UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 14, 2023

Aura

FAT Projects Acquisition Corp.

(Exact

name of registrant as specified in its charter)

Cayman

Islands

(State

or other jurisdiction of incorporation)

| 001-901886 |

|

N/A |

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1

Phillip Street, #09-00, Royal One Phillip

Singapore, 048692

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (65) 3135-1511

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☒ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Units, each consisting of

one Class A Ordinary Share and One Redeemable Warrant |

|

AFARU |

|

The Nasdaq Stock Market

LLC |

| Class A Ordinary Shares,

$0.0001 par value per share |

|

AFAR |

|

The Nasdaq Stock Market

LLC |

| Redeemable Warrants, each

warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

AFARW |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

As

previously announced, Aura FAT Projects Acquisition Corp, a Cayman Islands exempt company limited by shares, with company registration

number 384483 (the “Company”), Allrites Holdings Pte. Ltd., a Singapore private company limited by shares,

with company registration number 201703484C (“Allrites”), and Meta Gold Pte. Ltd., a Singapore exempt private

company limited by shares, with company registration number 202001973W, in its capacity as the representative for the shareholders of

Allrites, entered into a Business Combination Agreement dated May 7, 2023 (as it may be subsequently amended, the “Business

Combination Agreement”).

The

Business Combination Agreement provides for a series of transactions, pursuant to which, among other things, Allrites’ shareholders

will exchange all of their outstanding Allrites shares in consideration for newly issued Company Class A ordinary shares (the “Share

Exchange”), subject to the conditions set forth in the Business Combination Agreement, with Allrites becoming a wholly

owned subsidiary of the Company (the Share Exchange and the other transactions contemplated by the Business Combination Agreement, together,

the “Business Combination”). In connection with the Business Combination, the Company will change its corporate

name to Allrites Ltd.

Furnished

as Exhibit 99.1 and incorporated into this Item 7.01 by reference is an investor memorandum that will be used by the Company and

Allrites in connection with the Business Combination from time to time in presentations to investors and other stakeholders. The information

in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities

of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act.

By

filing this Current Report on Form 8-K and furnishing the information contained in this Current Report on Form 8-K, the Company

makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation

FD. The information contained in the investor presentation is summary information that is intended to be considered in the context of

the Company’s Securities and Exchange Commission filings and other public announcements that the Company may make, by press release

or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained

in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through

the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Additional

Information and Where to Find It

This

Current Report on Form 8-K does not contain all the information that should be considered concerning the Business Combination and

is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. The Company

filed a Registration Statement on Form F-4 with the SEC in the on June 8, 2023, (as further amended from time to time the “Registration

Statement”) relating to the Business Combination. This communication is not intended to be, and is not, a substitute for

the proxy statement or any other document that the Company has filed or may file with the SEC in connection with the Business Combination.

When available, the definitive proxy statement/prospectus and other relevant materials will be sent to all the Company shareholders as

of a record date to be established for voting on the Business Combination. The Company’s shareholders and other interested persons

are advised to read the preliminary proxy statement/prospectus and the amendments in the Registration Statement and, when available,

the definitive proxy statement/prospectus and documents incorporated by reference filed in connection with the Business Combination,

as these materials will contain important information about Allrites, the Company and the Business Combination. The Company also will

file other documents regarding the Business Combination with the SEC. Promptly after the Registration Statement is declared effective

by the SEC, the Company intends to mail the definitive proxy statement/prospectus and a proxy card to each shareholder entitled to vote

at the meeting relating to the approval of the Business Combination and other proposals set forth in the proxy statement/prospectus.

Before making any voting decision, investors and securities holders of the Company are urged to carefully read the Registration Statement,

the definitive proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with

the Business Combination as they become available because they will contain important information about the Company, Allrites and the

Business Combination.

Before

making any voting or investment decision, investors and stockholders of the Company are urged to carefully read the entire proxy statement,

when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents,

because they will contain important information about the Business Combination. The Company investors and stockholders will also be able

to obtain copies of the preliminary proxy statement, the definitive proxy statement, and other documents filed with the SEC that will

be incorporated by reference, without charge, once available, at the SEC’s website at www.sec.gov, or by written request

to the Company at Aura FAT Projects Acquisition Corp, 1 Phillip Street, #09-00, Royal One Phillip Singapore, 048692.

Participants

in Solicitation

The

Company and Allrites and their respective directors and officers may be deemed to be participants in the solicitation of proxies from

the Company’s shareholders in connection with the Business Combination. Information about the Company’s directors and executive

officers and their ownership of the Company’s securities is set forth in the Company’s filings with the SEC, including the

Company’s Annual Report on Form 10-K for the fiscal year ended November 30, 2022, which was filed with the SEC on February 23,

2023 and the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended May 31, 2023, which was filed with

the SEC on July 17, 2023. Additional information regarding the names and interests in the Business Combination of the Company’s

and Allrites’ respective directors and officers and other persons who may be deemed participants in the Business Combination may

be obtained by reading the proxy statement/prospectus contained in the Registration Statement regarding the Business Combination and

the definitive proxy statement/prospectus when it becomes available. You may obtain free copies of these documents as described in the

preceding paragraph.

