Antipodean Currencies Rise As Asian Shares Traded Higher

21 March 2024 - 1:02PM

RTTF2

The antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major currencies in the

Asian session on Thursday, as Asian stock markets traded higher

after the U.S. Fed left interest rates unchanged and reiterated

expectations for three quarter point interest rate cuts later this

year, which had been in some doubt. Traders also reacted to a

couple of domestic economic data each from Australia and Japan.

The latest projections suggest that Fed officials expect rates

to be lowered to a range of 4.50 to 4.75 percent by the end of

2024. In the accompanying statement, Fed officials acknowledged

inflation has eased over the past year, but still need "greater

confidence" inflation is moving sustainably toward 2 percent before

cutting rates.

The Australian dollar started rising after the release of

nation's upbeat jobs data for February.

In economic news, Australia's unemployment rate came in at a

seasonally adjusted 3.7 percent in February, the Australian Bureau

of Statistics said on Thursday - well beneath forecasts for 4.0

percent and down from 4.1 percent in January.

The Australian economy added 116,500 jobs last month, blowing

away forecasts for an increase of 39,700 jobs following the

addition of 500 jobs in the previous month. Full-time jobs saw an

increase of 78,200 after adding 11,100 a month earlier. The

participation rate fell to 66.7 percent, shy of expectations for

66.8 percent - which would have been unchanged.

Meanwhile, the manufacturing sector in Australia continued to

contract in March, the latest survey from Judo Bank revealed on

Thursday with a manufacturing PMI score of 46.8. That's down from

47.8 in February, and it moves further beneath the boom-or-bust

line of 50 that separates expansion from contraction. The survey

also showed that the services PMI improved to 53.5 in March from

53.1 in February.

Data from Statistics New Zealand showed that New Zealand's gross

domestic product contracted a seasonally adjusted 0.1 percent on

quarter in the fourth quarter of 2023. That was shy of forecasts

for an increase of 0.1 percent following the 0.3 percent decline in

the previous three months as the country remains in recession.

On an annualized basis, GDP fell 0.3 percent - again missing

forecasts for a gain of 0.1 percent after sinking 0.6 percent in

the third quarter.

In the Asian trading now, the Australian dollar rose to nearly a

9-1/2-year high of 99.89 against the yen and nearly a 2-week high

of 1.6498 against the euro, from yesterday's closing quotes of

99.47 and 1.6574, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 100.00 against the yen and

1.63 against the euro.

Against the Canada and the U.S. dollars, the aussie advanced to

1-week highs of 0.8923 and 0.6629 from Wednesday's closing quotes

of 0.8891 and 0.6599, respectively. The aussie may test resistance

near 0.90 against the loonie and 0.67 against the greenback.

Against the NZ dollar, the aussie advanced to nearly a 4-month

high of 1.0870 from yesterday's closing value of 1.0836. On the

upside, 1.09 is seen as the next resistance level for the

aussie.

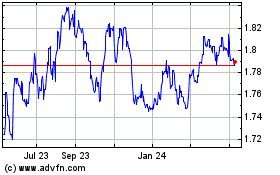

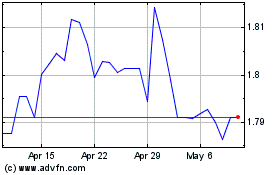

The NZ dollar rose to a 3-day high of 0.6101 against the U.S.

dollar and a 2-day high of 1.7922 against the euro, from

yesterday's closing quotes of 0.6090 and 1.7960, respectively. If

the kiwi extends its uptrend, it is likely to find resistance

around 0.62 against the greenback and 1.76 against the euro.

Against the yen, the kiwi edged up to 91.93 from Wednesday's

closing value of 91.80. The kiwi is likely to find resistance

around the 93.00 region.

Looking ahead, U.K. public sector finance data for February,

Eurozone current account data for January and PMI reports from

various European economies and U.K. for March are due to be

released in the European session.

At 4:30 am ET, the Swiss National Bank announces its monetary

policy decision. The bank is widely expected to maintain the

benchmark rate at 1.875%.

At 8:00 am ET, the Bank of England releases the monetary policy

summary and minutes of the monetary policy committee meeting. The

bank is widely expected to maintain the benchmark rate at 5.25

percent but to keep hawkish guidance.

In the New York session, U.S. Canada new housing price index for

February, U.S. weekly jobless claims, U.S.PMI data for March and

U.S. current account data for the fourth quarter are slated for

release.

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024