Commodity Currencies Rise On Higher Oil Prices

23 February 2024 - 2:29PM

RTTF2

Commodity currencies such as the Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Friday, after oil prices climbed on rising

tensions in the Middle East raised the possibility of a near-term

supply disruption.

West Texas Intermediate crude oil futures for April ended higher

by $0.70 or 0.9% at $78.61 a barrel.

Brent crude futures settled at $83.67 a barrel, gaining $0.64 or

0.77%.

Data from Energy Information Administration (EIA) showed crude

stockpiles in the U.S. rose by 3.5 million barrels in the week

ended February 16th, compared with forecasts for a rise of 3.9

million barrels.

The Houthis have reportedly stepped up attacks in the Red Sea

near Yemen, raising concerns about disruptions to crude supply. The

rebel group leader said there will be an escalation in attacks on

ships in the Red Sea and that they have introduced submarine

weapons.

In economic news, data from the Statistics New Zealand showed

that the total volume of retail sales in New Zealand was down a

seasonally adjusted 1.9 percent on quarter in the fourth quarter of

2023, contracting for the eight straight quarter.

That missed forecasts for a decline of 0.2 percent following the

flat reading in the previous three months.

In the Asian trading today, the Australian dollar rose to 1.6468

against the euro and 98.99 against the yen, from yesterday's

closing quotes of 1.6504 and 98.71, respectively. If the aussie

extends its uptrend, it is likely to find resistance around 1.63

against the euro and 100.00 against the yen.

Against the U.S., the Canada and the New Zealand dollars, the

aussie advanced to 0.6574, 0.8862 and 1.0606 from Thursday's

closing quotes of 0.6557, 0.8839 and 1.0576, respectively.The

aussie may test resistance around 0.68 against the greenback, 0.90

against the loonie and 1.07 against the kiwi.

The NZ dollar rose to more than a 9-year high of 93.43 against

the yen, from yesterday's closing value of 93.25. on the upside,

94.00 is seen as the next resistance level for the kiwi.

Against the U.S. dollar and the euro, the kiwi edged up to

0.6205 and 1.7446 from Thursday's closing quotes of 0.6195 and

1.7454, respectively. If the kiwi extends its uptrend, it is likely

to find resistance around 0.63 against the greenback and 1.72

against the euro.

The Canadian dollar rose to more than a 16-year high of 111.75

against the yen, from yesterday's closing value of 111.58. The

loonie may test resistance near the 112.00 region.

Against the U.S. dollar and the euro, the loonie edged up to

1.3476 and 1.4582 from early lows of 1.3495 and 1.4606,

respectively. If the loonie extends its uptrend, it is likely to

find resistance around 1.33 against the greenback and 1.44 against

the euro.

Looking ahead, German Ifo business climate index for February is

due to be released at 4:00 am ET.

In the New York session, U.S. Baker Hughes oil rig count data

and Canada budget balance for December are slated for release.

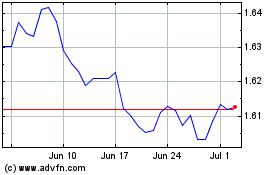

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024