No

Offer or Solicitation

This

Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities

or in respect of the Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy the securities

of the Company or Allrites, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or any applicable

exemptions.

|

Item 9.01. |

Financial Statements

and Exhibits. |

(d)

Exhibits

SIGNATURES

Under

the requirements of the Securities Exchange Act of 1934, as amended, the Company has caused this report to be signed by the duly authorized

undersigned.

| |

AURA FAT PROJECTS ACQUISITION CORP. |

| |

|

|

| Date: September 14, 2023 |

By: |

/s/

David Andrada |

| |

|

David Andrada |

| |

|

Co-Chief Executive Officer |

Exhibit

99.1

CONFIDENTIAL - NOT FOR DISTRIBUTION INVESTMENT PRESENTATION AUGUST 2023

This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Allrites Holdings Pte. Ltd., a Singapore private company limited by shares, with company registration number 201703484C (“Allrites”) and Aura Fat Projects Acquisition Corp, a Cayman Islands exempted company limited by shares, with company registration number 384483 (“AFAR”) and related transactions (the “Potential Business Combination”) and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of Allrites and AFAR, this Presentation and any information contained within it may not be (i) reproduced (in whole or in part). (ii) copied at any time, (iii) used for any purpose other than your evaluation of Allrites and the Potential Business Combination or (iv) provided to any other person, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there by any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuance to a definitive subscription agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sale of securities that do not involve a public offering. Allrites and AFAR reserve the right to withdraw or amend for any reason any offering and to reject any subscription agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representation or warranties, express or implied are giving in, or in respect of, this Presentation. To the fullest extent permitted by law, in no circumstances will Allrites, AFAR or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising for the use for this Presentation, its contents (including internal economic models), its omissions, reliance on the information contained within it, or opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither Allrites nor AFAR has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communication from or with Allrites, AFAR, or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purpose to be all - inclusive or contain all of the information that may be required to make a full analysis of Allrites or the Potential Business Combination. Recipients of this Presentation should each make their own evaluation of Allrites and the Potential Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. In connection with the Potential Business Combination, a registration statement on Form F - 4 (the “Form F - 4”) is expected to be filed with the SEC. The Form F - 4 will include a preliminary proxy statement for the stockholders of AFAR that also constitutes a preliminary prospectus. Allrites and AFAR urge investors, stockholders and other interested persons to read, when available, the Form F - 4, including the preliminary proxy statement/prospectus and amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the Potential Business Combination, as these materials will contain important information about Allrites, AFAR and the Potential Business Combination. Page 2 STRICTLY CONFIDENTIAL DISCLAIMER

The Form F - 4 and other documents in connections with the Potential Business Combination will be filed after you have made an investment decision one way or other regarding any potential investment in Allrites or AFAR. Because of this sequencing, when deciding whether to invest in Allrites or AFAR, you should carefully consider the information made available to you, including this Presentation, through the date of your decision. If you sign a subscription agreement, you will be required to make certain representations relating to the foregoing. When available, the definitive proxy statement / prospectus will be mailed to AFAR’s stockholders as of a record date to be established for voting on the Potential Business Combination. Interested parties will also be able to obtain free copies of such documents filed with the SEC (once available) at the SEC’s website www . sec . gov, or security holders may direct a request to AFAR and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of AFAR’s security holders in connection with the Potential Business Combination . Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of AFAR’s directors and executive officers in its filings with the SEC . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of AFAR’s security holders in connection with the Potential Business Combination will be set forth in the Form F - 4 , along with information concerning the interests of AFAR and Allrites’ participants in the solicitation . Such interest may, in some cases, be different from those of AFAR’s or Allrites’ equity holders generally . Forward - Looking Statements Certain statements included in this Presentation are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements include, but are not limited to, statement regarding estimates and forecasts of financial and performance metrics; expected results; the anticipated growth and expansion of Allrites’ business and the viability of Allrites’ growth strategy; trends and developments in Allrites’ industry; Allrites’ addressable market; competitive position; potential market opportunities; expected synergies; the listing of Allrites’ securities on Nasdaq; the expected management and governance of Allrites and other matters. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Allrites and/or AFAR’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by, any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Allrites and AFAR. These forward - looking statements are subject to a number of risks and uncertainties, including: the risk that the Potential Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of AFAR’s securities; AFAR’s potential failure to obtain any needed extension for the deadline for the Potential Business Combination; the failure to satisfy the conditions to the consummation of the Potential Business Combination, including the adoption of the business combination by the stockholders of AFAR; failure to satisfy the minimum cash amount following redemptions by AFAR’s public stockholders in connection with a stockholder vote to extend the business combination deadline and the stockholder vote to approve the business combination agreement and the transactions contemplated thereby; failure to receive certain governmental and regulatory approvals; the lack of a third party valuation in determining whether or not to pursue the Potential business combination; the occurrence of any event change or other circumstance that could give rise to the termination of the business combination agreement; costs related to the Potential Business Combination; actual or potential conflicts of interest of AFAR’s management with its public stockholders; the effect of the announcement or pendency of the Potential Business Combination on Allrites’ business relationships, performance and business generally; risks that the Potential Business Combination disrupts current plans of Allrites and potential difficulties in Allrites’ employee retention as a result of the Potential Business Combination; the outcome of any legal proceedings that may be instituted against Allrites or against AFAR related to the merger agreement or the Potential Business Combination; failure to realise the anticipated benefits of the Potential Business Combination; the inability to meet and maintain the listing of AFAR’s securities on Nasdaq; the risk that the price of Allrites’ or AFAR’s securities may be volatile due to a variety of factors, including macroeconomic and social environments affecting Allrites business and changes in the combined capital structure; Page 3 STRICTLY CONFIDENTIAL DISCLAIMER

