Kiwi Falls As RBNZ Monetary Policy Spurs Less Chance Of Rate Hike

28 February 2024 - 1:35PM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Wednesday, after the New Zealand's central

bank left the benchmark interest rate unchanged for the fifth

straight meeting, as widely expected, and suggested that the rate

will remain tight for a sustained period of time.

The Monetary Policy Committee of the Reserve Bank of New

Zealand, governed by Adrian Orr, decided to hold the Official Cash

Rate at 5.50 percent.

The bank had raised its policy rate sharply from 0.25 percent

since October 2021.

Policymakers said that interest rates need to remain at a

restrictive level for a sustained period of time to ensure that

inflation returns to the target range.

The MPC noted that risks to the outlook for inflation were more

balanced than at the time of the November 2023 statement.

Although inflation eased to 4.7 percent in the fourth quarter of

2023, it remained well above the 1-3 percent target band.

In the Asian trading, the NZ dollar fell to near 2-week lows of

0.6103 against the U.S. dollar and 91.84 against the yen, from

yesterday's closing quotes of 0.6169 and 92.84, respectively. If

the kiwi extends its downtrend, it is likely to find support around

0.60 against the greenback and 90.00 against the yen.

Moving away from a recent 2-day low of 1.7555 against the euro,

the kiwi slipped to more than a 3-week low of 1.7752. The kiwi may

test support near the 1.78 region.

Against the Australian dollar, the kiwi dropped to near 2-week

low of 1.0686 from Tuesday's closing value of 1.0599. On the

downside, 1.07 is seen as the next support level for the kiwi.

The other antipodean currency, or the Australian dollar also

fell against its major counterparts after the RBNZ rate

decision.

In economic news, data from the Australian Bureau of Statistics

showed that Australia's consumer price inflation remained stable in

January. The monthly consumer price index posted an annual increase

of 3.4 percent in January. The rate was forecast to rise to 3.6

percent. The current inflation was the lowest since November

2021.

The Australian dollar fell to nearly a 2-week low of 0.6512

against the U.S. dollar and an 8-day low of 98.09 against the yen,

from yesterday's closing quotes of 0.6543 and 98.47, respectively.

If the aussie extends its downtrend, it is likely to find support

around 0.63 against the greenback and 97.00 against the yen.

Against the euro, the aussie slipped to 1.6627 from Tuesday's

closing value of 1.6568. The aussie may test support near the 1.67

region.

Moving away from a recent 2-day high of 0.8861 against the

Canadian dollar, the aussie edged down to 0.8823. On the downside,

1.67 is seen as the next support level for the aussie.

Looking ahead, the European Commission is set to release euro

area economic sentiment survey data for February at 5:00 am ET in

the European session.

In the New York session, U.S. MBA mortgage approvals data,

Canada current account data for the fourth quarter, U.S. GDP data

for the fourth quarter, U.S. good trade balance for January, core

PCE price data for the fourth quarter, wholesale inventories for

January, and EIA crude oil data are slated for release.

At 9:00 am ET, ECB Member of the supervisory board Elizabeth

McCaul will speak at industry outreach conference on counterparty

credit risk management (CCR) organized by the Federal Reserve Bank

of New York in collaboration with the Basel Committee on Banking

Supervision (BCBS) in New York, U.S.A.

At 10:30 am ET, Bank of England policymaker Catherine Mann takes

part in Financial Times panel discussion, in London, U.K.

At 12:00 pm ET, Federal Reserve Bank of Atlanta President

Raphael Bostic will deliver a speech on monetary policy and the

economy before the Greater North Fulton Chamber of Commerce, in

Roswell, Georgia.

At 12:15 pm ET, Federal Reserve Bank of Boston President Susan

Collins will speak in a fireside chat before an event hosted by the

Center for Business, Government and Society at the Dartmouth

College Tuck School of Business, in Hanover, New Hampshire,

U.S.

Half-an-hour later, Federal Reserve Bank of New York President

John Williams will participate in hybrid economic briefing

organized by the Long Island Association, in Garden city, New York,

U.S.

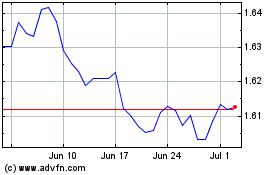

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024