Australian Dollar Climbs After RBA Keeps Rate On Hold

03 July 2018 - 1:00PM

RTTF2

The Australian dollar strengthened against its major

counterparts in the Asian session on Tuesday, trimming its early

losses, after Australia's central bank decided to leave its key

interest rate unchanged at a record low, consistent with its aim of

"sustainable growth in the economy and achieving the inflation

target over time."

The decision was widely expected.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, voted to maintain the cash rate at 1.50 percent. The bank had

reduced the rate by 25-basis points each in August and May last

year.

"The Board judged that holding the stance of monetary policy

unchanged at this meeting would be consistent with sustainable

growth in the economy and achieving the inflation target over

time," the bank said in a statement.

The bank reiterated the low level of interest rates is

continuing to support the Australian economy. Further progress in

reducing unemployment and having inflation return to target is

expected, although this progress is likely to be gradual, RBA

said.

Data from the Australian Bureau of Statistics showed that

Australia building approvals fell a seasonally adjusted 3.2 percent

on month in May, coming in at 17,791.

That was shy of expectations for a flat reading following the

5.0 percent decline in April.

Asian stock markets were mostly lower, as worries about trade

wars between the U.S. and other major economies weighed on investor

sentiment. Tariffs on $34 billion worth of Chinese imports to the

U.S. and a matching $34 billion worth of U.S. exports to China are

due to take effect on July 6.

The aussie dropped against its most major opponents on Monday,

as lingering trade worries, falling oil prices, soft Chinese

manufacturing data and German political uncertainty dampened risk

sentiment. It lost 0.7 percent against the yen, 0.9 percent against

the greenback and 0.6 percent against the euro for the day.

The aussie bounced off to 0.9714 against the loonie and 0.7373

against the greenback, from its early lows of 0.9661 and 0.7314,

respectively. The next likely resistance for the aussie is seen

around 0.98 against the loonie and 0.75 against the greenback.

The aussie firmed to 1.0977 against the kiwi, its highest since

January 31. If the aussie continues its rise, 1.11 is possibly seen

as its next resistance level.

The aussie edged up to 1.5801 against the euro, after having

fallen to near a 2-month low of 1.5888 at 9:45 pm ET. The aussie is

seen finding resistance around the 1.56 level.

Following a low of 81.03 hit at 9:45 pm ET, the aussie reversed

direction and rose to 81.82 against the yen. Next key resistance

for the aussie is likely seen around the 83.00 level.

Data from the Bank of Japan showed that Japan monetary base

advanced 7.4 percent on year in June, coming in at 493.363 trillion

yen.

That follows the 8.1 percent gain in May.

Looking ahead, U.K. construction PMI for June and Eurozone

retail sales and PPI for May are due in the European session.

In the New York session, U.S. factory orders and durable goods

orders for May will be out.

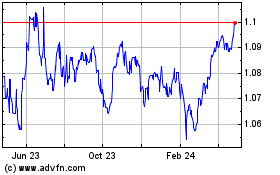

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2024 to May 2024

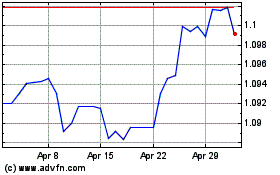

AUD vs NZD (FX:AUDNZD)

Forex Chart

From May 2023 to May 2024