MARKET WRAPS

Watch For:

Trade for November; Canada Trade for November; Earnings from

Albertsons

Today's Top Headlines/Must Reads:

- The former bond king, Bill Gross, says 10-year Treasury is

'overvalued'

- ESG Funds Underperformed in 2023. Backlash Wasn't the

Problem.

- As Retailers Cite Rising Theft and Shrinkage, Analysts Want

More Details

Opening Call:

Stock futures were lower early on Tuesday as a profit warning

from Samsung Electronics weighed on the technology sector.

Samsung said its fourth-quarter operating profit may fall 35% as

weak consumer demand for smartphones hits sales of memory

chips.

Overseas Markets

In Asia, the Nikkei 225 rose 1.2% to close at its best level

since March 1990. In contrast, the Hang Seng initially rose

following indications Beijing may ease monetary policy by cutting

banks reserve requirements, but ended down 0.2% to its lowest since

October 2022 as fears about China's economy lingered.

Premarket Movers

Boeing was down 0.8% in premarket trading after United Airlines

and Alaska Air said they discovered loose parts on Boeing 737 MAX 9

jets.

Match Group was rising 9.8% after the Journal reported Elliott

Investment Management has built a position of roughly $1 billion in

the company.

Nvidia closed Monday at an all-time high, rising 6.4% during the

session. The stock was up 0.2% in premarket trading.

Unity Software said it plans to lay off about 1,800 employees,

or 25% of its workforce, as the company "refocuses on its core

business." Shares rose 3.6%.

Monday's Post-Close Movers

BarkBox parent company Bark said sales for its fiscal third

quarter were better than the dog toy and treat company had

previously forecast. Shares rose 17%.

Extreme Networks lowered its second-quarter revenue outlook.

Shares fell 6.2%.

Hewlett Packard Enterprise is in advanced talks to buy Juniper

Networks for about $13 billion, the Wall Street Journal reported.

HPE shares fell 8.4% in after-market trading, while Juniper shares

rose 21%.

Microchip Technology fell 4.2% after the company said it

expected fiscal third-quarter sales to fall more than it had

anticipated, citing a "weakening economic environment."

Forex:

The dollar's gains at the start of this year have been modest

due to the market's conviction that the Federal Reserve will cut

interest rates this year, ING said.

Increasing long dollar positions is now viewed as a

"counter-trend trade."

January and February are typically good months for the dollar,

but the currency is more likely to trade in a range for now. ING

said the DXY dollar index could trade within a range between 101.90

and 103.10 this week, awaiting Friday's inflation data and bank

earnings.

Bonds:

Weakening growth, slowing inflation and an uncertain political

environment will create the perfect environment for bonds to

outperform other assets in the first quarter of 2024, Saxo

said.

"Bond investors are presented with the opportunity to lock in

one of the highest yields in more than 10 years," it said.

"Higher yields do not only mean higher returns, but also a lower

probability of bonds posting a negative return even if yields rise

slightly again."

Energy:

Oil prices gained, with ING saying that if market weakness

persisted, it would be difficult to see how OPEC+ would be able to

make more meaningful output reductions, given the scale of their

cuts already.

"What we are more likely to see is a rollover of current

voluntary cuts into 2Q24 in order to erode the surplus expected

next quarter."

Metals:

Base metals were weaker, while gold edged higher as market

watchers awaited this week's CPI data for more economic

clarity.

"Investors are awaiting the inflation print on Thursday, which

we expect will bring more volatility to the base metals complex,"

Sucden Financial said.

Uranium

Uranium prices could rise even higher on supply tightness ,

rising demand and thin spot markets, Berenberg said. However,

prices will likely normalize in the $70 per pound range in the long

term.

TODAY'S TOP HEADLINES

PepsiCo, Grocery Giant Bicker Over Who Dumped Whom

A breakup over grocery prices got messier Monday when PepsiCo

said that it, not supermarket chain Carrefour, initiated the

split.