the inability to implement business plans, forecasts and other expectation after the completion of the Potential Business Combination, and identify and realise additional opportunities; the risk that Allrites will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk that the post - combination company experiences difficulties in managing its growth and expanding operations; negative economic conditions that could impact Allrites and its industry in general; factors that affect content and media companies generally; changes in, and Allrites’ ability to comply with, laws and government regulations, reduction in demand for Allrites’ products; risks associated with Allrites doing business in emerging markets; conflict and uncertainty in neighbouring countries; and other risk and uncertainties set forth in the sections titled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in the Form 10 - K and subsequently filed Quarterly Reports on Form 10 - Q, the Form F - 4 and the proxy statement/prospectus contained therein, as well as those contained in the Potential Business Combination Risk Factors provided at the end of this Presentation. If any of these risks materialise or our assumption prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that neither Allrites nor AFAR presently know or that Allrites and AFAR currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Allrites’ and/or AFAR’s expectations, plans or forecasts of future events as of the date of this Presentation. Allrites and AFAR anticipate that subsequent events and developments will cause Allrites and AFAR’s assessments to change. However, while Allrites and AFAR may elect to update these forward - looking statements at some point in the future, Allrites and AFAR specifically disclaim any obligation to do so. These forward - looking statements should not be relied upon as representing Allrites and/or AFAR’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. Financial Information; Non - GAAP Financial Terms The financial information and data contained in this Presentation for the year ended 2023 and 2024 are unaudited. The financial information and data for the year ended 2023 and 2024 do not confirm to Regulation S - X promulgated by the SEC. Such information and data may not be included in, may be adjusted in, or may be presented differently in the Form F - 4 or other report or document to be filed or furnished by Allrites or AFAR with the SEC. Page 4 STRICTLY CONFIDENTIAL Trademarks This Presentation contains trademarks, service marks, trade names and copy rights of Allrites, AFAR and third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or copyrights in this Presentation is not intended to, and does not imply, a relationship with Allrites or AFAR, or any endorsement or sponsorship by or of Allrites or AFAR. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, * or © symbols, but such references are not intended to indicate, in any way, that Allrites or AFAR will not assert, to the fullest extent under applicable law, their rights or the rights of the applicable licensor to these trademarks, service marks, trade names and copyrights. DISCLAIMER

EXECUTIVE SUMMARY Page 5 STRICTLY CONFIDENTIAL THE STRATEGY FOCUSED ON A LARGE AND FAST GROWING MARKET, FRAUGHT WITH INEFFICIENCY AND RIPE FOR DISRUPTION 1 2 3 4 5 6 HIGHLY ADDRESSABLE NEW MARKETS AND CUSTOMER SEGMENTS FOR EXPANSION PROVEN PRODUCT - MARKET FIT WITH SUCCESSFUL COMMERCIALIZATION ACROSS DIVERSIFIED CUSTOMER BASES FORECASTED TO ACHIEVE TRIPLE - DIGIT REVENUE AND ARR CAGR (2021 – 2024), TARGETING US$8.5M IN REVENUE (US$13.5M IN ARR) BY 2024 BENEFITS FROM A STRONG NETWORK EFFECT THROUGH SUBSCRIPTION BASE, FURTHER DRIVING DEMAND FROM SELLERS AND BUYERS STRONG LEADERSHIP STRUCTURE IN PLACE, LED BY AN EMMY AWARD NOMINEE AND PRODUCER OF NAME BRAND TV SHOWS ACROSS ASIA KEY INVESTMENT HIGHLIGHTS

EXECUTIVE SUMMARY Page 6 STRICTLY CONFIDENTIAL SNAPSHOT OF ALLRITES TODAY Global Leading Content as a Service ("CaaS") Provider 2017 Founded 140K Hours of global TV & Film content As of May 2023 >40 Languages As of May 2023 >80 Different genres & themes As of May 2023 Allrites is a B2B video content subscription service and marketplace facilitating both the procurement and distribution of licensed videos globally including but not limited to, films, documentaries & TV content. Allrites provides a streamlined process and one platform in connecting, sellers of content such as major studios, independent producers and production companies to the content consumers ranging from established and emerging broadcasters and streaming platforms located around the world.

