial leadership in electrification, driving assistance

systems, reinvention of the interior experience and lighting

everywhere. These four areas, vital to the transformation of

mobility, are the Group's growth drivers. Valeo is the world’s

leading French patent applicant according to the rankings published

in June 2022 by France’s intellectual property institute

(INPI).Valeo in figures: 20 billion euros in sales in 2022; 109,900

employees at December 31, 2022; 29 countries, 183 plants, 21

research centers, 44 development centers, 18 distribution

platforms. Valeo is listed on the Paris Stock Exchange.

(1) Like for like. (2) Adjusted data: data for first-half 2022

has been adjusted as though the high-voltage electrification

business (formerly Valeo Siemens eAutomotive) had been consolidated

in the Group's financial statements as of January 1, 2022.(2) See

financial glossary, page 14. (3) Based on S&P Global Mobility

automotive production estimates released on July 14, 2023.

(4) See financial glossary, page 14.

(5) See financial glossary, page 14. (6) See financial glossary,

page 14. (7) See financial glossary, page 14. (8) See financial

glossary, page 14. (9) See financial glossary, page 14. (10) See

financial glossary, page 14.

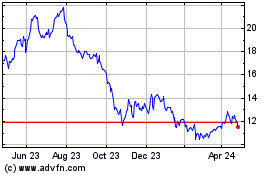

Valeo (EU:FR)

Historical Stock Chart

From Mar 2024 to Apr 2024

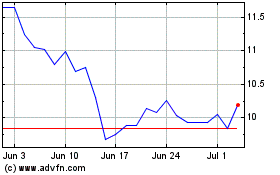

Valeo (EU:FR)

Historical Stock Chart

From Apr 2023 to Apr 2024