Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq:

ASRT), a specialty pharmaceutical company offering differentiated

products to patients, today reported financial results for the

third quarter ended September 30, 2022.

Financial Highlights (unaudited):

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| (in millions, except per share

amounts) |

2022 |

|

2021 |

|

2022 |

|

|

2021 |

|

|

Net Product Sales (GAAP) |

$ |

34.3 |

|

$ |

26.0 |

|

$ |

105.3 |

|

$ |

77.3 |

|

| Net Income (loss)

(GAAP) |

$ |

4.2 |

|

$ |

3.7 |

|

$ |

21.1 |

|

$ |

(5.9 |

) |

| Earnings (loss) Per

Share (GAAP) |

$ |

0.08 |

|

$ |

0.08 |

|

$ |

0.42 |

|

$ |

(0.14 |

) |

| Adjusted EBITDA

(Non-GAAP)1 |

$ |

21.4 |

|

$ |

15.8 |

|

$ |

68.2 |

|

$ |

31.0 |

|

| Adjusted Earnings Per

Share (Non-GAAP)1 |

$ |

0.22 |

|

$ |

0.19 |

|

$ |

0.85 |

|

$ |

0.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- Third quarter net product sales increased 32% year-over-year to

$34.3 million.

- Increased sales of Indocin and the addition of Otrexup more

than offset the expected declines in Zipsor and Solumatrix.

- Indocin sales increased 50%, primarily due to net pricing,

offset by lower volumes due to a deliberate reduction in channel

inventories in the quarter.

- Third quarter GAAP net income increased to $4.2 million,

compared to $3.7 million in the prior year quarter, and

adjusted EBITDA increased to $21.4 million, from $15.8 million.

- The increases were driven by $8.3 million of additional Net

Product Sales and the Company maintained its gross profit margin2

in the third quarter at 88% due to continued strong sales of

Indocin.

- Refinanced the Company’s 13.5% 2024 Senior Notes with a

$70.0 million 6.5% convertible notes offering that extends

debt maturity to 2027 and creates greater flexibility as the

Company seeks to further diversify the product portfolio.

- Cash at September 30, 2022 was $64.8 million, increased

from $52.3 million at June 30, inclusive of $10.0 million

in cash flow from operations during the third quarter.

- Announced an exclusive license for Sympazan® (clobazam) Oral

Film for an upfront payment of $9.0 million.

- On a full-year basis, Assertio estimates Sympazan would have

added $4.0 million to $4.5 million in adjusted EBITDA and an

additional $0.05 in adjusted EPS based on trailing 12 month net

sales of approximately $9.5 million.

- Received notice of allowance of a new Sympazan patent, and will

pay an additional $6 million in milestones in the fourth quarter.

When issued, this new patent will provide protection to 2039.

“Third quarter results demonstrated the value of our platform,

driving more than $21 million in adjusted EBITDA and $10 million in

cash flow from operations. In addition, our refinancing extends

maturity, significantly reduces our debt service cost and creates

greater operating flexibility as we continue to seek strategic

growth transactions that will further diversify our portfolio,”

said Dan Peisert, President and Chief Executive Officer of

Assertio. “Our recent Sympazan transaction exemplifies our goal of

acquiring assets that fit into our platform, are immediately

accretive, have long duration exclusivity and offer opportunities

for organic growth.”

“In addition to the attractive economics we can secure from

further acquisitions such as Sympazan, we continue to explore

larger transformative acquisition opportunities to accelerate our

goal to diversify our portfolio and take advantage of a favorable

M&A environment. With almost $65 million in cash on our balance

sheet at quarter end and continued positive cash flow, we are

fueled to execute on our strategic goals,” said Peisert.

