Aquestive Therapeutics, Inc. (NASDAQ:AQST), a pharmaceutical

company advancing medicines to bring meaningful improvement to

patients' lives through innovative science and delivery

technologies, today reported financial results for the fourth

quarter and full year ended December 31, 2023, and provided a

progress update on the key 2024 objectives previously outlined by

the Company.

“We ended 2023 on a strong note with double

digit base revenue growth, an improved balance sheet, and the start

of our pivotal study for Anaphylm. We are now focused on continuing

our progress in 2024 and building a strong foundation for the

long-term growth of the Company. This includes (1) progressing

Anaphylm to a US filing, (2) expanding and growing our revenue

base, (3) licensing or launching Libervant (diazepam) Buccal Film,

if approved by the FDA with market access, and (4) advancing our

next pipeline assets by utilizing our Adrenaverse technology,”

stated Daniel Barber, President and Chief Executive Officer of

Aquestive. “Anaphylm, as the only orally administered epinephrine

product under development for the treatment of severe allergic

reactions including anaphylaxis, continues to represent a

transformational opportunity for both patients and the Company. We

remain excited to see our topline pivotal data and continue to

anticipate reporting topline data from our Anaphylm pivotal study

this month.”

Anaphylm™Aquestive is advancing

the development of Anaphylm, the first and only orally delivered

epinephrine product candidate to demonstrate clinical results

comparable to autoinjectors (such as EpiPen® and Auvi-Q®) for the

emergency treatment of allergic reactions, including

anaphylaxis.

Aquestive received positive feedback in October

2023 from the U.S. Food and Drug Administration (FDA) on the

Company's pivotal Phase 3 Pharmacokinetic (PK) clinical protocol

for Anaphylm. The FDA indicated that the Company’s proposed

endpoints, sample size, and statistical analysis are reasonable. As

anticipated, the FDA also reminded the Company that PK

sustainability post-dosing (30–60 minutes) is an important factor

and recommended using repeat-dose data to support PK

sustainability. The Company has incorporated the FDA’s feedback

into the design of its clinical protocol for Anaphylm.

Aquestive commenced dosing in December 2023 in

the Phase 3 pivotal PK clinical study of Anaphylm. The two-part,

single-center, open-label, randomized study is designed to compare

the PK and pharmacodynamics (PD) of single and repeat doses of

Anaphylm versus single and repeat doses of the epinephrine IM

injection and epinephrine autoinjectors in healthy adult subjects.

The primary objective of the study is to compare the PK of

epinephrine following the single administration of Anaphylm to

single administration of epinephrine IM injection in healthy adult

subjects. The secondary objectives of the study include evaluating

PK sustainability following repeat administration and evaluating

the safety and tolerability following single and repeat

administrations versus epinephrine IM injection and epinephrine

autoinjectors. Aquestive anticipates reporting topline data from

the Anaphylm Pivotal PK study this month and continuing to guide to

a filing of the Anaphylm New Drug Application (NDA) with the FDA

before the end of 2024. A comprehensive adult and pediatric Human

Factors program, an expected and ongoing part of the Anaphylm

clinical development program, will also be included in the Anaphylm

NDA to support future labeling and the use of the product by

intended patients.

Libervant™In September 2023,

the FDA accepted Aquestive's NDA for Libervant (diazepam) Buccal

Film for the acute treatment of intermittent, stereotypic episodes

of frequent seizure activity (i.e., seizure clusters, acute

repetitive seizures) in patients between two and five years of age.

Diastat (diazepam) Rectal Gel is the only FDA approved treatment

currently available to this patient population for this indication.

Based on the latest information available to the Company, the

review of the Libervant NDA remains on track and there are

currently no outstanding information requests from the FDA. The NDA

for Libervant was assigned a PDUFA target action date of April 28,

2024.

The NDA for Libervant for the acute treatment of

intermittent, stereotypic episodes of frequent seizure activity

(i.e., seizure clusters, acute repetitive seizures) in patients

twelve years of age and older was tentatively approved by the FDA

in August 2022 and is currently subject to an orphan drug market

exclusivity block until January 2027 based on an FDA approved nasal

spray product of another company.

