0001626199false00016261992023-12-202023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2023

ALPINE IMMUNE SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-37449 | | 20-8969493 |

(State or Other Jurisdiction of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

188 East Blaine Street, Suite 200

Seattle, Washington 98102

(Address of Principal Executive Offices, including zip code)

(206) 788-4545

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | ALPN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

As previously disclosed, in June 2020, Alpine Immune Sciences, Inc. (the “Company”) entered into an Option and License Agreement, as amended in April 2022 (as amended, the “Agreement”), with AbbVie Ireland Unlimited Company (“AbbVie”). Under the terms of the Agreement the Company granted to AbbVie an exclusive option (the “Option”) to obtain an exclusive, royalty-bearing, sublicensable license to certain intellectual property rights for the research, development and commercialization of acazicolcept and any other molecule owned or controlled by the Company that binds to or directly modulates or targets ICOS at certain agreed-upon levels (collectively, the “Compounds”), on a worldwide basis for all human and non-human diagnostic, prophylactic and therapeutic uses, subject to certain exceptions set forth in the Agreement. Through the date of this Current Report on Form 8-K, the Company has received $105.0 million in upfront and pre-Option exercise development milestones as part of the Agreement.

On December 20, 2023, the Company and AbbVie Global Enterprises Ltd. (as assignee of AbbVie) entered into a letter amending the Agreement (the “Amendment”). Pursuant to the terms of the Amendment, within 30 days of the date of the Amendment, the Company will stop enrollment of any new patients in its ongoing Phase 2 clinical trial in systemic lupus erythematosus (the “Phase 2 Trial”) and conduct a final analysis (the “Analysis”) after the last patient enrolled in the Phase 2 Trial has completed the study protocol. The Company agreed to provide AbbVie with a data package based on the Analysis and including certain information described in the Amendment (the “Revised Data Package”). AbbVie may exercise the Option until its expiration 90 days following the date the Company delivers to AbbVie the Revised Data Package, subject to certain extensions as described in the Amendment.

Among other changes, under the terms of the Amendment, the Option exercise fee was reduced from $75 million to $10 million, other potential payments related to future development, commercial, and sales-based milestones as well as sales-based royalties under the Agreement were reduced by 25% from the originally agreed upon amounts, a pre-Option exercise development milestone was removed, and the timeline of the Phase 2 Trial and process for the Company to provide the Revised Data Package was revised.

As a result of the Amendment, if AbbVie exercises the Option, it will make cash payments to the Company in the period following the exercise of the Option upon AbbVie’s achievement of certain development and commercial milestones, up to an aggregate amount of $153.75 million. AbbVie will also make certain sales-based cash milestone payments to the Company upon the achievement of certain annual net sales targets up to an aggregate of $337.5 million. AbbVie will also pay the Company royalties based on future net sales of any pharmaceutical product that contains a Compound. Such royalty percentages range from a mid-single digit percentage to a high-single digit percentage of net sales, with the specific royalty rate depending on the aggregate net sales.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to, and should be read in conjunction with, the full text of the Agreement and related amendments, copies of which are filed as Exhibits 10.22 and 10.30 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission on March 23, 2023, and are incorporated herein by reference.

The foregoing summary and description of the Amendment does not purport to be complete and is qualified in its entirety by reference to, and should be read in conjunction with, the full text of the Amendment. A copy of the Amendment will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

On December 21, 2023, the Company issued a press release announcing the entry into the Amendment. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Date: December 21, 2023 | | | | ALPINE IMMUNE SCIENCES, INC. |

| | | |

| | | By: | | /s/ Paul Rickey |

| | | Name: | | Paul Rickey |

| | | Title: | | Senior Vice President and Chief Financial Officer |

Alpine Immune Sciences Announces Amendment of Acazicolcept Option and License Agreement with AbbVie

-- Enrollment in the phase 2 study of acazicolcept in systemic lupus erythematosus (Synergy) will be stopped to allow for early assessment of data --

-- Final analysis after last patient completes study protocol expected to occur by the end of 2024 --

SEATTLE, Washington, December 21, 2023 - Alpine Immune Sciences, Inc. (NASDAQ: ALPN), a leading clinical-stage immunotherapy company focused on developing innovative treatments for autoimmune and inflammatory diseases, announced today that the Company has amended the previously announced 2020 option and license agreement with AbbVie for acazicolcept.

Key terms of the amended agreement:

•Company will stop enrollment under the amended agreement in the phase 2 study of acazicolcept in systemic lupus erythematosus within 30 days. Currently enrolled patients will be allowed to complete the study. Patients who are currently in the screening process and meet eligibility requirements will be allowed to enter and complete the study.

•Final analysis will be conducted after the last patient completes the study protocol which is expected to occur by the end of 2024.

•AbbVie retains an exclusive option to obtain an exclusive worldwide license to acazicolcept which is exercisable by AbbVie at any time and will expire 90 days from delivery of an agreed upon data package by the Company to AbbVie.