Raises 2022 Financial GuidanceEffective

November 8, 2022, Assertio increased its outlook for the full year

2022 to now anticipate net product sales greater than $141 million,

and adjusted EBITDA greater than $86 million. The increased outlook

reflects higher than planned net product sales, continued operating

performance and the addition of $1 million (partial quarter) in

anticipated Sympazan sales.

|

|

Prior Guidance |

Current Guidance |

|

Net Product Sales (GAAP) |

$129.0 Million to $137.0 Million |

Greater than $141.0 Million |

|

Adjusted EBITDA (Non-GAAP)3 |

$73.0 Million to $79.0 Million |

Greater than $86.0 Million |

Balance Sheet and Cash Flow

For the quarter ended September 30, 2022 the company generated

$10.0 million in cash flow from operations, its sixth

consecutive quarter of positive cash flows. At quarter end, cash

and cash equivalents totaled $64.8 million.

During the third quarter, the company completed an offering of

$70.0 million aggregate principal amount of 6.5% convertible

senior notes due 2027. Assertio used proceeds from the offering to

fully redeem its $59.0 million 13% interest senior debt.

Conference Call and Investor Presentation

Information

Assertio’s management will host a conference call to discuss its

third quarter 2022 financial results today:

|

Date: |

November 8, 2022 |

|

Time: |

4:30 p.m. Eastern Time |

|

Webcast (live and archive): |

http://investor.assertiotx.com/overview/default.aspx (Events &

Webcasts, Investor Page) |

|

Dial-in numbers: |

1-929-526-1599 (domestic) |

|

Conference number: |

971287 |

To access the live webcast, the recorded conference call replay,

and other materials, please visit Assertio’s investor relations

website at http://investor.assertiotx.com/overview/default.aspx.

Please connect at least 15 minutes prior to the live webcast to

ensure adequate time for any software download that may be needed

to access the webcast. The replay will be available approximately

two hours after the call on Assertio’s investor website.

_______________1 Non-GAAP measures are reconciled to the

corresponding GAAP measures in the schedules attached. 2 Gross

profit margin represents the ratio of net products sales less cost

of sales to net product sales.3 See “Non-GAAP Financial Measures”

below for information about reconciling our Adjusted EBITDA

guidance to Net Income.

About Assertio

Assertio is a specialty pharmaceutical company offering

differentiated products to patients utilizing a non-personal

promotional model. We have built and continue to build our

commercial portfolio by identifying new opportunities within our

existing products as well as acquisitions or licensing of

additional approved products. To learn more about Assertio, visit

www.assertiotx.com.

Investor Contact

Matt KrepsManaging DirectorDarrow AssociatesAustin, TX M:

214-597-8200mkreps@darrowir.com

Forward Looking Statements

Statements in this communication that are not historical facts

are forward-looking statements that reflect Assertio's current

expectations, assumptions and estimates of future performance and

economic conditions. These forward-looking statements are made in

reliance on the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, future events or the

future performance or operations of Assertio, including our ability

to realize the benefits from our operating model, successfully

acquire and integrate new assets and explore new business

development initiatives. All statements other than historical facts

may be forward-looking statements and can be identified by words

such as "anticipate," "believe," "could," "design," "estimate,"

"expect," "forecast," "goal," "guidance," "imply," "intend," "may",

"objective," "opportunity," "outlook," "plan," "position,"

"potential," "predict," "project," "prospective," "pursue," "seek,"

"should," "strategy," "target," "would," "will," "aim" or other

similar expressions that convey the uncertainty of future events or

outcomes and are used to identify forward-looking statements. Such

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of

which are beyond the control of Assertio, including the risks

described in Assertio's Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the U.S. Securities and Exchange

Commission ("SEC") and in other filings Assertio makes with the SEC

from time to time. Investors and potential investors are urged not

to place undue reliance on forward-looking statements in this

communication, which speak only as of this date. While Assertio may

elect to update these forward-looking statements at some point in

the future, it specifically disclaims any obligation to update or

revise any forward-looking-statements contained in this press

release whether as a result of new information or future events,

except as may be required by applicable law. Nothing contained

herein constitutes or will be deemed to constitute a forecast,

projection or estimate of the future financial performance or

expected results of Assertio.