SECTION Page 7 STRICTLY CONFIDENTIAL CONTENTS PAGE 1 Industry Overview 8 2 Business Overview 11 3 Financial Overview 18 4 Customer Overview 24 5 Management Overview 28 5 Aura Fat Projects Acquisition Corp (AFAR) 30 6 Risks & Mitigants 34 TABLE OF CONTENTS

INDUSTRY OVERVIEW

The total global entertainment and media revenue rose 10.4% in 2021 - and is set to be a $3T industry by 2026. At the same time Over - the - top (“OTT”) video continues to grow: 22.8% in 2021 And innovative creator - led platforms such as Tik Tok, YouTube & Triller that allow storytellers’ creativity to flourish continue to rise in use. Page 9 STRICTLY CONFIDENTIAL A TRILLION DOLLAR INDUSTRY EVOLVES, AS THE WORLD CREATES AND CONSUMES... ...YET DESPITE ALL THE INNOVATION, BUYERS AND CONTENT CREATORS, STILL CONTEND WITH ARCHAIC PROBLEMS. Source: PwC Global Entertainment & Media Outlook 2022 – 2026

The TAM calculated above includes the total global revenues of OTT content by type; video streaming, pay per view, and video downloads. OTT Media refers to media services which are offered to viewers directly via the internet. There’s a wide range of OTT platforms that provide OTT media services, including Netflix, Disney+, Hulu, HBO Max, Amazon Prime Video etc. As a percentage of total, video streaming accounts for the largest proportion of the TAM at approximately 80% - 90% of total revenue from the three OTT content types. Page 10 STRICTLY CONFIDENTIAL 2021 2022 2023F 2024F 2025F 2026F 140 120 100 80 60 40 20 0 73.4 9.1 5.6 88.1 80.8 9.1 5.2 95.1 95.3 10.2 5.5 111.0 107.9 10.9 5.6 124.4 118.5 11.5 5.7 135.7 128.1 12.0 5.7 145.9 VIDEO STREAMING VIDEO DOWNLOADS PAY PER VIEW TOTAL INCOME INDUSTRY OVERVIEW TAM BY CONTENT TYPE TOTAL GLOBAL REVENUES OF OTT CONTENT IS EXPECTED TO REACH C.US$146 BILLION BY 2026, REPRESENTING A CAGR OF C.13% FROM 2021 TO 2026 Source: Statista Market Insights Unit: US$bn

BUSINESS OVERVIEW

BUYERS*: FACE INFLEXIBILE, EXPENSIVE PROCESS TO OBTAIN CONTENT. FRAGMENTED ‘How do I find this content and who owns it?’ EXPENSIVE ‘Do I really have to pay so much?’ INFLEXIBLE ‘If this content flops, I am stuck with it for years’ INNEFICIENT ‘I dont have time to speak to 20 indvidual studios’ RISKY ‘My revenue is not scaling with content costs’ *e.g established and emerging broadcasters and streaming platforms Page 12 STRICTLY CONFIDENTIAL CREATORS*: CONTEND WITH UNCERTAINTY AND UNFAVOURABLE DEALS. CONFUSING ‘I love creating content. Selling it, however...’ APATHETIC ‘Distributors only seem to care about the new stuff’ WEDDED ‘I am not getting any sales, and I cant work with anyone else’ SLOW ‘I have to wait a minimum of six to nine months for a cheque’ UNDERVALUED ‘My back catalogue is gathering dust with no sales’ *e.g major studios, independent producers and production companies BUSINESS OVERVIEW ANTIQUATED CONTENT LICENSING MODELS ARE NOT WORKING...

BUSINESS OVERVIEW ALLRITES DIRECTLY ADDRESSES THIS, PUTTING BUYERS & CREATORS IN CONTROL Page 13 STRICTLY CONFIDENTIAL BUYERS: FLEXIBLE CONTENT, ONE MONTHLY FEE, ONE PROVIDER. ONE - STOP ‘All the content I need is now in one place’ AFFORDABLE ‘I pay a minimal amount and only for the content I want’ FLEXIBLE ‘My content library can rotate in line with demand’ EFFICIENT ‘I no longer have to deal with multiple contacts & contracts’’ SECURE ‘I can ensure my cost base is effectively managed’ CREATORS: PREDICTABLE MONTHLY PAYMENTS, CONTENT EFFECTIVELY VALUED. EASY ‘Selling my content has never been easier’ VALUED ‘I can reach distributors of all sizes who value my content’ UNSHACKLED ‘I have complete control over my content distribution’ REGULAR ‘I have peace of mind knowing I will get paid regularly’ OPPORTUNITY ‘All my content has an opportunity to find a new audience’