•The previously disclosed option exercise fee of $75 million has been reduced to $10 million and the remaining pre-option development milestone has been removed.

•Potential future development, commercial, and sales-based milestones and sales-based royalties have been reduced by 25 percent from the originally agreed upon amounts.

•Company has received $105 million in non-refundable upfront and milestone payments to-date as part of the option and license agreement.

“AbbVie has been a tremendous partner, and we appreciate their flexibility in amending our agreement for the development of acazicolcept. While enrollment in the Synergy study will be stopped early, we still anticipate that sufficient clinical and pharmacodynamic data will be available to enable a thorough evaluation of the study.” said Mitchell H. Gold, MD, Executive Chairman and Chief Executive Officer. “We plan to focus our development resources to advance povetacicept into a broad development plan.”

About Acazicolcept and the Synergy Study

Acazicolcept is a first-in-class, dual inhibitor of the CD28 and ICOS T-cell costimulatory pathways being developed for treatment of systemic lupus erythematosus (SLE). By simultaneously blocking two key costimulatory pathways, acazicolcept has the potential to improve outcomes in patients suffering from severe autoimmune/inflammatory diseases. Preclinical studies have demonstrated efficacy in models of SLE, Sjögren’s syndrome, arthritis,

inflammatory bowel disease, multiple sclerosis, type 1 diabetes, uveitis, and graft versus host disease.

Synergy (NCT04835441) is a global, randomized, double-blind, placebo-controlled Phase 2 clinical study of acazicolcept in moderate-to-severe systemic lupus erythematosus (SLE) that initiated enrollment in June 2021.

About Alpine Immune Sciences

Alpine Immune Sciences is committed to leading a new wave of immune therapeutics. With world-class research and development capabilities, a highly productive scientific platform, and a proven management team, Alpine is seeking to create first- or best-in-class multifunctional immunotherapies via unique protein engineering technologies to improve patients’ lives. Alpine has entered into strategic collaborations with leading global biopharmaceutical companies and has a diverse pipeline of clinical and preclinical candidates in development. For more information, visit www.alpineimmunesciences.com. Follow @AlpineImmuneSci on X and LinkedIn.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical fact and include statements regarding our platform technology and potential therapies; the potential efficacy, safety profile, future development plans, addressable market, regulatory success, and commercial potential of our product candidates; the timing of and results from clinical trials and pre-clinical development activities; clinical and regulatory objectives and the timing thereof; our ability to achieve milestones in our collaboration with AbbVie; the efficacy of our clinical trial designs; and our ability to successfully develop and achieve milestones in our development programs. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions and include words such as “may,” “will,” “should,” “would,” “expect,” “plan,” “intend,” and other similar expressions, among others. These forward-looking statements are based on current assumptions that involve risks, uncertainties, and other factors that may cause actual results, events, or developments to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties, many of which are beyond our control, include, but are not limited to: clinical trials may not demonstrate safety and efficacy of any of our product candidates; our ongoing discovery and preclinical efforts may not yield additional product candidates; our discovery-stage and preclinical programs may not advance into the clinic or result in approved products; any of our product candidates may fail in development, may not receive required regulatory approvals, or may be delayed to a point where they are not commercially viable; we may not achieve additional milestones in our proprietary or partnered programs; the impact of competition; adverse conditions in the general domestic and global economic markets; we may be unable to advance povetacicept directly into a pivotal trial in IgA nephropathy or a phase 2 study in systemic lupus erythematosus in 2024; the impact of pandemics, or other related health crises on our business, research and clinical development plans and timelines and results of operations, including the impact on our clinical trial sites, collaborators, and contractors who act for or on our behalf; as well as the other risks identified in our filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof and we undertake no obligation to update forward-looking statements, and readers are cautioned not to place undue reliance on such forward-looking statements.

Source: Alpine Immune Sciences, Inc.

Media and Investor Relations Contact:

Temre Johnson

Alpine Immune Sciences, Inc.

ir@alpineimmunesciences.com

media@alpineimmunesciences.com

v3.23.4

Cover Page

|

Dec. 20, 2023 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001626199

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 20, 2023

|

| Entity Registrant Name |

ALPINE IMMUNE SCIENCES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37449

|

| Entity Tax Identification Number |

20-8969493

|

| Entity Address, Address Line One |

188 East Blaine Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98102

|

| City Area Code |

206

|

| Local Phone Number |

788-4545

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ALPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

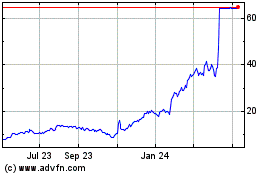

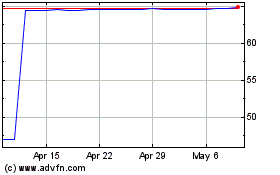

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Apr 2024 to May 2024

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From May 2023 to May 2024