Non-GAAP Financial Measures

To supplement the Company’s financial results presented on a

U.S. generally accepted accounting principles (GAAP) basis, the

Company has included information about non-GAAP measures of EBITDA,

adjusted EBITDA, adjusted earnings, and adjusted earnings per share

as useful operating metrics. The Company believes that the

presentation of these non-GAAP financial measures, when viewed with

results under GAAP and the accompanying reconciliation, provides

supplementary information to analysts, investors, lenders, and the

Company’s management in assessing the Company’s performance and

results from period to period. The Company uses these non-GAAP

measures internally to understand, manage and evaluate the

Company’s performance, and in part, in the determination of bonuses

for executive officers and employees. These non-GAAP financial

measures should be considered in addition to, and not a substitute

for, or superior to, net income or other financial measures

calculated in accordance with GAAP. Non-GAAP financial measures

used by us may be calculated differently from, and therefore may

not be comparable to, non-GAAP measures used by other

companies.

This release also includes estimated full-year non-GAAP adjusted

EBITDA information, which the Company believes enables investors to

better understand the anticipated performance of the business, but

should be considered a supplement to, and not as a substitute for

or superior to, financial measures calculated in accordance with

GAAP. No reconciliation of estimated non-GAAP adjusted EBITDA to

estimated net income is provided in this release because some of

the information necessary for estimated net income such as income

taxes, fair value change in contingent consideration, and

stock-based compensation is not yet ascertainable or accessible and

the Company is unable to quantify these amounts that would be

required to be included in estimated net income without

unreasonable efforts.

Specified Items

Non-GAAP measures presented within this release exclude

specified items. The Company considers specified items to be

significant income/expense items not indicative of current

operations. Specified items include adjustments to interest

expense, income tax expense (benefit), depreciation expense,

amortization expense, sales reserves adjustments for products the

Company is no longer selling, stock-based compensation expense,

fair value adjustments to contingent consideration, restructuring

costs, amortization of fair value inventory step-up as result of

purchase accounting, transaction-related costs, gains or losses

from adjustments to long-lived assets and assets not part of

current operations, and gains or losses resulting from debt

refinancing or extinguishment.

| |

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME(in thousands, except per share

