Current Report Filing (8-k)

16 March 2023 - 7:52AM

Edgar (US Regulatory)

0000719135false00007191352022-08-112022-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

March 14, 2023

Date of Report (date of earliest event reported)

APYX MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 0-12183 | 11-2644611 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

5115 Ulmerton Road, Clearwater, Florida 33760

(Address of principal executive offices, zip code)

(727) 384-2323

(Issuer's telephone number)

_____________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | APYX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry into a Material Definitive Agreement.

Sale-Leaseback of 5115 Ulmerton Road, Clearwater, Florida:

On March 14, 2023, Apyx Medical Corporation (the “Company”) entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with VK Acquisitions VI, LLC (the “Purchaser”), for the sale of the Company’s facility located at 5115 Ulmerton Road, Clearwater, Florida, as more fully described in the Purchase Agreement (collectively, the “Property”) for a purchase price of $7,650,000. The Purchase Agreement is subject to the satisfactory completion of due diligence by the Purchaser within thirty (30) days from the date of execution, during which time the Purchaser retains the right to cancel the Purchase Agreement. The closing shall occur five (5) days following the expiration of the due diligence period. Upon execution of the Purchase Agreement, the Purchaser paid a down payment of $400,000 into escrow, which shall be held in accordance with the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, the transaction is not conditioned upon Purchaser obtaining any form of financing. The Purchase Agreement contains customary representations, warranties and covenants.

In accordance with the terms of the Purchase Agreement, upon the closing of the sale of the Property, the Company will enter into a Single Tenant Industrial Building Lease (the “Lease”) with the Purchaser, pursuant to which the Property will be leased back to the Company. The Lease will have an initial term of ten (10) years commencing from the closing (the “Initial Term”), and a renewal term of five (5) years, exercisable at the Company’s option. The annual fixed rent will be $619,500 for the first year of the Initial Term, and will be subject to a 4% escalation every year thereafter through the Initial Term. Rent will be reset to the current market rate should the Company exercise the renewal option. The Lease provides for a 3% management fee on rent payments throughout the Initial Term and optional renewal term.

The Lease is a triple net lease, pursuant to which all costs, expenses, and obligations relating to the Property, including, repair and maintenance charges, utility charges, real estate taxes or other taxes that may be imposed that relate to the Property, shall be paid by the Company. In addition, the Lease contains other customary terms and provisions generally contained within leases of this type.

The net cash proceeds the Company expects to receive following closing is approximately $6,700,000 after taxes, expenses, and fees. This estimate is subject to the consummation of the transaction and the finalization of the Company’s obligations associated with the sale. The Company anticipates that the net cash proceeds will be used to strengthen its balance sheet and provide working capital.

The foregoing is a summary of the material terms of the Purchase Agreement and Lease and is qualified entirely by reference to the full text of the Purchase Agreement and Lease, copies of which are attached to this Current Report on Form 8-K as Exhibit 10.1 and Exhibit 10.2, respectively.

Item 9.01 Financial Statements and Exhibits.

(d)

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| 10.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: March 15, 2023 | Apyx Medical Corporation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| By: | /s/ Tara Semb | |

| | Tara Semb | |

| | Chief Financial Officer, Secretary and Treasurer | |

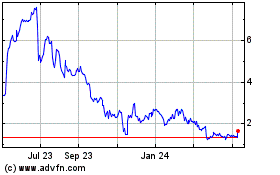

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

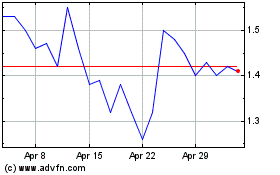

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2023 to Apr 2024