Content buyer selects volume of hours and regions they wish to purchase. Page 14 STRICTLY CONFIDENTIAL Documentary Sport 9 Titles Boats 12hr 14mins My Collection 24hr 12mins 32 Titles Drama Thriller USA My Collections Total: 36 hrs 26 min Documentary Sport Boats 12hr 14mins 9 Titles My Collection 24hr 12mins 32 Titles Drama Thriller Do you want to remove these titles? Cancel Confirm Congradulations! Your content is reday Buyers selects the titles they wish to integrate into their platform - from over 100k hours. allrites provides fully QA’d content selection - set for streaming & DRM’d, within 24H. Content can be rotated each and every month, using in - built analytics to optimise library. BUSINESS OVERVIEW A SEAMLESS & FLEXIBLE BUYER PROCESS Allrites’ product roadmap includes an artificial intelligence (“AI”) engine that will use anonymized viewership data for content on the platform to create smart recommendations for buyers. The system will be able to map performance of content in one country and audience demographic to another country and the buyer’s audience demographic taking out the guess work for buyers when they are selecting content. In addition, Allrites plans to introduce AI sub - titling and dubbing to exponentially increase the monetization opportunity for content

Uploading 24 titles (62%) Page 15 STRICTLY CONFIDENTIAL Total Revenue: $3568 $547 $325 $215 $831 $658 $393 Baltic Tribes 1hr 12mins Documentary Drama History Western Europe Hours in Inventory - 46 hrs Outstanding Hours - 35 hours Total Hours per Contract - 13 Number of Titles - 31 Creator uploads content with pre - agreed fee structure for regions and platform size. allrites takes care of packaging and delivery of content to buyer platforms. Creators have complete visibility on content performance through analytics platform. Creators receive guaranteed monthly payments without the fuss. BUSINESS OVERVIEW A FUSS & RISK FREE CREATOR PLATFORM

HOLLYWOOD 200+ titles | 4,4K+ hours Page 16 STRICTLY CONFIDENTIAL INTERNATIONAL FILMS & SERIES 6K+ titles | 6M+ hours INTERNATIONAL ENTERTAINMENT 700+ titles | 180+ hours BOLLYWOOD 700+ titles | 7,3K+ hours URBAN 7 titles | 70+ hours KIDS 300+ titles | 5K+ hours FACTUAL & DOCUMENTARIES 1,5K+ titles | 11K+ hours MUSIC 700+ titles | 7,4K+ hours FAITH - BASED 80+ titles | 600+ hours SPORTS 15+ titles | 300+ hours LIFESTYLE, TRAVEL & LIVING 400+ titles | 6,9K+ hours ADULT 180+ titles | 1,8K+ hours Buyers gain access to Allrites’ entire library of content via a monthly subscription for a certain number of content hours. Buyers have the added flexibility of adjusting their content month to month based on their customer preferences. BUSINESS OVERVIEW CONTENT CATEGORIES AND GENRES Allrites has created a B2B platform where content buyers can subscribe to and choose from more than 140,000 hours of content from creators and distributors worldwide. The CaaS Ρ service - oriented platform creates a simple and efficient environment where content buyers (OTT streaming services, telcos, linear TV broadcasters, etc.) subscribe to their desired volume and type of content. Allrites offers a standard license and a subscription - based model where buyers can switch content monthly. Deals are bundled pricing based on subscription video on demand (“SVOD”), advertising - based video on demand (“AVOD"), transactional video on demand (“TVOD") and fast channels options with adjustments for cable or other distribution channels.

The Allrites platform has the potential to attract a wide range of users from different parts of the world with different types of content. The platform can also add new features and services to its existing offerings to enhance the user experience and generate additional revenue streams. As the content library expands to include new genres and increases its geographical coverage (e.g., South America, North Asia, European content), it also increases its potential customer base in these new regions. Allrites has already identified a new content pipeline to address the unmet demand of their clients, which includes: Page 17 STRICTLY CONFIDENTIAL BUSINESS OVERVIEW EXPANSION OF CONTENT LIBARAY A LIST CAST FILMS & SERIES (PREMIUM) ENGLISH/SPANISH REALITY - TV PG 13 URBAN US KOREAN /JAPANESE STAND - UP DRAMA SERIES (ENG PRIORITY)

