Euro Strengthens As Eurozone Economic Confidence Improves

28 July 2017 - 4:00PM

RTTF2

The euro climbed against its major rivals in the early European

session on Friday, as Eurozone economic confidence strengthened

unexpectedly in July, pointing to acceleration in economic

recovery.

Survey data from the European Commission showed that the

economic sentiment index rose slightly to 111.2 in July from 111.1

in June. The score was forecast to fall to 110.8.

The industrial confidence indicator held steady at 4.5, slightly

above the forecast of 4.4 points. The flat change was caused by

managers' virtually unchanged assessments of all components

entering the confidence indicator.

The services confidence index rose to 14.1 in July from 13.3 in

June. The increase in services confidence owed exclusively to

markedly higher demand expectations and managers' views on past

demand.

Investors focus on flash inflation data from Germany later in

the day, which is expected to remain unchanged at 0.2 percent in

July.

The euro showed mixed performance in the Asian session. While

the euro rose against the greenback and the franc, it held steady

against the pound. Against the yen, it dropped.

The euro that closed Thursday's trading at 1.1675 against the

greenback advanced to 1.1717. Continuation of the euro's uptrend

may see it challenging resistance around the 1.19 region.

The euro rose to 130.34 against the Japanese yen, after having

fallen to a session's low of 129.55 at 9:00 pm ET. Next likely

resistance for the euro-yen pair is seen around the 133.00

level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's overall nationwide consumer prices rose 0.4

percent on year in June, in line with expectations and unchanged

from the previous month.

Nationwide core CPI, which excludes food prices, also gained 0.4

percent on year - again unchanged and as expected.

Extending early rally, the 19-nation currency spiked up to a

2-1/2-year high of 1.1379 versus the franc. On the upside, the euro

may locate resistance around the 1.16 mark.

The single currency strengthened to more than a 2-week high of

1.4700 versus the loonie, 2-day highs of 1.5686 against the kiwi

and 1.4719 versus the aussie, from its previous lows of 1.4644,

1.5568 and 1.4647, respectively. If the euro extends rise, 1.48,

1.58 and 1.485 are possibly seen as its next resistance levels

against the loonie, the kiwi and the aussie, respectively.

The common currency held steady against the pound, after

advancing to 0.8954 at 3:05 am ET. The pair finished Thursday's

trading at 0.8936.

Looking ahead, the German flash CPI data for July, Canada GDP

data for May, U.S. GDP data for the second quarter, U.S. University

of Michigan's final consumer sentiment index for July and U.S.

Baker Hughes rig count data are slated for release in the New York

session.

At 1:20 pm ET, Federal Reserve Bank of Minneapolis President

Neel Kashkari is expected to speak at a town hall event, in

Minnesota.

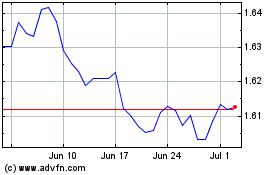

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2024 to May 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From May 2023 to May 2024