Not to be published, distributed or circulated

directly or indirectly in the United States, Canada, Australia or

Japan.

This press release is an advertisement and not

a prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017

Regulatory News:

ORPEA S.A (the « Company »), announces today the results

of its rights issue for a gross amount, including issue premium, of

EUR 390,019,672.62, by way of issuance of 29,324,787,415 new shares

(the “New Shares”) at a subscription price of EUR 0.0133 per

New Share, to which the members of the Groupement1 had committed to

subscribe in the amount of approximately EUR 195.7 million

(severally but not jointly), the balance, i.e. approximately EUR

194.3 million being backstopped by the members of the SteerCo2 (the

“Rights Issue”).

RESULTS OF THE RIGHTS ISSUE

Following the subscription period which ended on February 2nd,

2024, total demand amounted to 21,238,900,371 New Shares (including

14,715,668,849 New Shares subscribed by the Groupement members),

representing a subscription rate of 72.43%. The 29,324,787,415 New

Shares issued as part of the Rights Issue have been subscribed as

follows:

- 20,557,957,819 New Shares, representing 70.10% of the New

Shares, have been subscribed on an irreducible basis (à titre

irréductible) of which 14,715,668,849 New Shares subscribed by the

Groupement members, as set out in the terms of the agreement dated

February 14th, 2023 between the Company, the Groupement and the

SteerCo (the “Lock-Up Agreement”) and as provided under the

Accelerated Safeguard Plan (the “Subscription Commitments from

the Groupement”).

- Reducible demand (à titre réductible) accounted for 680,942,552

New Shares.

As a consequence, 8,085,887,044 New Shares, in an amount

(including the issue premium) of EUR 107.5 million, will be

subscribed by the SteerCo members in accordance with their

backstop3 commitments (the “Backstop Commitments from the

SteerCo” and together with the Subscription Commitments from

the Groupement, the “Subscriptions Commitments”).

IMPACT OF THE CAPITAL INCREASE ON THE COMPANY’S

SHAREHOLDING

After completion of the Rights Issue, the Company’s share

capital will amount to EUR 1,591, 917,031.11 and will be comprised

of 159,191,703,111 shares with a par value of EUR 0.01 each, held

as follows:

- Groupement: 50.18% of which:

- Caisse des Dépôts et Consignations (CDC): 22.41%,

- Mutuelle Assurance des Instituteurs de France (MAIF):

14.81%,

- CNP Assurances: 5.56% and

- MACSF Epargne Retraite: 7.41%

- Free float: 49.82%4

SETTLEMENT AND DELIVERY

Settlement, delivery and start of trading of the New Shares on

the regulated market of Euronext in Paris (“Euronext Paris”)

are expected to take place on February 15th, 2024. The New Shares

will immediately entitle their holders to all distributions, will

be immediately fungible with existing ordinary shares of the

Company and will be traded on the same trading line under the same

ISIN code FR0000184798.

Crédit Agricole Corporate and Investment Bank, Natixis and

Société Générale acted as global coordinators and joint bookrunners

(the “Global Coordinators and Joint Bookrunners") and BNP

Paribas as joint bookrunner (the “Joint Bookrunner") in

respect of the Rights Issue.

REVERSE STOCK SPLIT

It is reminded that the Company announced on February 5th, 2024,

that a reverse stock split will be implemented, such that one

thousand (1,000) ordinary shares with a nominal value of EUR 0.01

each will be exchanged for one (1) new share with a nominal value

of EUR 10 euros each (the “Reverse Split”). The launch of

the Reverse Split is scheduled for February 20th, 2024 for a period

of 30 days, i.e. until March 21st, 2024 inclusive, following which,

on the basis of the 159,191,703,111 shares with a nominal value of

EUR 0.01 each comprising the share capital of the Company after

completion of the Rights Issue, the share capital of the Company

will amount to EUR 1,591,917,030, comprised of 159,191,703 shares

with a nominal value of EUR 10 each. The final terms of the Reverse

Split will be detailed in a press release that the Company will

publish on the day of launch of the Reverse Split.

ISSUANCE OF WARRANTS IN RETURN OF THE SUBSCRIPTION

COMMITMENTS

It is reminded that in return for the Subscription Commitments

from the Groupement, the Accelerated Safeguard Plan provides that

the Company will grant members of the Groupement, following the

completion of the Rights Issue, and the Reverse Split, 1,170,888

warrants (the “Groupement Warrants”)5, corresponding,

on the basis of a theoretical value of the Company's equity

post-financial restructuring of approximately EUR 2,700 million, to

a total value equivalent to 10% of the amount of the Subscription

Commitments from the Groupement, i.e. approximately EUR 19.6

million, allowing their holders to subscribe (being specified that

each Warrant gives the right to subscribe one share of the Company,

at a price of EUR 0.01 per share) for shares representing (after

taking into account the Reverse Split) 0.725% of the Company’s

share capital, on a fully diluted basis. The issuance of the

Groupement Warrants was subject to the 27th resolution being passed

at the shareholders annual General Meeting of the Company held on

December 22nd, 2023. Such resolution was ultimately rejected by the

shareholders, the resolution having received only 65.55% votes in

favor (it being specified that the members of the Groupement did

not take part in the vote).