PepsiCo said that it had decided to stop supplying the chain's

European stores because the two sides hadn't reached an agreement

on a new contract.

United, Alaska Find Loose Parts on Some Boeing 737 MAX 9

Jets

United Airlines and Alaska Airlines have discovered loose parts

on Boeing 737 MAX 9 jets that they have inspected after a

near-catastrophe on a flight Friday, signaling Boeing's issues go

beyond the aircraft that made an emergency landing.

The disclosures came shortly before investigators at the

National Transportation Safety Board said that dangerous episode on

an Alaska Airlines jet occurred because an emergency exit-sized

door plug blew out at around 16,000 feet after somehow moving off a

set of stops that are designed to keep it attached to the

plane.

China Surges to the Top of Global Auto Exports

HONG KONG-China's overseas auto sales surged to a record last

year, on track to surpass Japan as the world's biggest exporter and

marking a tectonic shift for the global auto industry.

While China has become acknowledged as a world leader in

electric vehicles, traditional gas-powered autos were the main

driver of the increase, with demand surging especially in

Russia.

Big 2024 Presidential Election Changes Are Leaving Voters

Baffled

Iowa Republicans on Monday will caucus to choose a presidential

candidate, but Democrats will start to vote by mail and wait weeks

for results. In New Hampshire the following week, both parties will

cast primary ballots, but the Democrats' votes will be purely

symbolic.

And then in early February, Nevada Republicans can vote in two

contests: a caucus without all the GOP candidates, and a primary

where results won't count toward the nomination.

Co-Defendant in Trump Georgia Case Alleges Misconduct by Fulton

County Prosecutor Fani Willis

Fulton County District Attorney Fani Willis improperly hired and

paid a private attorney to aid her office in its racketeering case

against former President Donald Trump and others, according to a

court filing Monday by one of the defendants in the case.

A lawyer for Trump co-defendant Mike Roman stated that Willis is

"in a personal, romantic relationship" with Nathan Wade, a special

prosecutor in her office and a lead lawyer on the Trump case. The

motion asked a judge to disqualify Willis from the case she brought

against Trump and other defendants last year. Roman served as the

director of Election Day operations for Trump's 2020 campaign.

Write to ina.kreutz@wsj.com

TODAY IN CANADA

Earnings:

Tilray Brands 2Q

Economic Calendar (ET):

0830 Nov Trade

0830 Nov Building permits

Stocks to Watch:

Eupraxia Pharmaceuticals Announces Filing of Preliminary MJDS

Base Shelf Prospectus

Expected Major Events for Tuesday

00:01/UK: Dec BRC-KPMG Retail Sales Monitor

00:01/UK: CBI Financial Services Survey

00:01/UK: Dec Scottish Retail Sales Monitor

07:00/GER: Nov Industrial Production Index

07:45/FRA: Nov Foreign trade

07:45/FRA: Nov Balance of Payments

09:00/ITA: Nov Unemployment

11:00/US: Dec NFIB Index of Small Business Optimism

13:30/CAN: Nov International merchandise trade

13:30/US: Nov U.S. International Trade in Goods &

Services

13:30/CAN: Nov Building permits

13:55/US: 01/06 Johnson Redbook Retail Sales Index

15:00/US: Jan RCM/TIPP Economic Optimism Index

21:30/US: 01/05 API Weekly Statistical Bulletin

All times in GMT. Powered by Kantar Media and Dow Jones.

Expected Earnings for Tuesday

AZZ Inc (AZZ) is expected to report $0.82 for 3Q.

Acuity Brands (AYI) is expected to report $2.71 for 1Q.

Aehr Test Systems (AEHR) is expected to report for 2Q.

Albertsons Companies Inc (ACI) is expected to report $0.54 for

3Q.

Anixa Biosciences Inc (ANIX) is expected to report for 4Q.