The Company continues to engage with the FDA on

Libervant’s approval for U.S. market access and remains committed

to bringing Libervant to patients.

Commercial

CollaborationsAquestive continues to manufacture products

for the licensing and supply collaborations that it has

established. The Company manufactured approximately 45 million

doses in the fourth quarter 2023, compared to approximately 37

million doses in the fourth quarter 2022. The Company continues to

see consistent order demand for the manufacture of Indivior’s

Suboxone® Sublingual Film product and continues to support its

other global collaborations including the recent launch of Emilyf

(Riluzole) Oral Film product by Zambon in Europe.

Sales of royalty-based products, inclusive of

Sympazan® (clobazam) Oral Film for the treatment of seizures

associated with Lennox-Gastaut Syndrome in patients two years of

age and older, and Azstarys® for the treatment of Attention Deficit

Hyperactivity Disorder (ADHD) in patients six years of age and

older continued to improve in the fourth quarter of 2023.

Fourth Quarter 2023

FinancialsTotal revenues were $13.2 million in the fourth

quarter 2023, compared to $10.7 million in the fourth quarter 2022,

an increase of 24%. The increase was due to higher manufacture and

supply revenues, and license and royalty revenues, offset by the

discontinuance of proprietary product sales of Sympazan as a result

of the outlicensing agreement with Assertio in October 2022.

Manufacture and supply revenue increased by 23%,

or $2.1 million, primarily due to increased manufacturing revenues

of $3.2 million for Suboxone partially offset by decreases for

Ondif® for Hypera in Brazil and for Sympazan.

In addition, the Company recognized $1.0 million

in milestone royalty revenue for Azstarys from Zevra

Therapeutics.

Aquestive’s net loss for the fourth quarter 2023

was $8.1 million, or $0.12 loss per share. The net loss for the

fourth quarter 2022 was $12.4 million, or $0.23 loss per share. The

reduction in net loss was primarily driven by increases in revenue

described above, decreases in selling, general and administrative

expense, including severance costs and lower administrative costs

in the commercial organization subsequent to the outlicensing of

Sympazan, and a decrease in research and development cost and

expenses, partially offset by increases by a one-time loss on

extinguishment of debt of $1.0 million and higher interest expense

related to the amortization of debt discount related to the 13.5%

Notes payable.

Non-GAAP adjusted EBITDA loss was $2.8 million

in the fourth quarter 2023, compared to a $9.6 million loss in the

fourth quarter 2022. Non-GAAP adjusted EBITDA loss excluding

adjusted R&D expenses was $0.1 million in the fourth quarter

2023, compared to a non-GAAP adjusted EBITDA loss excluding

adjusted R&D expenses of $5.6 million in the fourth quarter

2022.

Full Year 2023

FinancialsExcluding the impact of prior year proprietary

sales of Sympazan, total revenues increased from $40.0 million for

the full year 2022 to $50.6 million for the full year 2023, an

increase of 26%. The increase was due to higher manufacture and

supply revenues and license and royalty revenue offset by the

discontinuance of proprietary product sales of Sympazan following

the outlicensing of Sympazan.

Total reported revenues were $50.6 million for

the full year 2023, compared to $47.7 million for the full year

2022, an increase of 6%.

Manufacture and supply revenue increased 20% due

to increased manufacturing revenues of $4.4 million for Suboxone,

increased revenues of $2.1 million for Ondif for Hypera subsequent

to receiving foreign regulatory approval in February 2022, and

increased revenues of $0.6 million for Sympazan.

License and royalty revenue increased 129%, or

$3.0 million, for the year ended December 31, 2023 compared to

the same period in 2022. This increase was primarily due to $1.5

million in milestone licensing revenues for Azstarys from Zevra

Therapeutics and increased licensing and royalty revenue of $1.3

million for Sympazan.