amounts)(unaudited) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues: |

|

|

|

|

|

|

|

|

Product sales, net |

$ |

34,279 |

|

|

$ |

25,997 |

|

|

$ |

105,258 |

|

|

$ |

77,271 |

|

|

Royalties and milestones |

|

473 |

|

|

|

416 |

|

|

|

1,916 |

|

|

|

1,391 |

|

|

Other revenue |

|

(540 |

) |

|

|

(941 |

) |

|

|

(1,290 |

) |

|

|

(976 |

) |

| Total revenues |

|

34,212 |

|

|

|

25,472 |

|

|

|

105,884 |

|

|

|

77,686 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of sales |

|

4,009 |

|

|

|

3,050 |

|

|

|

12,734 |

|

|

|

10,936 |

|

|

Selling, general and administrative expenses |

|

11,900 |

|

|

|

9,013 |

|

|

|

33,084 |

|

|

|

41,377 |

|

|

Fair value of contingent consideration |

|

3,900 |

|

|

|

300 |

|

|

|

6,845 |

|

|

|

1,902 |

|

|

Amortization of intangible assets |

|

7,969 |

|

|

|

7,175 |

|

|

|

24,438 |

|

|

|

20,939 |

|

|

Restructuring charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,089 |

|

| Total costs and expenses |

|

27,778 |

|

|

|

19,538 |

|

|

|

77,101 |

|

|

|

76,243 |

|

| Income from operations |

|

6,434 |

|

|

|

5,934 |

|

|

|

28,783 |

|

|

|

1,443 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

Interest expense |

|

(2,052 |

) |

|

|

(2,495 |

) |

|

|

(6,648 |

) |

|

|

(7,783 |

) |

|

Other gain |

|

2 |

|

|

|

344 |

|

|

|

453 |

|

|

|

747 |

|

| Total other expense |

|

(2,050 |

) |

|

|

(2,151 |

) |

|

|

(6,195 |

) |

|

|

(7,036 |

) |

| Net income (loss) before

income taxes |

|

4,384 |

|

|

|

3,783 |

|

|

|

22,588 |

|

|

|

(5,593 |

) |

| Income tax expense |

|

(210 |

) |

|

|

(46 |

) |

|

|

(1,516 |

) |

|

|

(294 |

) |

| Net income (loss) and

comprehensive income (loss) |

$ |

4,174 |

|

|

$ |

3,737 |

|

|

$ |

21,072 |

|

|

$ |

(5,887 |

) |

| |

|

|

|

|

|

|

|

| Basic net income (loss) per

share |

$ |

0.09 |

|

|

$ |

0.08 |

|

|

$ |

0.45 |

|

|

$ |

(0.14 |

) |

| Diluted net income (loss) per

share |

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.42 |

|

|

$ |

(0.14 |

) |

| Shares used in computing basic

net income (loss) per share |

|

48,180 |

|

|

|

44,969 |

|

|

|

46,566 |

|

|

|

42,550 |

|

| Shares used in computing

diluted net income (loss) per share |

|

57,386 |

|

|

|

45,055 |

|

|

|

50,470 |

|

|

|

42,550 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS(in

thousands, except share and per share

data)(unaudited) |

| |

| |

September 30,2022 |

|

December 31,2021 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

64,826 |

|

|

$ |

36,810 |

|

|

Accounts receivable, net |

|

44,680 |

|

|

|

44,361 |

|

|

Inventories, net |

|

14,268 |

|

|

|

7,489 |

|

|

Prepaid and other current assets |

|

2,720 |

|

|

|

14,838 |

|

|

Total current assets |

|

126,494 |

|

|

|

103,498 |

|

| Property and equipment,

net |

|

935 |

|

|

|

1,527 |

|

| Intangible assets, net |

|

191,617 |

|

|

|

216,054 |

|

| Other long-term assets |

|

4,298 |

|

|

|

5,468 |

|

| Total assets |

$ |

323,344 |

|

|

$ |

326,547 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

8,374 |

|

|

$ |

6,685 |

|

|

Accrued rebates, returns and discounts |

|

48,608 |

|

|

|

52,662 |

|

|

Accrued liabilities |

|

10,992 |

|

|

|

14,699 |

|

|

Long-term debt, current portion |

|

2,175 |

|

|

|

12,174 |

|

|

Contingent consideration, current portion |

|

10,900 |

|

|

|

14,500 |

|

|

Other current liabilities |

|

11,247 |

|

|

|

34,299 |

|

|

Total current liabilities |

|

92,296 |

|

|

|

135,019 |

|

| Long-term debt |

|

65,982 |

|

|

|

61,319 |

|

| Contingent consideration |

|

25,759 |

|

|

|

23,159 |

|

| Other long-term

liabilities |

|

4,392 |

|

|

|

4,636 |

|

| Total liabilities |

|

188,429 |

|

|

|

224,133 |

|

| Shareholders’ equity: |

|

|

|

|

Common stock, $0.0001 par value, 200,000,000 shares

authorized;48,196,618 and 44,640,444 shares issued and outstanding

as ofSeptember 30, 2022 and December 31, 2021,

respectively. |

|

5 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

543,064 |

|

|

|

531,636 |

|

|

Accumulated deficit |

|

(408,154 |

) |

|

|

(429,226 |

) |

|

Total shareholders’ equity |

|

134,915 |

|

|

|

102,414 |

|

| Total liabilities and

shareholders' equity |

$ |

323,344 |

|

|

$ |

326,547 |

|

| |

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS(in

thousands)(unaudited) |

|

|

| |

Nine Months Ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

| Operating

Activities |

|

|

|

| Net income (loss) |

$ |

21,072 |

|

|

|

(5,887 |

) |

| Adjustments to reconcile net

income to net cash provided by (used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

