ORPEA Announces the Implementation of the Reverse Share Split of Its Outstanding Shares

20 February 2024 - 5:30PM

Business Wire

MAIN TRANSACTION TERMS

- Reverse share split through the exchange of one thousand

(1,000) existing shares with a par value of one euro cent (€0.01)

for one (1) new share to be issued with a par value of ten euros

(€10.00)

- Period of the reverse share split exchange: from February

20th, 2024 to March 21st, 2024 inclusive

- Effective date of reverse share split (listing of new

shares): March 22nd, 2024

- Suspension of the deferred settlement service for existing

shares: from February 27th, 2024

Regulatory News:

ORPEA S.A. (the “Company”) (Paris:ORP) announces today

the implementation of the reverse share split of all outstanding

shares of the Company and gives details of the terms of the

operation (the "Reverse Share Split").

In accordance with the notice of the Reverse Share Split in the

Bulletin des Annonces Légales Obligatoires (BALO) on February 5th,

2024 and following the announcement of the details and expected

timetable of the Reverse Share Split by the Company in the press

release dated February 5th, 2024, the Reverse Share Split will

start today in accordance with the terms set out below.

It should be remembered that following settlement-delivery of

the share capital increase with shareholders' preferential

subscription rights, having been the subject of a prospectus

approved by the AMF on January 17th, 2024 under number 24-006,

which took place on February 15th, 2024, the Company's share

capital now amounts to EUR 1,591,917,031.11, divided into

159,191,703,111 ordinary shares with a par value of one euro cent

(0.01) each.

The Reverse Share Split will result in the allocation of one (1)

new ordinary share to be issued with a par value of ten (10.00)

euros (the "New Shares") for one thousand (1,000) existing

ordinary shares with a par value of one euro cent (0.01) each (the

"Existing Shares"), and the division by one thousand (1,000)

of the number of outstanding shares of the Company's share capital

as of today, i.e. a total of 159,191,703,111 shares with a par

value of one euro cent (0.01) each.

It should be remembered that the Reverse Share Split is a purely

technical exchange transaction with no direct impact on the total

value of the Company's shares held by each shareholder.

A list of Frequently Asked Questions (FAQ) about the

Reverse Share Split is available at the following link.

Definitive terms and conditions of the

Reverse Share Split:

- Date of the beginning of the Reverse Share Split:

February 20th, 2024.

- Basis of the Reverse Share Split: exchange of one

thousand (1,000) Existing Shares with a par value of one euro cent

(0.01) for one (1) New Share with a par value of ten (10.00)

euros.

- Number of Existing Shares subject to the Reverse Share

Split: 159,191,703,111 shares, each with a par value of 0.01

euros.

- Number of New Shares to be issued as a result of the Reverse

Share Split: 159,191,703 shares with a par value of 10 euros

each.

- Reverse Share Split exchange period: thirty (30) days

from the date of commencement of the Reverse Share Split, i.e. from

February 20th, 2024 to March 21st, 2024 inclusive.

- Whole shares: the conversion of Existing Shares into New

Shares will be carried out automatically (procédure d’office).

- Fractional shares: shareholders who do not hold a number

of Existing Shares corresponding to a whole number of New Shares

must personally purchase or sell fractional Existing Shares, in

order to obtain a number of shares that is a multiple of 1,000, up

to and including March 21st, 2024 inclusive. After this date, any

shares that could not be allocated individually and corresponding

to fractional shares will be sold in accordance with the terms and

conditions set out in Article R. 228-12 of the French Commercial

Code and in accordance with market practice. Existing shares that

have not been consolidated will be delisted at the end of the

Reverse Share Split period.

- Voting rights: the New Shares will immediately carry

double voting rights, provided they are held in registered form,

if, at the date of the Reverse Share Split of the Existing Shares

from which they are issued, each of these Existing Shares carried

double voting rights. At the end of the Reverse Share Split period,

shares that have not been consolidated will lose their voting

rights and will no longer be included in the calculation of the

quorum, and their rights to future dividends will be

suspended.

