Ascent Solar Technologies, Inc. Announces Second and Third Closings of Public Offering of Common Stock and Pre-Funded Warrants at $0.14 Per Share

19 April 2024 - 7:11AM

Ascent Solar Technologies, Inc. (“Ascent Solar” or the “Company”)

(NASDAQ: ASTI), a U.S. innovator in the design and manufacturing of

featherweight, flexible thin-film photovoltaic (PV) solutions,

today announced the second and third closings under its previously

announced “best efforts” public offering, at a per share offering

price of $0.14. 2,550,000 shares of common stock and 11,735,714

Pre-Funded Warrants, representing gross proceeds of $2 million

before deducting offering expenses, were sold in the final closing.

The Pre-Funded Warrants are immediately exercisable at a price of

$0.0001 per share of common stock and only expire when such

prefunded warrants are fully exercised. The Company previously

announced an initial closing under the offering that represented

gross proceeds of $3.09 million before deducting offering expenses

in gross proceeds. Aggregate gross proceeds from the offering

totaled $5.09 million before deducting offering expenses.

The net proceeds from of the second and third

closings of this offering (i) were utilized to pay $1.8 million to

purchase and cancel the remaining 2,798,116 warrants with a current

exercise price of $1.76 per share that were issued with our secured

notes issued in December 2022, and (ii) the balance will be used

for general and administration expenses and other general corporate

purposes.

As a result of the closings of the public

offering, the Company was able to repurchase and cancel a total of

5,596,232 warrants with an exercise price of $1.76 per share that

were issued with our secured notes issued in December 2022. The

repurchase of the warrants eliminated a substantial potential

future issuance of common stock at a substantially reduced price.

These warrants would have been adjusted in accordance with their

terms to provide for the purchase of 70,554,495 shares of the

Company’s common stock at an exercise price of $0.14, if they had

not been repurchased by the Company.

The Company believes that the repurchase of

these warrants, and the resulting elimination of potential future

ratchet adjustments of these warrants, will bring more certainty to

the Company’s capital structure and will assist the Company in

raising additional capital in the future.

Dawson James Securities, Inc. acted as the exclusive placement

agent for the offering.

Carroll Legal, LLC, Denver, CO, represented the

Company in connection with the offering, and ArentFox Schiff LLP,

Washington, DC, represented the placement agent.

This offering is being made pursuant to an

effective registration statement that has been filed with the U.S.

Securities and Exchange Commission (the “SEC”). The final

prospectus relating to the offering was filed with the SEC on April

12, 2024. The securities may only be offered by means of a

prospectus. Copies of the final prospectus may be obtained, when

available, at the SEC’s website at www.sec.gov or from Dawson James

Securities, Inc. Attention: Prospectus Department, 101 North

Federal Highway, Suite 600, Boca Raton, FL 33432,

investmentbanking@dawsonjames.com or toll free at 866.928.0928.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

About Ascent Solar Technologies, Inc.

Backed by 40 years of R&D, 15 years of

manufacturing experience, numerous awards, and a comprehensive IP

and patent portfolio, Ascent Solar Technologies, Inc. is a leading

provider of innovative, high-performance, flexible thin-film solar

panels for use in environments where mass, performance,

reliability, and resilience matter. Ascent’s photovoltaic (PV)

modules have been deployed on space missions, multiple airborne

vehicles, agrivoltaic installations, in industrial/commercial

construction as well as an extensive range of consumer goods,

revolutionizing the use cases and environments for solar power.

Ascent Solar’s research and development center and 5-MW nameplate

production facility is in Thornton, Colorado. To learn more,

visit https://www.ascentsolar.com or follow the Company on

LinkedIn and X (formerly Twitter).

Forward-Looking Statements

This press release contains “forward-looking

statements” as defined by the Private Securities Litigation Reform

Act of 1995 that involve risks and uncertainties. In some cases,

you can identify forward-looking statements by terms such as “may,”

“might,” “will,” “objective,” “intend,” “should,” “could,” “can,”

“would,” “expect,” “believe,” “design,” “estimate,” “predict,”

“potential,” “plan” or the negative of these terms and similar

expressions intended to identify forward-looking statements. These

statements include statements related to the intended use of

proceeds. Ascent Solar cautions readers that forward-looking

statements are based on management’s expectations and assumptions

as of the date of this news release and are subject to certain

risks and uncertainties that could cause actual results to differ

materially, including, but not limited to, risks related to

prevailing market conditions, the impact of general economic,

industry or political conditions in the United States, and Ascent

Solar’s ability to satisfy customary closing conditions associated

with the offering. Forward-looking statements reflect its analysis

only on their stated date, and Ascent Solar undertakes no

obligation to update or revise these statements except as may be

required by law.

Investor Relations

Contactir@ascentsolar.comMedia

ContactSpencer HerrmannFischTank

PRascent@fischtankpr.com

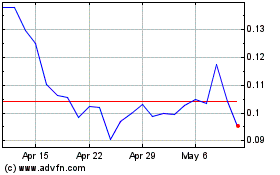

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

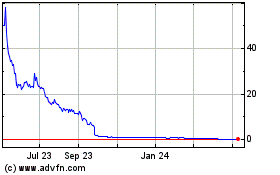

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Dec 2023 to Dec 2024