Moreover, in return for the Backstop Commitments from the

SteerCo, the Accelerated Safeguard Plan provides that the Company

will grant Members of the SteerCo, following completion of the

Rights Issue, 1,162,279 Warrants6 (the “SteerCo Warrants”

and together with the Groupement Warrants, the “Warrants”),

corresponding, on the basis of a theoretical value of the Company's

equity post-financial restructuring of approximately EUR 2,700

million, to a total value equivalent to 10% of the amount of the

Backstop Commitments from the SteerCo, i.e. an amount of

approximately EUR 19.4 million allowing their holders to subscribe

for shares representing (after taking into account the Reverse

Split) 0.720% of the Company’s share capital, on a fully diluted

basis. The issuance of the SteerCo Warrants was subject to the 28th

resolution being passed at the shareholders annual General Meeting

held on December 22nd, 2023. Such resolution was approved by the

shareholders (it being specified that the members of the SteerCo

and their affiliates did not take part in the vote).

If all of the Warrants are not issued within six months after

the settlement of the Rights Issue scheduled on February 15th,

2024, the Accelerated Safeguard Plan (paragraph 3.5.5(b) of part

III) provides that the members of the Groupement and the members of

the SteerCo will receive from the Company their equivalent in cash,

i.e. 10% of the Subscription Commitments from the Groupement and

10% of the Backstop Commitments from the SteerCo (i.e approximately

EUR 19.6 million for the benefit of the Groupement and

approximately EUR 19.4 million for the benefit of the SteerCo,

representing a total amount of approximately EUR 39 million).

The Company reserves the right to submit resolutions allowing to

grant Warrants to the members of the Groupement and the SteerCo for

approval to the next shareholders annual General Meeting which will

take place to approve the accounts for the financial year ending

December 31st, 2023.

Under this assumption and in the event of approval by the

general meeting of shareholders, the Company will issue the

Groupement Warrants for the benefit of the members of the

Groupement and will issue the SteerCo Warrants for the benefit of

the members of the SteerCo according to the above-mentioned terms.

In the event of rejection by the general meeting of shareholders,

the Groupement Warrants and the SteerCo Warrants will not be

issued, and the Company, in accordance with the provisions of the

Accelerated Safeguard Plan, will therefore pay the members of the

Groupement and the members of the SteerCo a total amount of

approximately EUR 39 million.

REMINDER ON THE ACCELERATED SAFEGUARD PLAN

The Rights Issue, as described in this press release, is the

third and last capital increase planned in the Accelerated

Safeguard Plan following (i) a capital increase with shareholders'

preferential subscription rights backstopped by the unsecured

creditors, having been the subject of a prospectus approved by the

AMF on November 10th, 2023 under number 23-465, and whose

delivery-settlement occurred on December 4th, 2023 and (ii) a share

capital increase without preferential subscription rights reserved

for named persons, namely the Groupement members, with a priority

right granted to the shareholders whose shares were evidenced by

book-entry (inscription en compte) at the end of the accounting day

of November 15th, 2023, having been the subject of a prospectus

approved by the AMF on December 5th, 2023 under number 25-503, and

whose delivery-settlement occurred on December 19th, 2023.

AVAILABILITY OF THE PROSPECTUS

The Rights Issue is the subject of a prospectus (the «

Prospectus ») approved by the AMF under number 24-006 on

January 17th, 2024, comprised of (i) ORPEA S.A. 2022 universal

registration document filed with the AMF on June 7, 2023 under

number D. 23-0461 (the “Universal Registration Document” or

“URD”), (ii) a first amendment to the URD filed with the AMF

on November 10, 2023 under number D.23-0461-A01 (the “First

Amendment to the URD”), (iii) a second amendment to the URD

filed with the AMF on December 5th, 2023 under number D.23-0461-A02

(the "Second Amendment to the URD”) (iv) a third amendment

to the URD filed with the AMF on January 17th, 2024 under number

D.23-0461-A03 (the "Third Amendment to the URD”), (v) the

securities note dated January 17th, 2024 (the “Securities

Note”) and (vi) the summary of the Prospectus (included in the

Securities Note) and available on the websites of the AMF

(www.amf-france.org) and the Company (www.orpea-group.com). Copies

of the Prospectus are available free of charge at the Company’s

registered office (12, rue Jean Jaurès, 92813 Puteaux Cedex).

