Abri SPAC I, Inc. (Nasdaq: ASPA, ASPAW, ASPAU, “Abri”), a special purpose acquisition company

(“SPAC”), today announced that

it will allow those holders of shares of the Company's common stock

originally sold as part of the units issued in its initial public

offering that elected by 5:00 p.m. Eastern Time on December 07,

2022 to redeem their common stock ("Redeeming Stockholders") in connection with

the special meeting of stockholders held today at 10:00 Eastern

time (the "Special Meeting"),

to reverse their redemption requests by sending a DTC DWAC

(Deposit/Withdrawal At Custodian) request to the Company's transfer

agent, Continental Stock & Transfer Company by 5:00 p.m.

Eastern Time today, Friday, December 09, 2022.

The Company proposed today at the special meeting, to amend the

Company's amended and restated certificate of incorporation and its

investment trust agreement, to extend the date by which the Company

must complete its initial business combination from February 12,

2023 (the “Termination Date”)

up to the August 12, 2023 (the "Extension

Date"), each extension for an additional one (1) month

period (each an “Extension”),

until August 12, 2023, by depositing into the Trust Account $87,500

(the “Extension Payment”) for

each one-month Extension, for a maximum of $525,000 (the

“Maximum Contribution”). The

proposals were approved.

In connection with the special meeting, the Company received

requests to redeem 4,931,548 shares from its public stockholders.

The per-share pro rata portion of the trust account on December 9,

2022 was approximately $10.20. There are 802,372 non-redeemed

shares remaining at the time of this press release.

The Company previously announced on September 9, 2022 that it

had entered into a definitive merger agreement (“Merger Agreement”) for a business combination

whereby it will merge with Abri Merger Sub, Inc., a wholly owned

subsidiary of Abri SPAC I, Inc. (Nasdaq: ASPA, ASPAW, ASPAU,

“Abri”), a special purpose

acquisition company (“SPAC”).

Upon closing of the business combination, the combined company is

expected to remain NASDAQ-listed under the name “DataLogiq,

Inc.”

Participants in the Solicitation of Today’s Special

Meeting

The Company and its directors and executive officers may be

deemed participants in the solicitation of proxies from the

Company's stockholders with respect to Extension Amendment Proposal

and the Charter Amendment Proposal. A list of the names of those

directors and executive officers and a description of their

interests in the Company is available in the Proxy Statement and

will be contained in the Registration Statement for the Business

Combination, when available, each of which will be available free

of charge at the SEC's web site at www.sec.gov and

https://www.cstproxy.com/abri-spac/2022. Additional information

regarding the interests of such participants will be contained in

the Registration Statement when available. (See additional

information below.)

About Abri SPAC I, Inc.

Abri is a blank check company formed for the purpose of

effecting a business combination with one or more businesses.

Although there was no restriction or limitation on what industry or

geographic region its targets operated in, Abri pursued prospective

targets that provide technological innovation in a range of

traditionally managed industries with particular emphasis on the

financial services industry. For more information, visit

https://abri-spac.com.

About DLQ

DLQ, Inc. is a U.S.-based provider of e-commerce and digital

customer acquisition solutions by simplifying digital advertising.

It provides a data-driven, end-to-end marketing through its results

solution or providing software to access data by activating

campaigns across multiple channels.

The Company’s digital marketing business includes a holistic,

self-serve ad tech platform. Its proprietary data-driven,

AI-powered solutions allows brands and agencies to advertise across

thousands of the world’s leading digital and connected TV

publishers.

Important Information About the Merger and Where to Find

It

In connection with the proposed Merger, Abri intends to file

preliminary and definitive proxy statements with the SEC. The

preliminary and definitive proxy statements and other relevant

documents will be sent or given to the stockholders of Abri as of

the record date established for voting on the proposed Merger and

will contain important information about the proposed Merger and

related matters. Stockholders of Abri and other interested persons

are advised to read, when available, the preliminary proxy

statement and any amendments thereto and, once available, the

definitive proxy statement, in connection with Abri’s solicitation

of proxies for the meeting of stockholders to be held to approve,

among other things, the proposed Merger because the proxy statement

will contain important information about Abri, DLQ and the proposed

Merger.

