EUROPE MARKETS: Europe Stocks Return From Christmas Break To End Lower As BP And Pharmas Slump

28 December 2018 - 5:16AM

Dow Jones News

By Emily Horton

Shares of Sage Group bucked the downbeat trend, finishing up

3.5%

Most European stock indexes on Thursday booked sharp losses, as

weaker oil prices and a retreat following Wednesday's stunning

equity-market surge weighed on sentiment.

BP PLC and Siemens AG are among the biggest blue-chip

movers.

How are the markets performing?

The Stoxx Europe 600 fell by 1.7% to 329.58. The index finished

0.4% lower on Monday just before the markets closed for the

Christmas break, a session that marked the weakest close since Nov.

8, 2016.

The German DAX slumped 2.4% to 10,381.51 and Italy's FTSE MIB

finished 1.8% lower to 18,064.62. Meanwhile, the FTSE 100 ended

1.5% lower at 6,584.68, having finished 0.5% down on Christmas

Eve.

Losses for France's CAC 40 were less intense, as that index

closed down 0.6% to 4,598.61.

As the dollar fell, the euro climbed to $1.1389, compared with

$1.1353 in New York late on Monday, while the British pound was

largely unchanged at $1.2636 from $1.2632.

What is driving markets?

(http://www.marketwatch.com/story/us-stock-futures-pull-back-after-biggest-gain-in-history-for-dow-2018-12-27)Dragging

the DAX, the biggest decliner among European bourses, headlined

Thursday's pullback, as shares of industrial giant Siemens (SIE.XE)

sank 2.4%.

Meanwhile, U.S. stocks fell Thursday

(http://www.marketwatch.com/story/us-stock-futures-pull-back-after-biggest-gain-in-history-for-dow-2018-12-27),

a day after a strong rally that reversed a battering for equities

on Christmas Eve. Wednesday saw all three major indexes log the

strongest one-day gains since March 23, 2009, on a percentage

basis, and it was the best ever day-after-Christmas performance for

the gauges.

A series of statements from senior White House aides that Trump

wasn't about to fire Jay Powell, Chair of the Federal Reserve, was

received well by the markets on Wednesday

(http://www.marketwatch.com/story/trump-started-a-fight-with-the-fed-he-had-zero-chance-of-winning-now-hes-backing-down-2018-12-26),

with the Dow soaring about 1,086 points after an afternoon

rally.

Oil, both crude oil and Brent futures dropped sharply, putting

major oil companies under pressure.

Thursday marked the sixth day of the partial U.S. government

shutdown, with neither President Trump or the Democrats showing

signs of softening its stance over the funding for his proposed

U.S.-Mexico border wall.

What stocks are active?

Nestlé SA (NESN.EB) (NESN.EB) shares dropped 3.8%, while other

heavyweights in the pharmaceutical sector -- Novartis AG (NOVN.EB)

(NOVN.EB) and Roche Holding Ltd(ROG.EB) ended down by 2% and 3.2%,

respectively.

Software and fashion sectors were in the green Thursday, with

Sage Group PLC (SGE.LN) finished the session 3.5% lower, but luxury

fashion house Burberry Group PLC (BRBY.LN) slipped 0.2%.

Among telecommunications companies, BT Group PLC (BT.A.LN)

dropped by 2.6%, while U.K. satellite company Inmarsat PLC

(ISAT.LN) led the index's decliners, with a 4.9% drop.

(END) Dow Jones Newswires

December 27, 2018 13:01 ET (18:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

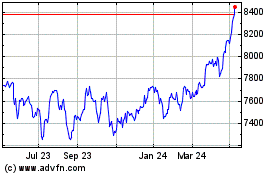

FTSE 100

Index Chart

From Jun 2024 to Jul 2024

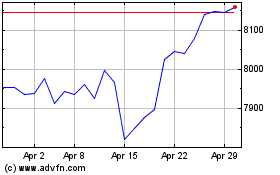

FTSE 100

Index Chart

From Jul 2023 to Jul 2024