The Company’s net loss for the full year 2023

was $7.9 million, or $0.13 loss per share. The net loss for the

full year 2022 was $54.4 million, or $1.12 loss per share. The

reduction in net loss was primarily driven by $14.5 million of

other income which consisted of $6.0 million from an amendment to

the Indivior Commercial Exploitation Agreement, and $8.5 million

from the patent litigation settlement with BioDelivery Sciences

International, increases in revenue described above, decrease in

selling, general and administrative expense, including severance

costs and significantly lower administrative costs in the

commercial organization subsequent to the outlicensing of Sympazan,

a decrease in research and development cost and expenses and lower

interest expense related to the KYNMOBI® monetization transaction,

partially offset by a loss on extinguishment of debt of $1.4

million and higher interest expense related to the amortization of

debt discount related to the 13.5% Notes payable.

Non-GAAP adjusted EBITDA loss was $11.6 million

in the full year 2023, compared to a loss of $35.3 million in the

full year 2022. The year-over-year change in non-GAAP adjusted

EBITDA was primarily driven by the items described above. Non-GAAP

adjusted EBITDA income excluding adjusted R&D expenses was $1.0

million in the full year 2023, compared to a non-GAAP adjusted

EBITDA loss excluding adjusted R&D expenses of $18.7 million in

the full year 2022.

As of December 31, 2023, cash and cash

equivalents were $23.9 million. During the fourth quarter 2023,

the Company accessed capital net proceeds of $3.7 million under its

"At-the-Market" (ATM) facility.

2024

Outlook

Aquestive is providing its full year 2024

financial outlook. The Company expects:

|

|

Guidance |

| Total revenue (in millions) |

$48 to $51 |

| Non-GAAP adjusted EBITDA loss (in

millions) |

$22 to $26 |

| |

|

Revenue guidance does not include any revenue

for Libervant. In addition, the guidance for 2024 includes

continued focused R&D investments related to the continued

development and planned NDA filing of Anaphylm.

Tomorrow’s Conference Call and Webcast

ReminderThe Company will host a conference call at 8:00

a.m. ET on Wednesday, March 6, 2024.

In order to participate, please register in advance here to

obtain a local or toll-free phone number and your personal pin.

A live webcast of the call will be available on Aquestive’s

website: Fourth Quarter 2023 Earnings Call. The webcast will be

archived for 30 days.

About Aquestive

TherapeuticsAquestive is a pharmaceutical company

advancing medicines to bring meaningful improvement to patients'

lives through innovative science and delivery technologies. We are

developing orally administered products to deliver complex

molecules, providing novel alternatives to invasive and

inconvenient standard of care therapies. Aquestive has five

commercialized products marketed by its licensees in the U.S. and

around the world and is the exclusive manufacturer of these

licensed products. The Company also collaborates with

pharmaceutical companies to bring new molecules to market using

proprietary, best-in-class technologies, like PharmFilm®, and has

proven drug development and commercialization capabilities.

Aquestive is advancing a late-stage proprietary product pipeline

focused on treating diseases of the central nervous system and an

earlier stage pipeline for the treatment of severe allergic

reactions, including anaphylaxis. For more information, visit

Aquestive.com and follow us on LinkedIn.

Non-GAAP Financial

InformationThis press release and our webcast earnings

call regarding our quarterly financial results contains financial

measures that do not comply with U.S. generally accepted accounting

principles (GAAP), such as non-GAAP adjusted EBITDA loss, non-GAAP

adjusted EBITDA loss excluding adjusted R&D expenses, non-GAAP

adjusted gross margins, non-GAAP adjusted costs and expenses and

other adjusted expense measures, because such measures exclude, as

applicable, share-based compensation expense, interest expense,

interest expense related to the sale of future revenue, interest

income, depreciation, amortization, and income taxes.

