2019 annual results

- Revenue growth to €816.9 million in line with objectives

- Revenue of €816.9 million, a 3.5% increase

- Revenue of €805.6 million at constant exchange rates, up

2%

- EBITDA of €111.5 million, increasing year over year on a

like-for-like basis

- Strong improvement in free cash flow to €28.3 million and

net debt reduced to €280.5 million (excluding IFRS 16

impact) thanks to a significant reduction in inventories

- 2020: Continuation of the value-creation strategy initiated by

the Group

- Significant growth in the Interventional Imaging segment

- Continuation of the “Cost to Win” savings plan

- Finalisation of gadopiclenol phase III

- Continuation of the inventory reduction plans

- 2020 outlook: Uncertainty related to the measures taken to

combat the COVID-19 epidemic despite a minor impact on Guerbet’s

activity observed to date

Villepinte, 24 March

2020 – Guerbet (FR0000032526), a global leader in medical

imaging, is announcing its consolidated annual results for

2019.

On 24 March 2020, the Board of Directors

approved the financial statements for the financial year ended 31

December 2019. The audit procedures have been completed, and the

statutory auditors’ report is being prepared.

Both business segment

growing

Reported revenue of €816.9 million was up

3.5% from 2018, including a favourable forex impact of

€11.3 million. Revenue was up 2.0% at €805.6 million at

constant exchange rates(1). Excluding the impact of the decrease in

activity related to a subcontract inherited from the CMDS

activities, revenue growth at constant exchange rates would have

been 3.7% over the 2019 financial year.

Diagnostic Imaging sales

increased to €711.0 million at constant exchange rates (+3.0%)

and €719.5 million at current exchange rates.

- Sales in the MRI(2) segment totalled

€271.4 million at constant exchange rates and like-for-like

period and scope (€275.0 million at current exchange rates)

compared with sales of €272.0 million in 2018. In 2019,

activity suffered from the planned withdrawal of Optimark® from the

market. Excluding Optimark®, MRI sales at constant exchange rates

were up 1.6%.

- CT/Cath Lab(2) sales grew 5.2% to

€439.5 million at constant exchange rates thanks to

double-digit sales growth of Optiray® over the period

(€444.6 million at current exchange rates). This strong

growth, combined with the stability of Xenetix® sales, illustrates

Guerbet’s market penetration in this segment.

Intervention Imaging now

represents just over 9% of the Group’s revenue. It posted revenue

at constant exchange rates of €73.5 million, up 12.5% (€75.5

million at current exchange rates).

A financial year marked primarily by

expenditures for future growth

IFRS 16 on the recognition of leases for

consolidated financial statements entered into force on 1 January

2019. Guerbet decided to apply this standard on a simplified

retrospective basis, which does not provide for restatement of the

previous financial year. For comparison purposes, the 2019 figures

are presented after application of IFRS 16 and then before

application of IFRS 16 to make them comparable with the 2018

figures.

|

In millions of eurosConsolidated financial statements (IFRS) |

2018Published |

2019Published(With

IFRS 16) |

2019 (Without IFRS 16) |

|

Revenue |

789.6 |

816.9 |

|

|

EBITDA (3) |

110.6 |

111.5 |

101.8 |

|

% of revenue |

14.0% |

13.7% |

12.5% |

|

Operating income |

69.9 |

51.7 |

51.6 |

|

% of revenue |

8.9% |

6.3% |

6.3% |

|

Net income |

46.8 |

37.3 |

37.6 |

|

% of revenue |

5.9% |

4.6% |

4.6% |

|

Net Debt |

308.7 |

296.5 |

280.5 |

Reported EBITDA totalled €111.5 million,

including €9.7 million for the elimination of rents due to the

implementation of IFRS 16.

The change in EBITDA should be interpreted in

the light of several specific occurrences in 2018 and

2019:

- As a reminder, the 2018 EBITDA included extraordinary gains

related to the revaluation of inventories for €12.8 million,

the sale of our distribution activities in Argentina for

€5 million, and an €8 million expense for the destruction

of obsolete inventories.