- Centralization: all transactions relating to the Reverse

Share Split will be carried out by Société Générale Securities

Services, 32 rue du Champ de Tir, CS 30812, 44308 Nantes Cedex 3,

appointed as agent for the centralization of the Reverse Share

Split. Pursuant to Articles L. 228-6-1 and R. 228-12 of the French

Commercial Code, at the end of a period of 30 days from March 22nd,

2024, the New Shares that could not be allocated individually and

corresponding to fractional shares will be sold on the stock market

by the account holders, and the proceeds of the sale will be

allocated in proportion to the fractional shares of the holders of

these shares. Existing Shares subject to the Reverse Share Split

will be admitted to trading on Euronext Paris under ISIN code

FR0000184798 until March 21st, 2024, the last day of trading. New

Shares resulting from the Reverse Share Split will be admitted to

trading on Euronext Paris from March 22nd, 2024, the first day of

trading, under the new ISIN code FR001400NLM4.

- Adjustment of the exercise ratio of free shares awarded:

the Board of Directors has granted full powers to the Chief

Executive Officer, in order to preserve the rights of holders of

free shares awarded, to adjust the exercise ratio of free shares

awarded following the Reverse Share Split, if necessary, to take

account of the impact of the said Reverse Share Split on the

situation of holders of free shares awarded.

- Suspension of the eligibility of the Existing Shares for the

deferred settlement service: until the close of trading on

February 26th, 2024, the Existing Shares will remain eligible for

the deferred settlement service (the "DSS") and may

therefore continue to be subject to deferred settlement. As from

February 27th, 2024, the Existing Shares will no longer be eligible

for the DSS and will have to be settled in cash until their last

trading day, i.e. March 21st, 2024. As from March 22nd, 2024, the

date of their admission to listing, the New Shares will be eligible

for the DSS.

Indicative timetable:

February 5th, 2024

Publication of the notice of the Reverse

Share Split in the Bulletin des Annonces Légales Obligatoires

February 20th, 2024

Start of Reverse Share Split

operations

From February 27th, 2024

Suspension of the DSS for the Existing

Shares

February 20th, 2024 to March 21st, 2024

inclusive

Possibility for shareholders to buy and

sell shares in order to obtain a number without fractional

shares

March 21st, 2024

Last day of trading of Existing Shares

March 22nd, 2024

Listing of the New Shares

* * *

About ORPEA

ORPEA is a leading global player, expert in providing care for

all types of frailty. The Group operates in 20 countries and covers

three core businesses: care for the elderly (nursing homes,

assisted living facilities, homecare and services), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 76,000 employees and welcomes more than 267,000

patients and residents each year.

https ://www.orpea-group.com/

Since December 2023, the ORPEA Group has been 50.2% owned by

Caisse des Dépôts, CNP Assurances, MAIF and MACSF Épargne

Retraite.

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120 and CAC Mid 60 indices.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240219882598/en/

Investor Relations

ORPEA Benoit Lesieur Investor Relations Director

b.lesieur@orpea.net

Toll-free number for shareholders : 0 805 480 480

Investor Relations

NewCap Dusan Oresansky Tel.: 01 44 71 94 94

ORPEA@newcap.eu

Press Relations

ORPEA Isabelle Herrier-Naufle Investor Relations Director

Tel.: 07 70 29 53 74 i.herrier-naufle@orpea.net

Image7 Charlotte Le Barbier // Laurence Heilbronn 06 78

37 27 60 – 06 89 87 61 37 clebarbier@image7.fr

lheilbronn@image7.fr

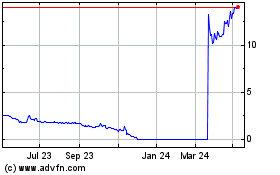

Orpea (EU:ORP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orpea (EU:ORP)

Historical Stock Chart

From Apr 2023 to Apr 2024