RISK FACTORS

Investors’ attention is drawn to the risk factors relating to

the Company included in chapter 2 « Internal Control and Risk

Factors » of the URD as updated in Chapter 2 of the First Amendment

to the URD, in chapter 2 of the Second Amendment to the URD, and in

Chapter 2 of the Third Amendment to the URD and the risk factors

relating to the transaction and the New Shares mentioned in chapter

2 “Risk Factors” of the Securities Note, in particular risk factor

2.1 related to the massive dilution implied by the Capital

Increases and the need for Existing Shareholders to invest or to

have invested significant amounts in order to maintain their stakes

unchanged.

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https ://www.orpea-group.com/en

Since December 2023, the ORPEA Group is held at 50.2% by Caisse

des Dépots, CNP Assurance, MAIF and MACSF Épargne Retraite.

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

ordinary shares in any State or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the member states of the European Economic Area

(others than France) and the United Kingdom (each a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the securities referred to herein

requiring a publication of a prospectus in any Relevant State. As a

result, the securities may and will be offered in any Relevant

State only (i) to qualified investors within the meaning of the

Prospectus Regulation, for any investor in a Member State of the

European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set forth in Article 1 (4)

of the Prospectus Regulation or under any other circumstances which

do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation, of the UK

Prospectus Regulation and/or to applicable regulations of that

Relevant State.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused

to be communicated (all such persons together being referred to as

“Relevant Persons”). Any investment or investment activity

to which this document relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

document or any of its contents.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company does not intend to register all or any

portion of the securities in the United States under the Securities

Act or to conduct a public offering of the securities in the United

States.

This announcement may not be published, forwarded or

distributed, directly or indirectly, in the United States, Canada,

Australia or Japan.

___________________________________ 1 The “Groupement”

referring to Caisse des Dépôts et Consignations (CDC), Mutuelle

Assurance des Instituteurs de France (MAIF), CNP Assurances and

MACSF Epargne Retraite (or companies affiliated with them). 2 The

“SteerCo” referring to five institutions holding a

significant portion of the company’s unsecured debt set off as part

of the Equitization Capital Increase (as defined below). 3 It is

reminded that under the Backstop Commitments from the SteerCo, each

member of the SteerCo has committed if (x) the amount of all

subscriptions on an irreducible basis (à titre irréductible) and

the subscriptions on a reducible basis (à titre réductible) of the

holders of preferential subscription rights in the Rights Issue

(other than the members of the Groupement pursuant to the

Subscription Commitments from the Groupement) increased by (y) the

amount of the Subscription Commitments from the Groupement, would

not represent 100% of the amount of the Rights Issue (the

difference between (A) the amount of the Rights Issue and (B) all

subscriptions on an irreducible basis (à titre irréductible) and

subscriptions on a reducible basis (à titre réductible) referred to

in (x) and (y) above being the “Available Amount”), to

subscribe, in cash, a number of shares corresponding to the

Available Amount, i.e. a maximum amount of approximately EUR 194.3

million, split between them pro rata to the unsecured debt held by

each of them as of 31 January 2023. 4 Including Unsecured-Creditors

whose Unsecured Debt has been converted into shares as part of the

Equitization capital increase and who still hold shares on the date

of this press release, including the SteerCo. 5 For purely

illustrative purposes, the number of Groupement Warrants which

would have been granted excluding the effect of the Reverse Split

would amount to 1,170,888,000 Groupement Warrants (i.e. 1,170,888 x

1,000). On this basis, the theoretical exercise price of the

Groupement Warrants would be EUR 0.00001 (i.e. 0.01 / 1,000). 6 For

purely illustrative purposes, the number of SteerCo Warrants which

would have been granted excluding account of the Reverse Split

would amount to 1,162,279,000 Groupement Warrants (i.e. 1,162,279 x

1,000). On this basis, the theoretical exercise price of the

SteerCo Warrants would be EUR 0.00001 (i.e. 0.01 / 1,000).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240207055342/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net Toll-free number for

shareholders: 0 805 480 480 Investor Relations NewCap

Dusan Oresansky Tel. : 01 44 71 94 94 ORPEA@newcap.eu Press

Relations ORPEA Isabelle Herrier-Naufle Investor Relations

Director Tel. : 07 70 29 53 74 i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78 37

27 60 – 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

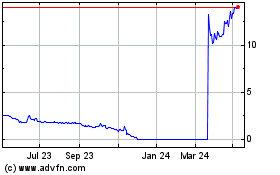

Orpea (EU:ORP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orpea (EU:ORP)

Historical Stock Chart

From Apr 2023 to Apr 2024