Down 83% From Record Highs, Is DocuSign Stock a Buy Right Now?

24 September 2022 - 7:25AM

Finscreener.org

DocuSign (NASDAQ: DOCU) is a

company that thrived amid the pandemic. As lockdowns were imposed

and businesses were shut, demand for DocuSign’s suite of services

gained pace, allowing it to increase sales from $973.9 million in

fiscal 2020 to $1.45 billion in fiscal 2021 and $2.1 billion in

fiscal 2022.

But analysts now forecast

DocuSign’s revenue growth to decelerate to 17.7% in fiscal 2023 and

to 10.7% in fiscal 2024. A less than impressive growth rate,

coupled with a challenging macro environment, has driven

DocuSign stock lower

by 83% from all-time highs, valuing

it at a market cap of $10.8 billion.

So, is DocuSign stock a buy now,

or will its price move lower in the next year?

An overview of DocuSign’s recent results

Founded in 2003, DocuSign

accounts for 70% of the e-signature market. It ended fiscal Q2 with

1.28 million customers, an increase of 22% year-over-year. The

company also provides contract lifecycle management services for

human resource departments. These services are bundled together in

DocuSign Agreement Cloud,

which is subscription-based.

DocuSign announced its fiscal Q2

of 2023 (ended in July) results earlier this month and reported

revenue of $622.2 million, an increase of 22% year-over-year. The

company beat analyst estimates by $19.9 million as its billings

surged 9% to $647.7 million.

DocuSign’s net income fell 8% to

$90.1 million or $0.44 per share, but beat estimates that forecast

the bottom line at $0.42 per share.

For the third quarter, DocuSign

forecasts revenue between 14% and 15% year over year, and billings

are estimated to increase between 3% and 5%. In fiscal 2023, sales

are expected to increase by 18%, with billings growth forecast at

9%.

While these estimates were in

line with analyst projections, it will also be the slowest top-line

growth rate for DocuSign as a publicly listed company.

DocuSign stock might remain volatile

Investors expected DocuSign’s

revenue growth rate to stabilize once the dreaded pandemic is

brought under control. But the company now has to wrestle with

macroeconomic challenges such as inflation, interest rate hikes,

and geopolitical tensions.

During its Q2 earnings call, CEO

Maggie Wilderotter stated DocuSign continues to experience softness

in certain verticals such as real estate and financial services.

These factors also lowered its net dollar retention rate to 110% in

Q2 from 114% in Q1 and 124% in the year-ago

quarter.

Historically, net dollar

retention rates have ranged between 112% and 119%, but DocuSign

expects it to stay lower in Q3 as well. This indicates existing

customers have lowered spending on the DocuSign platform in the

last year.

Amid a volatile period, DocuSign

will need to improve its profit margins in the future. Analysts

expect adjusted net income to fall by 16.7% to $1.65 per share in

fiscal 2023. But its forecast to rise by 20% annually in the next

five years. It indicates DocuSign enjoys certain pricing power in

the e-signature services market, despite facing competition

from Adobe’s (NASDAQ: ADBE) Sign

and Dropbox’s (NASDAQ: DBX) HelloSign.

Alternatively, the company is

still reporting a net loss on a GAAP basis. In the first six months

of fiscal 2023, DocuSign’s net losses more than doubled to $72.5

million, compared to $34 million in the year-ago period. Its

stock-based compensation surged 39% to more than $252 million,

accounting for a fifth of total sales.

Is DocuSign stock a buy?

DocuSign stock is valued at 4.4x

forward sales and 33x forward earnings, which is quite steep. Right

now, there are better cloud-based stocks trading at similar

valuations. But analysts remain bullish on DOCU stock and expect

shares to rise by more than 50% in the next year.

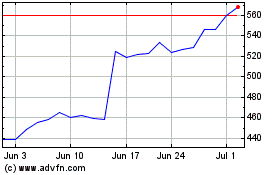

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024