CalAmp (CAMP) is expected to report $-0.15 for 3Q.

Cohbar Inc (CWBR) is expected to report for 3Q.

E2open Parent Holdings Inc (ETWO) is expected to report for

3Q.

MSC Industrial Direct Co Inc (MSM) is expected to report $1.30

for 1Q.

Neogen Corp (NEOG) is expected to report $0.03 for 2Q.

Park Aerospace Corp (PKE) is expected to report for 3Q.

PriceSmart (PSMT) is expected to report $1.09 for 1Q.

SMART Global Holdings Inc (SGH) is expected to report $-0.18 for

1Q.

Saratoga Investment Corp (SAR) is expected to report $1.01 for

3Q.

TD SYNNEX Corp (SNX) is expected to report $2.11 for 4Q.

TSR Inc (TSRI) is expected to report for 2Q.

Tilray Brands Inc (TLRY) is expected to report $-0.05 for

2Q.

VOXX International Corp - Class A (VOXX) is expected to report

$-0.10 for 3Q.

WD 40 (WDFC) is expected to report $1.00 for 1Q.

Powered by Kantar Media and Dow Jones.

ANALYST RATINGS ACTIONS

Advanced Micro Devices Raised to Buy From Hold by Melius

Research

agilon health Cut to Peer Perform From Outperform by Wolfe

Research

American Airlines Group Raised to Overweight From Equal-Weight

by Morgan Stanley

Apple Hospitality REIT Cut to Neutral From Buy by B of A

Securities

Ares Capital Cut to Neutral From Buy by B. Riley Securities

Arista Networks Raised to Buy From Hold by Melius Research

Array Technologies Cut to Equal-Weight From Overweight by Wells

Fargo

Axalta Coating Systems Cut to Neutral From Buy by UBS

Bank OZK Cut to Neutral From Buy by UBS

BankUnited Cut to Sell From Neutral by UBS

Beacon Roofing Supply Raised to Outperform From Market Perform

by William Blair

Blink Charging Raised to Buy From Hold by Needham

Blue Owl Capital Cut to Neutral From Buy by B. Riley

Securities

Brown & Brown Raised to Buy From Neutral by Goldman

Sachs

Brown & Brown Raised to Outperform From Sector Perform by

RBC Capital

Cabot Corp Cut to Neutral From Buy by UBS

Capital One Cut to Neutral From Outperform by Baird

Capital Southwest Cut to Neutral From Buy by B. Riley

Securities

Cboe Global Markets Raised to Overweight From Equal-Weight by

Barclays

ChampionX Cut to Neutral From Overweight by Piper Sandler

Chevron Raised to Buy From Hold by Jefferies

Cisco Systems Cut to Hold From Buy by Melius Research

CME Group Cut to Equal-Weight From Overweight by Barclays

CMS Energy Cut to Neutral From Buy by Seaport Global

Core & Main Raised to Buy From Neutral by Citigroup

CSX Corp Raised to Positive From Neutral by Susquehanna

Deere & Co Cut to Hold From Buy by Melius Research

Dell Technologies Raised to Overweight From Neutral by JP

Morgan

DoorDash Raised to Buy From Hold by Jefferies

DTE Energy Cut to Neutral From Buy by Seaport Global

Eagle Materials Raised to Buy From Hold by Loop Capital

Ecolab Cut to Neutral From Buy by Seaport Global

Enphase Energy Raised to Overweight From Equal-Weight by Wells

Fargo

Equifax Raised to Buy From Underperform by B of A Securities

Exelon Cut to Neutral From Buy by Seaport Global

Fastly Raised to Sector Perform From Underperform by RBC

Capital

FedEx Raised to Buy From Hold by Melius Research

Fidus Investment Cut to Neutral From Buy by B. Riley

Securities

First Solar Cut to Equal-Weight From Overweight by Wells

Fargo

Fiserv Raised to Overweight From Sector Weight by Keybanc

Franklin Resources Raised to Equal-Weight From Underweight by

Wells Fargo

Frontier Group Cut to Equal-Weight From Overweight by Morgan

Stanley

GitLab Raised to Buy From Neutral by Mizuho

Harpoon Therapeutics Cut to Neutral From Buy by HC Wainwright

& Co.