Specifically, the Company adjusts net income

(loss) for loss on the extinguishment of debt; certain non-cash

expenses, including share-based compensation expenses; depreciation

and amortization; and interest expense related to the sale of

future revenue, interest income and other income (expense), net and

income taxes, with a result of adjusted EBITDA loss. Similarly,

manufacture and supply expense, research and development expense,

and selling, general and administrative expense were adjusted for

certain non-cash expenses of share-based compensation expense and

depreciation and amortization. Adjusted EBITDA loss and these

non-GAAP expense categories are used as a supplement to the

corresponding GAAP measures to provide additional insight regarding

the Company’s ongoing operating performance.

These measures supplement the Company’s

financial results prepared in accordance with GAAP. Aquestive

management uses these measures to analyze its financial results,

and its future manufacture and supply expenses, gross margins,

research and development expense and selling, general and

administrative expense and to help make managerial decisions. In

management’s opinion, these non-GAAP measures provide added

transparency into the operating performance of Aquestive and added

insight into the effectiveness of our operating strategies and

actions. The Company may provide one or more revenue measures

adjusted for certain discrete items, such as fees collected on

certain licensed products, in order to provide investors added

insight into our revenue stream and breakdown, along with providing

our GAAP revenue. Such measures are intended to supplement, not act

as substitutes for, comparable GAAP measures and should not be read

as a measure of liquidity for Aquestive. Adjusted EBITDA loss and

the other non-GAAP measures are also likely calculated in a way

that is not comparable to similarly titled measures reported by

other companies.

Non-GAAP Outlook

In providing the outlook for non-GAAP adjusted

EBITDA and non-GAAP gross margin, we exclude certain items which

are otherwise included in determining the comparable GAAP financial

measures. In order to inform our outlook measures of non-GAAP

adjusted EBITDA and non-GAAP gross margin, a description of the

adjustments which have been applicable in determining non-GAAP

Adjusted EBITDA and non-GAAP gross margin for these periods are

reflected in the tables below. In providing outlook for non-GAAP

gross margin, the Company adjusts for non-cash share-based

compensation expense and depreciation and amortization. The Company

is providing such outlook only on a non-GAAP basis because the

Company is unable to predict with reasonable certainty the totality

or ultimate outcome or occurrence of these adjustments for the

forward-looking period such as share-based compensation expense,

income tax, amortization, and certain other adjusted items, which

can be dependent on future events that may not be reliably

predicted. Based on past reported results, where one or more of

these items have been applicable, such excluded items could be

material, individually or in the aggregate, to reported

results.

Forward-Looking

StatementCertain statements in this press release include

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Words such as “believe,”

“anticipate,” “plan,” “expect,” “estimate,” “intend,” “may,”

“will,” or the negative of those terms, and similar expressions,

are intended to identify forward-looking statements. These

forward-looking statements include, but are not limited to,

statements regarding the advancement and related timing of our

product candidate Anaphylm through clinical development and

approval by the FDA, including receipt and release of topline data

and the filing of the Anaphylm NDA; regarding the FDA’s approval

and related timing of the filing of the NDA for Libervant with the

FDA for the acute treatment of intermittent, stereotypic episodes

of frequent seizure activity (i.e., seizure clusters, acute

repetitive seizures) that are distinct from a patient’s usual

seizure pattern in patients between two and five years of age;

regarding the approval for U.S. market access of Libervant for

these epilepsy patients aged two years and older; overcoming the

orphan drug market exclusivity of an FDA approved nasal spray

product of another company extending to January 2027 for this

patient population; regarding the potential benefits Anaphylm and

Libervant could bring to patients; regarding the potential growth

in market demand for existing licensed products of the Company in

the U.S. and abroad and the potential and related timing for

expanding the Company’s manufacturing capabilities and supporting

the growth of demand for existing and potential future licensed

products in the U.S. and other countries; regarding the financial

outlook of the Company and its growth and future financial and

operating results and financial position; regarding advancing the

Company's pipeline assets utilizing the Company's Adrenaverse

technology through clinical development and regulatory approval;

and other statements that are not historical facts. These

forward-looking statements are subject to the uncertain impact of

the COVID-19 global pandemic on the Company’s business including

with respect to its clinical trials including site initiation,

enrollment and timing and adequacy of clinical trials; on

regulatory submissions and regulatory reviews and approval of

Anaphylm and Libervant and the Company's other pipeline products,

pharmaceutical ingredients and other raw materials supply chain,

manufacture, and distribution; and ongoing availability of an

appropriate labor force and skilled professionals.

