Australian, NZ Dollars Fall In Cautious Trade

24 August 2022 - 2:20PM

RTTF2

The Australian and NZ dollars weakened against their major

counterparts in the Asian session on Wednesday, as weak U.S.

economic data sparked recession concerns and investors awaited Fed

Chairman Jerome Powell's speech at the Jackson Hole Symposium for

more signals on inflation and the rate outlook.

Data from S&P Global showed on Tuesday that US manufacturing

PMI declined to 51.3 in August from 52.2 in July and the services

PMI plunged to 44.1 from 47.3.

Data from the Commerce Department showed that U.S. new home

sales dropped 12.6% month-over-month to a seasonally adjusted

511,000 in July, the lowest reading since January 2016.

Powell will deliver a speech at the Jackson Hole Symposium on

Friday, with investors awaiting more clues about policy

outlook.

Federal Reserve bank of Minneapolis President Neel Kashkari said

that inflation is much more embedded at a much higher level than

the policy makers or markets appreciate and an aggressive stance is

needed to bring it back down.

The aussie dropped to 0.6895 against the greenback and 0.8949

against the loonie, from its early highs of 0.6931 and 0.8980,

respectively. The aussie is likely to face support around 0.67

against the greenback and 0.88 against the loonie.

Reversing from its early highs of 94.77 against the yen and

1.4377 against the euro, the aussie slipped to 94.19 and 1.4428,

respectively. Next key support for the aussie is likely seen around

90.5 against the yen and 1.48 against the euro.

The kiwi depreciated to a 2-day low of 84.44 against the yen and

near a 4-week low of 1.1169 against the aussie, off its early highs

of 85.02 and 1.1135, respectively. The kiwi is seen finding support

around 82.00 against the yen and 1.13 against the aussie.

The kiwi edged down to 0.6179 against the greenback and 1.6100

against the euro, down from its early highs of 0.6219 and 1.6025,

respectively. The next possible support for the kiwi is seen around

0.60 against the greenback and 1.63 against the euro.

Looking ahead, Canada wholesale sales and U.S. durable goods

orders and pending home sales, all for July, are due in the New

York session.

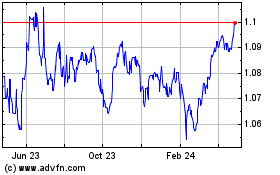

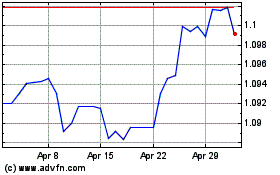

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024