- The 2019 EBITDA includes:

- Nearly €12 million in additional expenses related to the

transition to direct distribution in Japan, the enhancement of

resources required for the development of the interventional

imaging activity, and the increase in costs associated with

gadopiclenol phase III. The Group indicates that the

phase III costs incurred in 2019 totalled approximately

€7 million.

- €9 million in extraordinary expenses related to

resolutions of supplier disputes, in particular with Mallinckrodt,

compensation following the CEO’s departure, and the incident at the

Dublin site in November. The consequences of this incident are

expected to affect inventory levels and therefore sales of Optiray®

in the first half of the 2020 financial year.

- Lastly, EBITDA benefited from strict cost control resulting

from the implementation of the Cost to Win plan, saving an

estimated €8 million. This plan to reduce expenditures is

expected to start delivering its full potential in 2021.

At 31 December 2019, the operating result

totalled €51.7 million.

Net income was €37.3 million compared with

€46.8 million for the 2018 financial year. This figure

incorporates a favourable change in the effective tax rate to

27.1%.

Sound financial structure and dividend distribution of

€0.70 per share

Following the application of IFRS 16, the

Group booked greater non-current assets by including the rights to

use leased real estate assets for a net amount of €16 million,

resulting in greater financial debt.

Free cash flow was up significantly in 2019,

resulting especially from the Group’s inventory reduction

initiatives and leading to a decrease in net debt of approximately

€28 million for the 2019 financial year (excluding

IFRS 16 impact). Net debt totalled €296.5 million

including IFRS 16 impact (€279.2 million excluding

IFRS 16 impact).

As a reminder, Guerbet signed a five-year

€500 million credit agreement on 13 February 2019 to refinance

its existing debt. As of the end of December 2019, the net

debt/EBITDA ratio was 2.75 (excluding IFRS 16 impact). The

Group therefore has a solid balance sheet and sufficient bank

credit lines to cover its liquidity requirements even in an

environment with little visibility.

Considering the quality of the results but also

in the context of the sanitary and economical crisis related to the

pandemic of Covid-19, the Board of Directors will propose a

dividend of €0.70 per share to the shareholders at the General

Meeting on 29 May 2020.

2020 outlook

The measures taken to combat the COVID-19

epidemic and their impact on the economy make the 2020 financial

year uncertain, although Guerbet has so far seen only a minor

impact on its activity. The Group’s top priority remains the health

of its employees. With this in mind, Guerbet has put in place plans

to promote business continuity and maintain all critical activities

while ensuring employee safety.

Guerbet is focusing all its efforts on the

continuity of supply of its speciality products to the market, some

of which are identified as medicinal products of major therapeutic

interest, while continuing to prioritise employee safety. While the

impact in China is expected to be limited, the effects of COVID-19

on the supply chain in Europe is still very uncertain and highly

dependent on the duration of the pandemic response. However, the

current inventory levels of critical raw materials are sufficient

to ensure production over the coming weeks. To date, all of the

Group’s production sites around the world are operating normally,

and all the distribution centres are continuing to ship orders to

all customers wherever they are.Regardless of the COVID-19

situation, Guerbet anticipates its revenue growth to benefit from

the good performance of:

- Lipiodol®;

- consumables for contrast agent injections;

- digital solutions and after-sales services; and

- the gradual acceleration of sales of Accurate

microcatheters.

Conversely, certain sources of uncertainty are

likely to weigh on revenue growth:

- The introduction of a generic in the United States, which will

slow the growth of Dotarem®, even though this will be partially

offset by growth opportunities for Dotarem® in Europe and

Asia;

- The coming into force of two measures in France. The first

concerns article 66 of the social security finance law for 2019,

which provides that insured individuals are now reimbursed

exclusively on the basis of the price of the generic. The second

concerns the introduction of a reduction in the public price for

iodinated agents.