25,033 |

|

|

|

21,698 |

|

|

Amortization of royalty rights |

|

128 |

|

|

|

159 |

|

|

Provision for inventory and other assets |

|

828 |

|

|

|

(86 |

) |

|

Stock-based compensation |

|

5,116 |

|

|

|

2,596 |

|

|

Recurring fair value measurement of assets and liabilities |

|

6,845 |

|

|

|

1,902 |

|

| Changes in assets and

liabilities, net of acquisition: |

|

|

|

|

Accounts receivable |

|

(319 |

) |

|

|

8,205 |

|

|

Inventories |

|

(7,607 |

) |

|

|

6,317 |

|

|

Prepaid and other assets |

|

13,288 |

|

|

|

5,777 |

|

|

Accounts payable and other accrued liabilities |

|

(7,193 |

) |

|

|

(22,405 |

) |

|

Accrued rebates, returns and discounts |

|

(4,058 |

) |

|

|

(19,284 |

) |

|

Interest payable |

|

(1,232 |

) |

|

|

2,400 |

|

|

Net cash provided by operating activities |

|

51,901 |

|

|

|

1,392 |

|

| Investing

Activities |

|

|

|

| Purchase of Otrexup |

|

(16,889 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

(16,889 |

) |

|

|

— |

|

| Financing

Activities |

|

|

|

| Proceeds from issuance of 2027

Convertible Notes |

|

65,916 |

|

|

|

— |

|

| Payments in connection with

2021 Convertible Notes |

|

— |

|

|

|

(335 |

) |

| Payment in connection with

2024 Senior Notes |

|

(70,750 |

) |

|

|

(4,750 |

) |

| Payment of contingent

consideration |

|

(7,845 |

) |

|

|

(2,495 |

) |

| Payment of Royalty Rights |

|

(630 |

) |

|

|

(510 |

) |

| Proceeds from issuance of

common stock |

|

7,020 |

|

|

|

44,861 |

|

| Proceeds from exercise of

stock options |

|

— |

|

|

|

193 |

|

| Shares withheld for payment of

employee's withholding tax liability |

|

(707 |

) |

|

|

(416 |

) |

|

Net cash (used in) provided by financing activities |

|

(6,996 |

) |

|

|

36,548 |

|

| Net increase in cash and cash

equivalents |

|

28,016 |

|

|

|

37,940 |

|

| Cash and cash equivalents at

beginning of year |

|

36,810 |

|

|

|

20,786 |

|

| Cash and cash equivalents at

end of period |

$ |

64,826 |

|

|

$ |

58,726 |

|

| Supplemental

Disclosure of Cash Flow Information |

|

|

|

|

Net cash refunded for income taxes |

$ |

(7,822 |

) |

|

$ |

— |

|

|

Cash paid for interest |

$ |

7,752 |

|

|

$ |

5,216 |

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF GAAP NET INCOME TO NON-GAAP EBITDA and

ADJUSTED EBITDA (in

thousands)(unaudited) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Financial Statement Classification |

| GAAP Net

Income/(Loss) |

|

$ |

4,174 |

|

$ |

3,737 |

|

$ |

21,072 |

|

$ |

(5,887 |

) |

|

|

|

Interest expense |

|

|

2,052 |

|

|

2,495 |

|

|

6,648 |

|

|

7,783 |

|

|

Interest expense |

|

Income tax expense |

|

|

210 |

|

|

46 |

|

|

1,516 |

|

|

294 |

|

|

Income tax expense |

|

Depreciation expense |

|

|

197 |

|

|

236 |

|

|

592 |

|

|

758 |

|

|

Selling, general and

administrative expenses |

|

Amortization of intangible assets |

|

|

7,969 |

|

|

7,175 |

|

|

24,438 |

|

|

20,939 |

|

|

Amortization of intangible

assets |

| EBITDA

(Non-GAAP) |

|

$ |

14,602 |

|

$ |

13,689 |

|

|

54,266 |

|

|

23,887 |

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Legacy products revenue reserves(1) |

