0000879407FALSE00008794072022-11-282022-11-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

February 6, 2024

Date of Report

(Date of earliest event reported)

Arrowhead Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38042 | | 46-0408024 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

177 E. Colorado Blvd, Suite 700, Pasadena, CA 91105

(Address of principal executive offices, including Zip Code)

(626) 304-3400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | ARWR | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 6, 2024, Arrowhead Pharmaceuticals, Inc. announced and commented on its fiscal 2024 first quarter financial results for the period ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (the cover page tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: February 6, 2024

| | | | | | | | |

| ARROWHEAD PHARMACEUTICALS, INC. |

| | |

| By: | | /s/ Kenneth Myszkowski |

| | | Kenneth Myszkowski |

| | | Chief Financial Officer |

EXHIBIT 99.1

PRESS RELEASE

February 6, 2024

Arrowhead Pharmaceuticals Reports Fiscal 2024 First Quarter Results

–Conference Call and Webcast Today, February 6, 2024 at 4:30 p.m. ET

PASADENA, Calif., February 6, 2024 — Arrowhead Pharmaceuticals, Inc. (NASDAQ: ARWR) today announced financial results for its fiscal 2024 first quarter ended December 31, 2023. The company is hosting a conference call today, February 6, 2024, at 4:30 p.m. ET to discuss the results.

Webcast and Conference Call and Details

Investors may access a live audio webcast on the Company's website at http://ir.arrowheadpharma.com/events.cfm. A replay of the webcast will be available approximately two hours after the conclusion of the call.

For analysts that wish to participate in the conference call, please register at https://register.vevent.com/register/BId9fba8b41eb34305a8f07de301a9d42c. Once registered, you will receive the dial-in number and a personalized PIN code that will be required to access the call.

Selected Recent Events

•Continued to build the cardiometabolic vertical to include two new additional complementary medicines designed to treat obesity and metabolic disease, both of which are on schedule for clinical trial application (CTA) filings before the end of 2024

◦ARO-INHBE utilizes the liver targeted TRiMTM platform and targets the INHBE gene. INHBE expression is increased in obesity and INHBE loss-of-function variants identified in human genetic databases are protective of type 2 diabetes and are associated with reduced visceral fat and a reduced waste to hip ratio

◦The second is based on Arrowhead’s adipose tissue targeting TRiMTM platform and addresses an undisclosed gene target

•Performed a portfolio review and R&D organization restructuring resulting in key changes, including:

◦Arrowhead will focus investment in late-stage clinical development and build out commercial infrastructure to support sales and marketing of medicines primarily in the cardiometabolic and pulmonary verticals

◦Engaged Bruce Given, M.D., Arrowhead’s former chief operating officer and head of R&D for Arrowhead for several years before his retirement in 2020 after a more than 30-year career in biotechnology and pharmaceutical research, development, and sales and marketing, on an interim basis to serve as chief medical scientist to help with restructuring efforts and the process to recruit new therapeutic area experts to decentralize the chief medical officer function

◦Identified opportunities to reduce forward operating cash burn guidance by up to $100 million, approximately $30 million per quarter, while retaining full funding and investment in core cardiometabolic and pulmonary programs

◦Focused R&D spending for non-core programs on development activities that advance candidates to an attractive stage for potential partnerships

◦Terminated development of ARO-SOD1 and HZN-457

•Strengthened the balance sheet through an underwritten registered offering of common stock gross proceeds of approximately $450 million, before deducting underwriting discounts, commissions, and other offering expenses payable by the company

•Presented data on cardiometabolic pipeline at the American Heart Association Scientific Sessions in November 2023

◦Presented new Phase 2 clinical data from the ongoing SHASTA-2 and MUIR studies of plozasiran (ARO-APOC3) and the ARCHES-2 study of zodasiran (ARO-ANG3)

◦Hosted a webinar to discuss plozasiran featuring experts in the treatment and management of lipid and lipoprotein disorders

•Completed chronic GLP toxicology for pulmonary candidates ARO-RAGE, designed to reduce expression of the receptor for advanced glycation end products as a potential treatment for inflammatory pulmonary diseases, and ARO-MMP7, designed to reduce expression of matrix metalloproteinase 7 as a potential treatment for idiopathic pulmonary fibrosis

◦Results were highly encouraging and suggest sufficient safety margins to proceed to Phase 2 studies

•Filed for regulatory clearance to initiate a Phase 1/2a study of ARO-CFB, Arrowhead’s RNAi therapeutic candidate for patients with complement renal disease such as immunoglobulin A nephropathy (IgAN), which is the world’s most common glomerular disease

•Filed for regulatory clearance to initiate a Phase 1/2a study of Arrowhead’s second RNAi therapeutic candidate targeting skeletal muscle, ARO-DM1, for patients with type 1 myotonic dystrophy

Selected Fiscal 2024 Financial Results

ARROWHEAD PHARMACEUTICALS, INC.