Given the uncertainty associated with the fight

against COVID-19 and its effects, Guerbet will communicate more

precisely on its 2020 outlook at a later stage when the Group has

more visibility on the duration and scale of the implemented

response measures, particularly in Europe.

(1) At constant exchange rates: amounts and rates of growth are

calculated by cancelling out the exchange rate effect, which is

defined as the difference between the indicator’s value for period

N, converted at the exchange rate for period N-1, and the

indicator’s value for period N-1.

(2) As a reminder, MRI and CT / Cath Lab segments now

include the sales of injection systems and consumables.

(3) EBITDA refers to operating income with the net allowance for

amortisation, depreciation, and provisions added back in.

Upcoming events:

Publication of first-quarter 2020

revenueApril 23, 2020, after trading

About

Guerbet

Guerbet is a leader in medical imaging

worldwide, offering a wide range of pharmaceutical products,

medical devices, digital and AI solutions for diagnostic and

interventional imaging, to improve the diagnosis and treatment of

patients. A pioneer since more than 90 years in the field of

contrast media with over 2,800 people globally, Guerbet is

continuously innovating with 9% of revenue dedicated to Research

& Development and four centers in France, Israel and the United

States. Guerbet (GBT) is listed on Euronext Paris (segment B – mid

caps) and generated €817 million in revenue in 2019. For more

information about Guerbet, please visit www.guerbet.com

Forward-looking statements

Certain information contained in this press release does not

reflect historical data but constitutes forward-looking statements.

These forward-looking statements are based on estimates, forecasts,

and assumptions, including but not limited to assumptions about the

current and future strategy of the Group and the economic

environment in which the Group operates. They involve known and

unknown risks, uncertainties, and other factors that may result in

a significant difference between the Group’s actual performance and

results and those presented explicitly or implicitly by these

forward-looking statements.

These forward-looking statements are valid only as of the date

of this press release, and the Group expressly disclaims any

obligation or commitment to publish an update or revision of the

forward-looking statements contained in this press release to

reflect changes in their underlying assumptions, events,

conditions, or circumstances. The forward-looking statements

contained in this press release are for illustrative purposes only.

Forward-looking statements and information are not guarantees of

future performance and are subject to risks and uncertainties that

are difficult to predict and are generally beyond the Group’s

control. These risks and uncertainties include but are not limited

to the uncertainties inherent in research and development, future

clinical data and analyses (including after a marketing

authorisation is granted), decisions by regulatory authorities

(such as the US Food and Drug Administration or the European

Medicines Agency) regarding whether and when to approve any

application for a drug, process, or biological product filed for

any such product candidates, as well as their decisions regarding

labelling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

businesses can be found in Chapter 4.4 “Risk Factors” of the

Group’s Registration Document filed with the French Financial

Markets Authority (AMF) under number D-18-0387 on 25 April 2018,

available on the Group’s website (www.guerbet.com).

For more information about Guerbet, please visit

www.guerbet.com

Contacts

| Jérôme

EstampesChief Financial

Officer+33 (0)1 45 91 50 00 |

Financial

CommunicationsBenjamin

Lehari+33 (0)1 56 88 11 25blehari@actifin.fr PressJennifer

Jullia+33 (0)1 56 88 11 19jjullia@actifin.fr |

- 03242020 - Annual results 2019

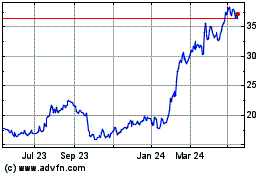

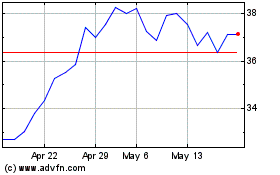

Guerbet (EU:GBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Guerbet (EU:GBT)

Historical Stock Chart

From Nov 2023 to Nov 2024