These forward-looking statements are based on

the Company’s current expectations and beliefs and are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Such risks and uncertainties include, but are not

limited to, risks associated with the Company’s development work,

including any delays or changes to the timing, cost and success of

its product development activities and clinical trials for

Anaphylm, Libervant and our other product candidates; risk of the

Company’s ability to generate sufficient data in its PK/PD

comparability submission for FDA approval of Anaphylm; risk of the

Company’s ability to address the FDA’s comments on the Company’s

pivotal PK study protocol and other concerns identified in the FDA

End-of-Phase 2 meeting for Anaphylm, including the risk that the

FDA may require additional clinical studies for approval of

Anaphylm; risk of delays in or the failure to receive FDA approval

of Anaphylm; risks that the FDA will not approve Libervant for U.S.

market access by overcoming the seven year orphan drug market

exclusivity of an FDA approved nasal spray product of another

company in effect until January 2027; risk of delays in or the

failure to receive FDA approval of the NDA for Libervant for these

epilepsy patients between two and five years of age, including the

risk that the FDA may require additional clinical studies for

approval of Libervant for this age group, and there can be no

assurance that the Company will be successful in obtaining any of

the foregoing FDA approvals for Anaphylm and Libervant, including

for U.S. market access for Libervant for any age group of patients;

risk that a competing pediatric epilepsy product of Libervant will

receive FDA approval prior to the Company’s receipt of FDA approval

of the Libervant NDA for these epilepsy patients between two and

five years of age; risk relating to the unpredictability of the

FDA’s decisions regarding orphan drug exclusivity; risk of

litigation brought by third parties relating to overcoming their

orphan drug exclusivity of an FDA approved product should the FDA

approve Libervant for U.S. market access for any age group of this

epilepsy patient population; risk in obtaining market access for

Libervant for other reasons; risks associated with the Company’s

development work, including any delays or changes to the timing,

cost and success of the Company’s product development activities;

risk of the success of any competing products; risk inherent in

commercializing a new product (including technology risks,

financial risks, market risks and implementation risks, and

regulatory limitations); risk of the rate and degree of market

acceptance of our product candidates, including Anaphylm and

Libervant, and our licensed products in the U.S. and abroad; risk

of insufficient capital and cash resources, including insufficient

access to available debt and equity financing and revenues from

operations, to satisfy all of the Company’s short-term and longer

term liquidity and cash requirements and other cash needs, at the

times and in the amounts needed, including to fund future clinical

development activities for Anaphylm, Libervant and our other

product candidates; risk of failure to satisfy all financial and

other debt covenants and of any default under existing debt

financing; risk that our manufacturing capabilities will be

sufficient to support demand for existing and potential future

licensed products in the U.S. and other countries; risk of eroding

market share for Suboxone® and risk as a sunsetting product, which

accounts for the substantial part of our current operating revenue;

risk of the size and growth of our product markets; risks of

compliance with all FDA and other governmental and customer

requirements for our manufacturing facilities; risks associated

with intellectual property rights and infringement claims relating

to the Company's products; risk of unexpected patent developments;

uncertainties related to general economic, political (including

acts of war and terrorism), business, industry, regulatory,

financial and market conditions and other unusual items; and other

risks and uncertainties affecting the Company described in the

“Risk Factors” section and in other sections included in the

Company’s 10-K, Quarterly Reports on Form 10-Q, and Current Reports

on Form 8-K filed with the U.S. Securities and Exchange Commission.

Given those uncertainties, you should not place undue reliance on

these forward-looking statements, which speak only as of the date

made. All subsequent forward-looking statements attributable to the

Company or any person acting on its behalf are expressly qualified

in their entirety by this cautionary statement. The Company assumes

no obligation to update forward-looking statements or outlook or

guidance after the date of this press release whether as a result

of new information, future events or otherwise, except as may be

required by applicable law.