CONSOLIDATED CONDENSED FINANCIAL INFORMATION

(in thousands, except per share amounts)

| | | | | | | | | | | |

| | Year Ended December 31, |

| OPERATING SUMMARY | 2023 | | 2022 |

| (Unaudited) |

| Revenue | $ | 3,551 | | | $ | 62,546 | |

| Operating Expenses: | | | |

| Research and development | 116,491 | | | 83,695 | |

| General and administrative expenses | 23,605 | | | 20,985 | |

| Total Operating Expenses | 140,096 | | | 104,680 | |

| Operating loss | (136,545) | | | (42,134) | |

| Total other (expense) income | (2,144) | | | 340 | |

| Loss before income tax (benefit) expense and noncontrolling interest | (138,689) | | | (41,794) | |

| Income tax (benefit) expense | (3,313) | | | 17 | |

| Net loss including noncontrolling interest | (135,376) | | | (41,811) | |

| Net loss attributable to noncontrolling interest, net of tax | (2,512) | | | (486) | |

| Net loss attributable to Arrowhead Pharmaceuticals, Inc. | $ | (132,864) | | | $ | (41,325) | |

| | | | |

| Net loss per share attributable to Arrowhead Pharmaceuticals, Inc. - Diluted | $ | (1.24) | | | $ | (0.39) | |

| Weighted-average shares used in calculating - Diluted | 107,415 | | | 106,039 | |

| | | | | | | | | | | |

| FINANCIAL POSITION SUMMARY | December 31,

2023 | | September 30,

2023 |

| (unaudited) | | |

| Cash, cash equivalents and restricted cash | $ | 58,215 | | | $ | 110,891 | |

| Investments | 162,064 | | | 292,735 | |

| Total cash resources (cash and investments) | 220,279 | | | 403,626 | |

| Other assets | 406,007 | | | 361,926 | |

| Total Assets | $ | 626,286 | | | $ | 765,552 | |

| | | |

| Current deferred revenue | $ | — | | | $ | 866 | |

| Other liabilities | 452,572 | | | 477,524 | |

| Total Liabilities | $ | 452,572 | | | $ | 478,390 | |

| | | |

| Total Arrowhead Pharmaceuticals, Inc. Stockholders' Equity | $ | 160,407 | | | $ | 271,343 | |

| Noncontrolling Interest | 13,307 | | 15,819 |

| Total Noncontrolling Interest and Stockholders' Equity | $ | 173,714 | | | $ | 287,162 | |

| Total Liabilities, Noncontrolling Interest and Stockholders' Equity | $ | 626,286 | | | $ | 765,552 | |

| | | |

| Shares Outstanding | 107,500 | | | 107,312 | |

About Arrowhead Pharmaceuticals

Arrowhead Pharmaceuticals develops medicines that treat intractable diseases by silencing the genes that cause them. Using a broad portfolio of RNA chemistries and efficient modes of delivery, Arrowhead therapies trigger the RNA interference mechanism to induce rapid, deep, and durable knockdown of target genes. RNA interference, or RNAi, is a mechanism present in living cells that inhibits the expression of a specific gene, thereby affecting the production of a specific protein. Arrowhead’s RNAi-based therapeutics leverage this natural pathway of gene silencing.

For more information, please visit www.arrowheadpharma.com, or follow us on Twitter @ArrowheadPharma. To be added to the Company's email list and receive news directly, please visit http://ir.arrowheadpharma.com/email-alerts.

Safe Harbor Statement under the Private Securities Litigation Reform Act:

This news release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this release except for historical information may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “hope,” “intend,” “plan,” “project,” “could,” “estimate,” or “continue” are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, trends in our business, expectations for our product pipeline or product candidates, including anticipated regulatory submissions and clinical program results, prospects or benefits of our collaborations with other companies, or other characterizations of future events or circumstances are forward-looking statements. These statements are based upon our current expectations and speak only as of the date hereof. Our actual results may differ materially and adversely from those expressed in any forward-looking statements as a result of numerous factors and uncertainties, including the impact of the ongoing COVID-19 pandemic on our business, the safety and efficacy of our product candidates, decisions of regulatory authorities and the timing thereof, the duration and impact of regulatory delays in our clinical programs, our ability to finance our operations, the likelihood and timing of the receipt of future milestone and licensing fees, the future success of our scientific studies, our ability to successfully develop and commercialize drug candidates, the timing for starting and completing clinical trials, rapid technological change in our markets, the enforcement of our intellectual property rights, and the other risks and uncertainties described in our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other documents filed with the Securities and Exchange Commission from time to time. We assume no obligation to update or revise forward-looking statements to reflect new events or circumstances.

Contacts:

Arrowhead Pharmaceuticals, Inc.

Vince Anzalone, CFA

626-304-3400

ir@arrowheadpharma.com

Investors:

LifeSci Advisors, LLC

Brian Ritchie

212-915-2578

britchie@lifesciadvisors.com

www.lifesciadvisors.com

Media:

LifeSci Communications, LLC

Josephine Belluardo, Ph.D.

646-751-4361

jo@lifescicomms.com

www.lifescicommunications.com

Source: Arrowhead Pharmaceuticals, Inc.

# # #

v3.24.0.1

Cover

|

Nov. 28, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity Registrant Name |

Arrowhead Pharmaceuticals, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38042

|

| Entity Tax Identification Number |

46-0408024

|

| Entity Address, Address Line One |

177 E. Colorado Blvd

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91105

|

| City Area Code |

626

|

| Local Phone Number |

304-3400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ARWR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000879407

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

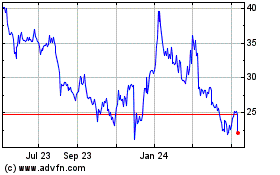

Arrowhead Pharmaceuticals (NASDAQ:ARWR)

Historical Stock Chart

From Jan 2025 to Feb 2025

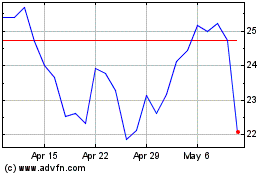

Arrowhead Pharmaceuticals (NASDAQ:ARWR)

Historical Stock Chart

From Feb 2024 to Feb 2025