U.S. Dollar Climbs As Fed Meeting Looms

22 July 2022 - 1:29PM

RTTF2

The U.S. dollar advanced against its major counterparts in the

Asian session on Friday, on expectations for an aggressive rate

hike from the Federal Reserve at its meeting due next week.

The Fed meets on July 26 and 27, at which the policymakers are

expected to hike rates by 75 basis points.

Investors digested the latest batch of economic data from the

U.S. showing an increase in initial jobless claims last week and a

contraction in regional factory activity for July.

Disappointing earnings results from Snap fuelled fresh worries

about the economic outlook.

Earnings results from Apple, Microsoft, Alphabet, Meta and Visa

are due next week.

The greenback rose to 137.95 against the yen and 0.9690 against

the franc, after falling to a 9-day low of 137.02 and a 3-day low

of 0.9658, respectively in early deals. The greenback is seen

finding resistance around 139.00 against the yen and 0.98 against

the franc.

Reversing from its prior lows of 1.0231 against the euro and

1.2003 against the pound, the greenback edged up to 1.0180 and

1.1952, respectively. The currency is likely to locate upside

target levels of around 0.97 against the euro and 1.17 against the

pound.

The greenback gained to 0.6897 against the aussie, from more

than a 3-week low of 0.6938 seen at 5:30 pm ET. On the upside, 0.67

is possibly seen as its next resistance level.

The greenback rebounded from its previous lows of 0.6253 against

the kiwi and 1.2866 against the loonie, rising to 0.6211 and

1.2898, respectively. If the greenback rises further, 0.60 and 1.31

are possibly seen as its next resistance levels against the kiwi

and the loonie, respectively.

Looking ahead, PMI reports from major European economies are due

in the European session.

Canada retail sales for May will be featured in the New York

session.

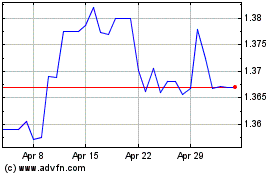

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2024 to May 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From May 2023 to May 2024