|

|

540 |

|

|

941 |

|

|

1,290 |

|

|

976 |

|

|

Other revenue |

|

Stock-based compensation |

|

|

2,400 |

|

|

866 |

|

|

5,116 |

|

|

2,596 |

|

|

Selling, general and

administrative expenses |

|

Contingent consideration fair value change(2) |

|

|

3,900 |

|

|

300 |

|

|

6,845 |

|

|

1,902 |

|

|

Fair value of contingent

consideration |

|

Restructuring charges |

|

|

— |

|

|

— |

|

|

— |

|

|

1,089 |

|

|

Restructuring charges |

|

Other(3) |

|

|

— |

|

|

— |

|

|

700 |

|

|

554 |

|

|

Multiple |

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

21,442 |

|

$ |

15,796 |

|

|

68,217 |

|

|

31,004 |

|

|

|

|

(1) |

Represents

removal of the impact of revenue adjustment to reserves for product

sales allowances (gross-to-net sales allowances) estimates related

to previously divested products. |

| |

|

| (2) |

The fair value of the contingent consideration is remeasured

each reporting period, with the change in the fair value resulting

from changes in the underlying inputs being recognized as operating

expenses until the contingent consideration arrangement is

settled. |

| |

|

| (3) |

Other represents amortization of inventory step-up recognized

in Cost of sales related acquired inventories sold. |

|

RECONCILIATION OF GAAP NET INCOME and GAAP NET INCOME PER

SHARE TO NON-GAAP ADJUSTED EARNINGS and ADJUSTED

EARNINGS PER SHARE (1)(in

thousands, except per share

amounts)(unaudited) |

| |

|

|

|

| |

Three Months Ended September 30, 2022 |

|

Three Months Ended September 30, 2021 |

|

|

Amount |

|

Diluted EPS(4) |

|

Amount |

|

Diluted EPS |

|

Net income per share (GAAP) |

4,174 |

|

|

0.07 |

|

|

3,737 |

|

|

0.08 |

|

| Add: Interest Expense on

convertible debt, net of tax(4) |

497 |

|

|

0.01 |

|

|

— |

|

|

— |

|

| Adjustments |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

7,969 |

|

|

0.14 |

|

|

7,175 |

|

|

0.16 |

|

|

Legacy products revenue reserves |

540 |

|

|

0.01 |

|

|

941 |

|

|

0.02 |

|

|

Stock-based compensation |

2,400 |

|

|

0.04 |

|

|

866 |

|

|

0.02 |

|

|

Contingent consideration fair value change |

3,900 |

|

|

0.07 |

|

|

300 |

|

|

0.01 |

|

|

Restructuring charges |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Other |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Contingent consideration cash payable(2) |

(4,374 |

) |

|

(0.07 |

) |

|

(2,908 |

) |

|

(0.06 |

) |

|

Income taxes expense, as adjusted(3) |

(2,609 |

) |

|

(0.05 |

) |

|

(1,594 |

) |

|

(0.04 |

) |

| Adjusted earnings

(Non-GAAP) |

12,497 |

|

|

0.22 |

|

|

8,517 |

|

|

0.19 |

|

| |

|

|

|

|

|

|

|

| Diluted shares used in

calculation(4) |

57,386 |

|

|

|

|

45,055 |

|

|

|

| Dilution effect of 2027

Convertible Notes(4) |

7,246 |

|

|

|

|

— |

|

|

|

|

(1) |

Represents per

share calculations of adjustments reflected in the Company’s

reconciliation of GAAP net income to non-GAAP adjusted EBITDA and

therefore should be read in conjunction with that reconciliation

and respective footnotes. |

| |

|

| (2) |

Represents the accrued cash payable of the INDOCIN contingent

consideration for the respective period based on 20% royalty for

annual INDOCIN net sales over $20.0 million. |

| |

|

| (3) |

Represents the Company’s income tax expense adjusted for the

tax effect of pre-tax adjustments excluded from adjusted earnings.

The tax effect of pre-tax adjustments excluded from adjusted

earnings is computed at the blended federal and state statutory

rate of 25%. |

| |

|

| (4) |

The Company uses the if-converted method to compute adjusted

diluted earnings per share with respect to its convertible debt.