PharmFilm®, Sympazan® and the Aquestive logo are

registered trademarks of Aquestive Therapeutics, Inc. All other

registered trademarks referenced herein are the property of their

respective owners.

Investor inquiries:ICR WestwickeStephanie

Carringtonstephanie.carrington@westwicke.com646-277-1282

|

AQUESTIVE THERAPEUTICS, INC. |

|

Consolidated Balance Sheets |

|

(In thousands, except share and per share

amounts) |

|

(Unaudited) |

| |

| |

December 31, |

| |

2023 |

|

2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

23,872 |

|

|

$ |

27,273 |

|

|

Trade and other receivables, net |

|

8,471 |

|

|

|

4,704 |

|

|

Inventories, net |

|

6,769 |

|

|

|

5,780 |

|

|

Prepaid expenses and other current assets |

|

1,854 |

|

|

|

2,131 |

|

|

Total current assets |

|

40,966 |

|

|

|

39,888 |

|

| Property and equipment,

net |

|

4,179 |

|

|

|

4,085 |

|

| Right-of-use assets, net |

|

5,557 |

|

|

|

5,211 |

|

| Intangible assets, net |

|

1,278 |

|

|

|

1,435 |

|

| Other non-current assets |

|

5,438 |

|

|

|

6,451 |

|

|

Total assets |

$ |

57,418 |

|

|

$ |

57,070 |

|

| |

|

|

|

| Liabilities and

stockholders’ deficit |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

8,926 |

|

|

$ |

9,946 |

|

|

Accrued expenses |

|

6,497 |

|

|

|

7,967 |

|

|

Lease liabilities, current |

|

390 |

|

|

|

255 |

|

|

Deferred revenue |

|

1,551 |

|

|

|

1,513 |

|

|

Liability related to the sale of future revenue, current |

|

922 |

|

|

|

1,147 |

|

|

Loans payable, current |

|

22 |

|

|

|

18,700 |

|

|

Total current liabilities |

|

18,308 |

|

|

|

39,528 |

|

|

Loans payable, net |

|

27,508 |

|

|

|

33,448 |

|

|

Royalty obligations, net |

|

14,761 |

|

|

|

— |

|

|

Liability related to the sale of future revenue, net |

|

63,568 |

|

|

|

64,112 |

|

|

Lease liabilities |

|

5,399 |

|

|

|

5,085 |

|

|

Deferred revenue, net of current portion |

|

32,345 |

|

|

|

31,417 |

|

|

Other non-current liabilities |

|

2,016 |

|

|

|

2,034 |

|

|

Total liabilities |

|

163,905 |

|

|

|

175,624 |

|

|

Contingencies |

|

|

|

| |

|

|

|

| Stockholders’ deficit: |

|

|

|

|

Common stock, $0.001 par value. Authorized 250,000,000 shares;

68,533,085 and 54,827,734 shares issued and outstanding at

December 31, 2023 and December 31, 2022,

respectively |

|

69 |

|

|

|

55 |

|

|

Additional paid-in capital |

|

212,521 |

|

|

|

192,598 |

|

|

Accumulated deficit |

|

(319,077 |

) |

|

|

(311,207 |

) |

|

Total stockholders’ deficit |

|

(106,487 |

) |

|

|

(118,554 |

) |

|

Total liabilities and stockholders’ deficit |

$ |

57,418 |

|

|

$ |

57,070 |

|

| |

|

|

|

|

|

|

|

|

AQUESTIVE THERAPEUTICS, INC. |

|

Consolidated Statements of Operations and Comprehensive

Loss |

|

(In thousands, except share and per share data

amounts) |

|

(Unaudited) |

| |

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenues |

$ |

13,206 |

|

|

$ |

10,682 |

|

|

$ |

50,583 |

|

|

$ |

47,680 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Manufacture and supply |