FINANCIAL OVERVIEW

CAGR HISTORICAL AND FORECAST FINANCIALS - DECEMBER FINANCIAL YEAR END FY21 - 24 FY24 (F) FY23 (F) FY22 (A) FY21 (A) US$’000 195% 13,500 5,000 4,133 651 Annual Recurring Revenue 170% 21% 535% n/a y - o - y growth 106% 8,500 3,300 2,528 974 Revenue 158% 31% 159% 221% y - o - y growth 112% 5,925 2,550 2,124 640 Gross Profit 132% 20% 248% 606% y - o - y growth 70% 77% 84% 66% Gross profit margin n/a (1,107) (739) (1,437) (741) Adjusted EBITDA* (50%) 49% n/a n/a y - o - y growth (13%) (22%) (57%) (76%) EBITDA margin FINANCIAL OVERVIEW Page 19 STRICTLY CONFIDENTIAL OVERVIEW ALLRITES HAS ACHIEVED TRIPLE DIGIT REVENUE GROWTH HISTORICALLY & IS EXPECTED TO ACHIEVE SIGNIFICANT GROWTH IN 2024 WITH NEW FUNDING * EBITDA has been adjusted for deal related expenses and listing fees (e.g. legal, listing, consultancy fees etc.) to present an EBITDA on a like - for - like basis FY21 and FY22 are US GAAP audited. Annual Recurring Revenue based on management accounts. FY23 (F) and FY24 (F) based on management forecasts and assumptions. Note: Based on latest available information as of July 2023

0.5 4.1 5.0 13.5 TOTAL ANNUAL RECURRING REVENUE Page 21 STRICTLY CONFIDENTIAL Management has historically grown ARR by 553% year - on - year from 2021 to 2022. FINANCIAL OVERVIEW ANNUAL RECURRING REVENUE TOTAL ARR IS EXPECTED TO GROW AT A CAGR OF 195% FROM 2021 TO REACH C.US$13.5 MILLION BY 2024 Unit: US$m HISTORICAL ARR FORECAST ARR Note: Based on latest available information as of July 2023 Dec 2021 Dec 2022 Dec 2023 Dec 2024

0.6 2.1 2.5 5.9 64% 84% 77% 70% Unit: US$m Page 22 STRICTLY CONFIDENTIAL With the company’s strategy to increase its focus on winning contracts from larger customers (which are expected to generate greater contract values than those from small customers), the gross profit margin is forecasted to fall from approximately 84% in 2022 to c.70% in 2024F mainly due to the expected shift in product mix from basic to premium content which is more costly to procure as compared to basic content Note: GPM - Gross Profit Margin Based on latest available information as of July 2023 GROSS PROFIT BLENDED GPM FINANCIAL OVERVIEW GROSS PROFIT ALLRITES GROSS PROFIT IS EXPECTED TO REACH APPROXIMATELY US$2.9M AND US$10.2M IN 2023 AND 2024 RESPECTIVELY, REPRESENTING A 35% AND 256% Y - O - Y GROWTH OVER THE SAME TWO PERIODS HISTORICAL AND FORECAST GROSS PROFIT 2021 2022 2024F 2023F

- 0.8 - 1.4 - 0.7 - 1.1 - 57% - 22% - 13% - 85% 2023F and 2024F EBITDA has been adjusted for deal related expenses and listing fees (e.g. legal, listing, consultancy fees etc.) to present an EBITDA on a like - for - like basis FINANCIAL OVERVIEW Page 23 STRICTLY CONFIDENTIAL EBITDA GROWTH EBITDA MARGINS ARE PROJECTED TO IMPROVE SIGNIFICANTLY FROM - 85% IN 2021 TO - 13% IN 2024, WITH THE COMPANY EXPECTING AN EBITDA POSITIVE POSITION BY 2025 HISTORICAL AND FORECAST EBITDA Unit: US$m EBITDA EBITDA MARGIN Note: Based on latest available information as of July 2023 2021 2022 2024F 2023F

CUSTOMER OVERVIEW

THE ALLRITES PLATFORM IS NOT GEOGRAPHY SPECIFIC AND IS ABLE TO COMMAND A GLOBAL CLIENT BASE. THE ARR CONTRIBUTION MIX BY COUNTRY IS EXPECTED TO CHANGE SIGNIFICANTLY BASED ON THE CURRENT IDENTIFIED CONTRACTS FOR 2023 North America (57.4%) Africa (3.2%) South East Asia (26.3%) Europe (6.3%) CUSTOMER OVERVIEW ARR BY GEOGRAPHY 2022 2023 MENA (5.3%) Global (1.5%) North America (35.6%) Africa (9.8%) South East Asia (17.8%) Europe (4.5%) MENA (3.9%) Global (11.5%) South Asia (14.1%) LATAM (1.6%) North Asia (1.4%) Note: Graph above pertains to fiscal year ending December 2022 and 2023; Based on latest available information as of July 2023 Page 25 STRICTLY CONFIDENTIAL