Hartford Financial Cut to Neutral From Overweight by JP

Morgan

Helmerich & Payne Cut to Neutral From Overweight by Piper

Sandler

Horizon Tech Finance Cut to Sell From Neutral by B. Riley

Securities

Host Hotels & Resorts Raised to Buy From Underperform by B

of A Securities

Intercontinental Exchange Raised to Overweight From Equal-Weight

by Barclays

Main Street Capital Cut to Neutral From Buy by B. Riley

Securities

Markel Cut to Sector Perform From Outperform by RBC Capital

MarketAxess Cut to Equal-Weight From Overweight by Barclays

Marsh & McLennan Cut to Sell From Buy by Goldman Sachs

MetLife Raised to Buy From Neutral by Goldman Sachs

Navient Cut to Underperform From Market Perform by TD Cowen

NetApp Cut to Underweight From Neutral by JP Morgan

NEXTracker Raised to Overweight From Equal-Weight by Wells

Fargo

NY Community Bancorp Cut to Neutral From Buy by UBS

Oaktree Specialty Lending Cut to Neutral From Buy by B. Riley

Securities

Okta Cut to Neutral From Buy by Mizuho

Old Dominion Freight Raised to Positive From Neutral by

Susquehanna

PBF Energy Cut to Neutral From Overweight by Piper Sandler

Pebblebrook Hotel Trust Cut to Underperform From Neutral by B of

A Securities

Pool Corp Cut to Hold From Buy by Loop Capital

PulteGroup Cut to Neutral From Buy by Citigroup

Saratoga Investment Cut to Neutral From Buy by B. Riley

Securities

Sherwin-Williams Cut to Neutral From Buy by Seaport Global

SiteOne Landscape Supply Cut to Hold From Buy by Loop

Capital

Southwest Airlines Cut to Underperform From Market Perform by

Bernstein

Stellus Capital Invest Cut to Sell From Neutral by B. Riley

Securities

SunPower Cut to Underweight From Equal-Weight by Wells Fargo

T Rowe Price Cut to Underweight From Equal-Weight by Wells

Fargo

TD SYNNEX Cut to Neutral From Overweight by JP Morgan

Terran Orbital Cut to Neutral From Buy by B. Riley

Securities

Thermo Fisher Cut to Market Perform From Outperform by

Bernstein

Toll Brothers Raised to Outperform From Peer Perform by Wolfe

Research

TopBuild Raised to Buy From Hold by Loop Capital

Upwork Raised to Buy From Hold by Jefferies

Verisk Analytics Cut to Neutral From Buy by B of A

Securities

Voya Financial Cut to Neutral From Buy by Goldman Sachs

Wells Fargo Cut to Neutral From Outperform by Baird

WhiteHorse Finance Cut to Neutral From Buy by B. Riley

Securities

WR Berkley Cut to Sector Perform From Outperform by RBC

Capital

Zions Bancorp Cut to Neutral From Buy by Compass Point

ZoomInfo Technologies Cut to Underperform From Sector Perform by

RBC Capital

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 09, 2024 06:08 ET (11:08 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

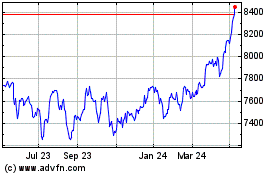

FTSE 100

Index Chart

From Jun 2024 to Jul 2024

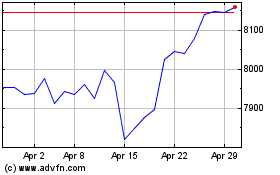

FTSE 100

Index Chart

From Jul 2023 to Jul 2024