Under the if-converted method, the Company assumes the 2027

Convertible Notes were converted at the beginning of each period

presented. As a result, interest expense and any adjustments

recognized in net income for the 2027 Convertible Notes is added

back to net income used in the diluted earnings per share

calculation. Additionally, the diluted shares used in the diluted

earnings per share calculation includes the dilution effect of the

2027 Convertible Notes. |

|

|

|

RECONCILIATION OF GAAP NET INCOME and GAAP NET INCOME PER

SHARE TONON-GAAP ADJUSTED EARNINGS and ADJUSTED

EARNINGS PER SHARE(1)(in

thousands, except per share

amounts)(unaudited) |

| |

|

|

|

| |

Nine Months Ended September 30, 2022 |

|

Nine Months Ended September 30, 2021 |

|

|

Amount |

|

Diluted EPS(4) |

|

Amount |

|

Diluted EPS |

|

Diluted net income (loss) per share (GAAP) |

21,072 |

|

|

0.42 |

|

|

(5,887 |

) |

|

(0.14 |

) |

| Add: Interest Expense on

convertible debt, net of tax(4) |

487 |

|

|

0.01 |

|

|

— |

|

|

— |

|

| Adjustments |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

24,438 |

|

|

0.48 |

|

|

20,939 |

|

|

0.49 |

|

|

Legacy products revenue reserves |

1,290 |

|

|

0.03 |

|

|

976 |

|

|

0.02 |

|

|

Stock-based compensation |

5,116 |

|

|

0.10 |

|

|

2,596 |

|

|

0.06 |

|

|

Contingent consideration fair value change |

6,845 |

|

|

0.14 |

|

|

1,902 |

|

|

0.04 |

|

|

Restructuring charges |

— |

|

|

— |

|

|

1,089 |

|

|

0.03 |

|

|

Other |

700 |

|

|

0.01 |

|

|

554 |

|

|

0.01 |

|

|

Contingent consideration cash payable(2) |

(9,213 |

) |

|

(0.18 |

) |

|

(4,443 |

) |

|

(0.10 |

) |

|

Income taxes expense, as adjusted(3) |

(7,294 |

) |

|

(0.14 |

) |

|

(5,903 |

) |

|

(0.14 |

) |

| Adjusted earnings

(Non-GAAP) |

43,441 |

|

|

0.85 |

|

|

11,823 |

|

|

0.27 |

|

| |

|

|

|

|

|

|

|

| Diluted shares used in

calculation(4) |

50,470 |

|

|

|

|

42,550 |

|

|

|

| Dilution effect of 2027

Convertible Notes(4) |

2,442 |

|

|

|

|

|

|

|

|

(1) |

Represents per

share calculations of adjustments reflected in the Company’s

reconciliation of GAAP net income to non-GAAP adjusted EBITDA and

therefore should be read in conjunction with that reconciliation

and respective footnotes. |

| |

|

| (2) |

Represents the accrued cash payable of the INDOCIN contingent

consideration for the respective period based on 20% royalty for

annual INDOCIN net sales over $20.0 million. |

| |

|

| (3) |

Represents the Company’s income tax expense adjusted for the

tax effect of pre-tax adjustments excluded from adjusted earnings.

The tax effect of pre-tax adjustments excluded from adjusted

earnings is computed at the blended federal and state statutory

rate of 25%. |

| |

|

| (4) |

The Company uses the if-converted method to compute adjusted

diluted earnings per share with respect to its convertible debt.

Under the if-converted method, the Company assumes the 2027

Convertible Notes were converted at the beginning of each period

presented. As a result, interest expense and any adjustments

recognized in net income for the 2027 Convertible Notes is added

back to net income used in the diluted earnings per share

calculation. Additionally, the diluted shares used in the diluted

earnings per share calculation includes the dilution effect of the

2027 Convertible Notes. |

| |

|

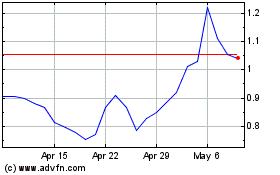

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2024 to May 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From May 2023 to May 2024