|

4,679 |

|

|

|

5,305 |

|

|

|

20,831 |

|

|

|

19,386 |

|

|

Research and development |

|

2,888 |

|

|

|

4,278 |

|

|

|

13,104 |

|

|

|

17,481 |

|

|

Selling, general and administrative |

|

9,550 |

|

|

|

11,812 |

|

|

|

31,750 |

|

|

|

52,879 |

|

|

Total costs and expenses |

|

17,117 |

|

|

|

21,395 |

|

|

|

65,685 |

|

|

|

89,746 |

|

|

Loss from operations |

|

(3,911 |

) |

|

|

(10,713 |

) |

|

|

(15,102 |

) |

|

|

(42,066 |

) |

| Other income (expenses): |

|

|

|

|

|

|

|

|

Interest expense |

|

(2,273 |

) |

|

|

(1,650 |

) |

|

|

(6,337 |

) |

|

|

(6,552 |

) |

|

Interest expense related to royalty obligations |

|

(905 |

) |

|

|

— |

|

|

|

(905 |

) |

|

|

— |

|

|

Interest expense related to the sale of future revenue |

|

(57 |

) |

|

|

(54 |

) |

|

|

(220 |

) |

|

|

(5,891 |

) |

|

Interest income and other income, net |

|

165 |

|

|

|

65 |

|

|

|

16,321 |

|

|

|

99 |

|

|

Loss on the extinguishment of debt |

|

(1,029 |

) |

|

|

— |

|

|

|

(1,382 |

) |

|

|

— |

|

|

Net loss before income taxes |

|

(8,010 |

) |

|

|

(12,352 |

) |

|

|

(7,625 |

) |

|

|

(54,410 |

) |

|

Income taxes |

|

(101 |

) |

|

|

— |

|

|

|

(245 |

) |

|

|

— |

|

|

Net loss |

$ |

(8,111 |

) |

|

$ |

(12,352 |

) |

|

$ |

(7,870 |

) |

|

$ |

(54,410 |

) |

| Comprehensive loss |

$ |

(8,111 |

) |

|

$ |

(12,352 |

) |

|

$ |

(7,870 |

) |

|

$ |

(54,410 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share – basic and

diluted |

$ |

(0.12 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.13 |

) |

|

$ |

(1.12 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average number of

common shares outstanding - basic and diluted |

|

67,199,645 |

|

|

|

54,390,696 |

|

|

|

61,255,864 |

|

|

|

48,734,377 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AQUESTIVE

THERAPEUTICS, INC. |

|

Reconciliation of Non-GAAP Adjustments - Net Loss to

Adjusted EBITDA |

| (In

Thousands) |

|

(Unaudited) |

| |

|

|

|

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP net loss |

$ |

(8,111 |

) |

|

$ |

(12,352 |

) |

|

$ |

(7,870 |

) |

|

$ |

(54,410 |

) |

|

Share-based compensation expense |

|

923 |

|

|

|

712 |

|

|

|

2,689 |

|

|

|

4,381 |

|

|

Interest expense |

|

2,273 |

|

|

|

1,650 |

|

|

|

6,337 |

|

|

|

6,552 |

|

|

Interest expense related to the sale of future revenue |

|

57 |

|

|

|

54 |

|

|

|

220 |

|

|

|

5,891 |

|

|

Interest expense related to royalty obligations |

|

905 |

|

|

|

— |

|

|

|

905 |

|

|

|

— |

|

|

Interest income and other income (expense), net |

|

(165 |

) |

|

|

(65 |

) |

|

|

(16,321 |

) |

|

|

(99 |

) |

|

Income taxes |

|

(101 |

) |

|

|

— |

|

|

|

(245 |

) |

|

|

— |

|

|

Depreciation, amortization, and impairment |

|

433 |

|

|

|

397 |

|

|

|

1,345 |

|

|

|

2,387 |

|

|

Loss on extinguishment of debt |

|

1,029 |

|

|

|

— |

|

|

|

1,382 |

|

|

|

— |

|