THE BREADTH OF ALLRITES’ CONTENT LIBRARY WILL CONTINUE TO GROW RESULTING IN A MORE DIVERSIFIED CUSTOMER BASE, WHICH IS ALREADY EVIDENT IN THE IDENTIFIED CONTRACTS IN 2023, WHERE ARR CONTRIBUTION FROM CONTENT STREAMING CUSTOMERS HAVE REDUCED FROM C.70% IN 2022 TO C.42% OF ARR Streaming (41.8%) Broadcasting (1.7%) Healthcare (2.4%) Gaming (1.9%) Cable TV (27.9%) Production (0.3%) Tech Services (1.9%) Licensing (2.9%) Conglomerate (5.8%) Other (5.9%) Advertising (1.4%) Telco (1.3%) Mobile (0.6%) Streaming (68.9%) Cable TV (26.6%) Other (2.9%) Telco (1.5%) CUSTOMER OVERVIEW ARR BY CUSTOMER TYPE Note: Graph above pertains to fiscal year ending December 2022 and 2023; Based on latest available information as of July 2023 2022 2023 Page 26 STRICTLY CONFIDENTIAL

MANAGEMENT OVERVIEW

TEAM OVERVIEW KEY MANAGEMENT Riaz MEHTA CEO & Founder Riaz Mehta is a serial entrepreneur with vast experience within entertainment and media. In addition to establishing Allrites in July 2017, Riaz founded Imagine Group in 2004, a leading producer of reality shows across Asia. Prior to founding these companies, Riaz spent close to 10 years at KAZ Group Australia, serving in the capacity of managing director in his last four years at the company. Suki SOHN CFO Suki has significant experience in the media and entertainment industry having held top positions at well - known brands. Suki started her career as a business development analyst at Star TV before joining The Walt Disney Company as a director of Business Development. Mike PARSONS CSO Mike is Allrites Chief Strategy Officer and has significant experience in the media and advertising industry. Mike launched Australia's first internet radio station, and also sold his first Silicon Valley startup. During his time in advertising, Mike won many global awards - Deloitte Fast 50, Inc. 5000, DA&D Pencils, Cannes Lion's, Effie's – even a TED award. He's appeared on CNN and the FT STRICTLY CONFIDENTIAL Page 29

AFAR AURA FAT PROJECTS ACQUISITION CORP. Established by fund management firm Aura Group and Fat Projects, a boutique investment company and venture studio, Aura Fat Projects Acquisition Corp. (NASDAQ: AFAR) executed its IPO in June 2022, to acquire, merge or do a business combination with New Emerging Technology companies with an acute growth potential in Southeast Asia and Australasia in sectors such as Web3, blockchain, cryptocurrency, digital ledger, e - gaming and other financial technology and services sectors. On May 7, 2023, AFAR and Allrites entered into a business combination agreement that, if completed, will result in Allrites becoming a Nasdaq - listed public corporation. STRICTLY CONFIDENTIAL The sponsors of AFAR, Aura Group and Fat Projects are headquartered in Singapore (with offices in Sydney, Melbourne, Manila and Ho Chi Minh City). The combined group has a track record of over 20 years operating as Founder/Operators, Professional Investors (Venture Capital, Venture Debt, Private Equity), Public Markets (IPO, RTO, SPAC), Fund Management and Mergers & Acquisitions. The group’s expertise lies in Southeast Asia and Australasia with a robust ecosystem of high - quality portfolio companies and network of UHNWIs, family offices & institutions and access to capital and deal flows. Aura Group and Fat Projects are licensed by the Monetary Authority of Singapore (Capital Markets Services) and the Australian Securities and Investments Commission. >US$1b Funds Under Management and Advice 60+ Portfolio Companies 150+ Staff globally Venture Capital Private Wealth Equity Capital Markets Private Equity Multi - Family Office Debt Capital Markets Private Credit Accounting & Tax Mergers & Acquisitions Multi - Asset Dealer Services IPO and RTO Fund Management Wealth Management Capital Solutions Sydney Manila Ho Chi Minh City Singapore Melbourne Note: Data in table above pertains to the sponsors of AFAR, Aura Group and Fat Projects. The data is based on latest available information or otherwise as of May 2023; Funds Under Management and Advice is based on equity accounting Page 31

AFAR TRANSACTION DETAILS STRICTLY CONFIDENTIAL INITIAL CONSIDERATION AT BUSINESS COMBINATION (“FINANCIAL CLOSE”) 1 DEFERRED CONSIDERATION 2 OTHER DETAILS 3 US$92 million implied enterprise value at US$10/share Deferred consideration in total US$ 18 million in AFAR shares paid over two fiscal years following Financial Close subject to certain earning hurdles First Tranche: US$ 8 million at US$10 / share if Allrites achieves an ARR equal or greater than US$ 12 million for FY2023 Second Tranche: US$ 10 million in shares at US$10 / share if Allrites achieves an ARR equal or greater than US$ 20 million for FY2024 If the earning hurdle of the first tranche (ARR of US$12 million) is not met in FY2023 but the earning hurdle of the second tranche (ARR US$20 million) is met in FY2024 then the deferred consideration would be paid in full In accordance to the business combination agreement dated May 7, 2023, one of the condition precedent to Financial Close is a new investment capital commitment of up to US$10 million Sponsors and select Allrites shareholders and key management will be subject to a 12 month escrow post business combination Page 32