When available, the definitive proxy statement for the Merger

will be mailed to Abri’s stockholders as of a record date to be

established for voting on the proposed Merger. Stockholders will

also be able to obtain copies of the proxy statement, without

charge, once available, at the SEC’s website at www.sec.gov or by

directing a request to: Abri SPAC I, Inc., 9663 Santa Monica Blvd.,

No 1091, Beverly Hills, CA 90210, telephone: (424) 732-1021.

Forward-Looking Statements

This press release includes certain statements that are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. All statements, other than

statements of present or historical fact included in this press

release, regarding Abri’s proposed Merger with DLQ, Abri’s ability

to consummate the transaction, the benefits of the transaction and

the combined company’s future financial performance, as well as the

combined company’s strategy, future operations, estimated financial

position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management are forward-looking

statements. These statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectations of the respective managements of Abri and DLQ and are

not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Abri or DLQ.

Potential risks and uncertainties that could cause the actual

results to differ materially from those expressed or implied by

forward-looking statements include, but are not limited to, changes

in domestic and foreign business, market, financial, political and

legal conditions; the inability of the parties to successfully or

timely consummate the Merger, including the risk that any

regulatory approvals are not obtained, are delayed or are subject

to unanticipated conditions that could adversely affect the

combined company or the expected benefits of the Merger or that the

approval of the stockholders of Abri or DLQ is not obtained;

failure to realize the anticipated benefits of Merger; risk

relating to the uncertainty of the projected financial information

with respect to DLQ; the amount of redemption requests made by

Abri’s stockholders; the overall level of consumer demand for DLQ’s

products/services; general economic conditions and other factors

affecting consumer confidence, preferences, and behavior;

disruption and volatility in the global currency, capital, and

credit markets; the financial strength of DLQ’s customers; DLQ’s

ability to implement its business strategy; changes in governmental

regulation, DLQ’s exposure to litigation claims and other loss

contingencies; disruptions and other impacts to DLQ’s business, as

a result of the COVID-19 pandemic and government actions and

restrictive measures implemented in response; stability of DLQ’s

suppliers, as well as consumer demand for its products, in light of

disease epidemics and health-related concerns such as the COVID-19

pandemic; the impact that global climate change trends may have on

DLQ and its suppliers and customers; DLQ’s ability to protect

patents, trademarks and other intellectual property rights; any

breaches of, or interruptions in, DLQ’s information systems;

fluctuations in the price, availability and quality of electricity

and other raw materials and contracted products as well as foreign

currency fluctuations; changes in tax laws and liabilities,

tariffs, legal, regulatory, political and economic risks. More

information on potential factors that could affect Abri’s or DLQ’s

financial results is included from time to time in Abri’s public

reports filed with the SEC, as well as the preliminary and the

definitive proxy statements that Abri intends to file with the SEC

in connection with Abri’s solicitation of proxies for the meeting

of stockholders to be held to approve, among other things, the

proposed Merger. If any of these risks materialize or Abri’s or

DLQ’s assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking

statements. There may be additional risks that neither Abri nor DLQ

presently know, or that Abri and DLQ currently believe are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect Abri’s and DLQ’s expectations,

plans or forecasts of future events and views as of the date of

this press release. Nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. Abri and DLQ anticipate that subsequent events and

developments will cause their assessments to change. However, while

Abri and DLQ may elect to update these forward-looking statements

at some point in the future, Abri and DLQ specifically disclaim any

obligation to do so, except as required by law. These

forward-looking statements should not be relied upon as

representing Abri’s or DLQ’s assessments as of any date subsequent

to the date of this press release. Accordingly, undue reliance

should not be placed upon the forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221209005530/en/

Redemption Contact: Attn: Mark Zimkind E-mail:

mzimkind@continentalstock.com

Media Contacts

DLQ & Logiq Brent Suen | ir@logiq.com | +1.808.829.1057

Abri Jeffrey Tirman | info@abriadv.com | +1.424.732.1021

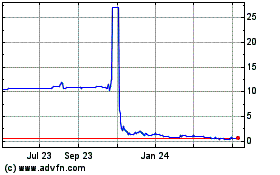

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

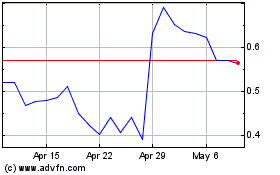

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Apr 2023 to Apr 2024