| Total non-GAAP

adjustments |

$ |

5,354 |

|

|

$ |

2,748 |

|

|

$ |

(3,688 |

) |

|

$ |

19,112 |

|

| Adjusted EBITDA |

$ |

(2,757 |

) |

|

$ |

(9,604 |

) |

|

$ |

(11,558 |

) |

|

$ |

(35,298 |

) |

| Excluding adjusted R&D

expenses |

$ |

(2,688 |

) |

|

$ |

(3,975 |

) |

|

$ |

(12,557 |

) |

|

$ |

(16,636 |

) |

| Adjusted EBITDA excluding

adjusted R&D expenses |

$ |

(69 |

) |

|

$ |

(5,629 |

) |

|

$ |

999 |

|

|

$ |

(18,662 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AQUESTIVE

THERAPEUTICS, INC. |

|

Reconciliation of Non-GAAP Adjustments - Total Costs and

Expenses to Adjusted Costs and Expenses |

| (In

Thousands) |

|

(Unaudited) |

| |

|

|

|

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Total costs and expenses |

$ |

17,117 |

|

|

$ |

21,395 |

|

|

$ |

65,685 |

|

|

$ |

89,746 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(923 |

) |

|

|

(712 |

) |

|

|

(2,689 |

) |

|

|

(4,381 |

) |

|

Depreciation, amortization, and impairment |

|

(433 |

) |

|

|

(397 |

) |

|

|

(1,345 |

) |

|

|

(2,387 |

) |

| Adjusted costs and

expenses |

$ |

15,761 |

|

|

$ |

20,286 |

|

|

$ |

61,651 |

|

|

$ |

82,978 |

|

|

Manufacture and supply expense |

$ |

4,679 |

|

|

$ |

5,305 |

|

|

$ |

20,831 |

|

|

$ |

19,386 |

|

|

Gross Margin on total revenue |

|

65 |

% |

|

|

50 |

% |

|

|

59 |

% |

|

|

59 |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(36 |

) |

|

|

(44 |

) |

|

|

(191 |

) |

|

|

(203 |

) |

|

Depreciation, amortization, and impairment |

|

(395 |

) |

|

|

(317 |

) |

|

|

(1,140 |

) |

|

|

(1,890 |

) |

| Adjusted manufacture and

supply expense |

$ |

4,248 |

|

|

$ |

4,944 |

|

|

$ |

19,500 |

|

|

$ |

17,293 |

|

|

Non-GAAP Gross Margin on total revenue |

|

68 |

% |

|

|

54 |

% |

|

|

61 |

% |

|

|

64 |

% |

|

Research and development expense |

$ |

2,888 |

|

|

$ |

4,278 |

|

|

$ |

13,104 |

|

|

$ |

17,481 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(179 |

) |

|

|

(266 |

) |

|

|

(456 |

) |

|

|

(672 |

) |

|

Depreciation, amortization, and impairment |

|

(21 |

) |

|

|

(37 |

) |

|

|

(91 |

) |

|

|

(173 |

) |

| Adjusted research and

development expense |

$ |

2,688 |

|

|

$ |

3,975 |

|

|

$ |

12,557 |

|

|

$ |

16,636 |

|

|

Selling, general and administrative expenses |

$ |

9,550 |

|

|

$ |

11,812 |

|

|

$ |

31,750 |

|

|

$ |

52,879 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

(708 |

) |

|

|

(402 |

) |

|

|

(2,042 |

) |

|

|

(3,506 |

) |

|

Depreciation, amortization, and impairment |

|

(17 |

) |

|

|

(43 |

) |

|

|

(79 |

) |

|

|

(324 |

) |

| Adjusted selling, general and

administrative expenses |

$ |

8,825 |

|

|

$ |

11,367 |

|

|

$ |

29,629 |

|

|

$ |

49,049 |

|

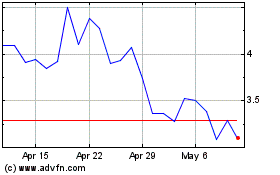

Aquestive Therapeutics (NASDAQ:AQST)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aquestive Therapeutics (NASDAQ:AQST)

Historical Stock Chart

From Dec 2023 to Dec 2024