AFAR EXECUTIVE TEAM AND BOARD STRICTLY CONFIDENTIAL Tristan LO Co - Chief Executive Officer Chairman of the Board Co - Founder FAT Projects, Founder mums.sg sold to JD.com Aneel RANADIVE Non - Executive Director Founder Soma Capital NBA Sacramento Kings Owner David ANDRADA Co - Chief Executive Officer Chief Financial Officer Co - Founder Fat Projects, Ex - HSBC, Bank of America Merrill Lynch John LAURENS Audit Committee Chair Ex - DBS C - suite Board Member SWIFT, AXS Nils MICHAELIS President, Chief Operating Officer Head of Mergers & Acquisition Managing Partner Fat Projects, Ex - Accenture, McKinsey, AMEX Jay MCCARTHY Non - Executive Director Founder Eqm.ai sold to FiscalNote Ex - Morgan Stanley, Sparklabs GP Calvin NG Director Chief Advisor Founder Aura Group, Co - Founder Finsure sold to MA Financial Group, Active ASX Board Member Andrew PORTER Non - Executive Director Chief Investment Officer of Aventine Capital Pty Ltd Thorsten NEUMANN Non - Executive Director CTO Standard Chartered Bank Ventures, Founder SmartPesa, Founder Indtev sold to Alviva (JSE listed) EXECUTIVES AND DIRECTORS NON - EXECUTIVEDIRECTORS Page 33

RISKS AND MITIGANTS

POTENTIAL RISKS AND MITIGATING FACTORS Page 35 STRICTLY CONFIDENTIAL Note: You are also encouraged to read and consider the select risk factors above pertaining to Allrites as well the risk factors specific to AFAR’s businesses (that may also affect the combined entity) after the closing of the business combination because, as a result of the business combination, they will become the combined entity’s risks. Please also see “Where You Can Find More Information,” for information on where you can find the periodic reports and other documents AFAR has filed with the SEC or that Allrites and AFAR will furnished to the SEC. Financial Condition Allrites has previously incurred significant operating losses and may not be able to generate sufficient revenue to maintain profitability or generate positive cash flow on a sustained basis The company may require additional capital to support its business plan and objectives; this capital might not be available on acceptable terms, if at all Allrites was founded in 2017 so there is also a limited operating history on which the business and its prospects can be evaluated Business Risk If the company’s efforts to attract prospective customers and advertisers and to retain existing customers and users of its services are not successful, its growth prospects and revenue will be adversely affected Allrites has no control over third - party providers of its content. The concentration of control of content by its content providers means that even one entity, or a small number of entities working together, may unilaterally affect its access to licensable video content Allrites is a party to many license agreements that are complex and impose numerous obligations upon it that may make it difficult to operate the business and provide all the functionality it would like for its services, and a breach of such agreements could materially adversely affect our business, operating results, and financial condition Minimum guarantees and advances required under certain of its license agreements may limit operating flexibility and may materially adversely affect our business, operating results, and financial condition The company’s services and software may contain undetected software bugs or vulnerabilities, which could manifest in ways that could seriously harm our reputation and our business Revenue Projections Risk Allrites’ revenue projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, Allrites’ projected revenue, gross profit, EBITDA and net profit may differ materially from expectations. Allrites operates in a competitive industry and its revenue projections will be subject to numerous risks including the risks and assumptions made by management reflected herein as well as Allrites’ ability to manage growth, meet customer demands and evolving technology, and meet other unforeseen risks. Operating results are difficult to forecast because they generally depend on a number of factors, including the competition, which may result in less revenue than projected Operating performance will be carefully and consistently monitored through monthly management accounts, especially around operating costs, and capital expenditures, to ensure prudency in cash flow management Annual and quarterly operating plans will also be keenly reviewed to ensure the pipeline consists of high - quality and addressable customer accounts In the event where external capital is required, Aura will assist where needed to connect to capital providers and facilitate discussions towards terms that are beneficial to the company The company will periodically review its library of content sourced from content sellers to ensure minimal concentration within one or more sellers, or otherwise be alerted to said concentration License agreements will from time to time be reviewed to maintain relevance and avoid or minimizeminimize potentially detrimental or onerous terms to Allrites Regular preventive maintenance will be prioritized for Allrites’ technological infrastructure, including the upkeep of proper cybersecurity - related measures, to ensure minimal disruption to business continuity KEY RISKS MITIGATING FACTORS

CONTACT US Page 36 STRICTLY CONFIDENTIAL Riaz Mehta, CEO/Founder E: riaz@allrites.com W: allrites.com

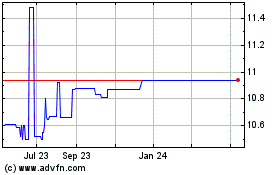

Aura FAT Projects Acquis... (NASDAQ:AFARU)

Historical Stock Chart

From Apr 2024 to May 2024

Aura FAT Projects Acquis... (NASDAQ:AFARU)

Historical Stock Chart

From May 2023 to May 2024