Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the

Company”), a leading Canadian producer of hot and cold rolled steel

sheet and plate products, today provided guidance for its fiscal

third quarter 2023. Unless otherwise specified, all amounts are in

Canadian dollars.

Fiscal third quarter 2023 total steel shipments

are expected to be approximately 455,000 tons and Adjusted EBITDA

is expected to be in a range of $(35) million to $(45) million.

Michael Garcia, the Company’s Chief Executive

Officer, commented, “The sequential decrease in steel shipments and

Adjusted EBITDA as compared to the fiscal second quarter 2023 is

largely due to lower than expected plate shipments, continued

softening in steel pricing, and normal seasonal maintenance

activities ahead of winter, which we discussed on our most recent

earnings call on November 8, 2022. Despite a return to more typical

levels of unfinished plate production, total plate shipments were

adversely impacted by temporary downstream finishing constraints as

we ramped up plate production. These impacts to Adjusted EBITDA

adversely offset the expected benefit of higher sequential

production volumes from the Direct Strip Production Complex

operations as compared to the fiscal second quarter 2023.”

Mr. Garcia continued, “We expect to produce

Adjusted EBITDA of $395 million to $405 million for the first nine

months of our fiscal 2023. I am pleased that the plate mill has

resumed normal production levels. We expect to return to more

normalized shipments in calendar 2023, and to apply the lessons

learned during phase one of the Plate Mill Modernization to our

future capital projects. This will reflect the more robust earning

power of Algoma. We remain laser focused on completion of our

transformative electric arc furnace project, which remains on

budget and on track to be producing steel in calendar 2024, as we

transition to being one of the greenest producers of steel in North

America.”

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

information” under applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively, “forward

looking statements”), including statements regarding Algoma’s

future as a leading producer of green steel, Algoma’s Adjusted

EBITDA guidance, estimated shipments for the third quarter of

fiscal 2023, expectations regarding the return to normalized plate

shipments and expectations of enhanced long-term profitability for

the business, Algoma’s ability to deliver long-term value creation

for all of its stakeholders and the timeline for completion of the

transformation to Electric Arc Furnace steelmaking. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this document, including but not

limited to: the risks that Algoma will be unable to realize its

business plans and strategic objectives, including its investment

in and transition to electric arc steelmaking; risks relating to

short-term absenteeism affecting production due to reduced

available operations workforce, as well as challenges of

commissioning new technology in an operating mill which, through

delays and other challenges, may impact volumes; the risks

associated with the steel industry generally; and changes in

general economic conditions, including as a result of the COVID-19

pandemic, inflation and the ongoing conflict in Ukraine. The

foregoing list of factors is not exhaustive and readers should also

consider the other risks and uncertainties set forth in the section

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Algoma’s Annual Report on Form 20-F

filed with the SEC (available at www.sec.gov), and the Ontario

Securities Commission (“OSC”) (available under Algoma’s SEDAR

profile at www.sedar.com), and in Algoma’s other public filings

with the SEC and the OSC. Forward-looking statements speak only as

of the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and Algoma assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Non-IFRS Financial

Measures

To supplement our financial statements, which

are prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(“IFRS”), we use certain non-IFRS measures to evaluate

the performance of Algoma. These terms do not have any standardized

meaning prescribed within IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing a further understanding

of our financial performance from management’s perspective.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS.

Adjusted EBITDA, as we define it, refers to net

(loss) income before amortization of property, plant, equipment and

amortization of intangible assets, finance costs, interest on

pension and other post-employment benefit obligations, income

taxes, foreign exchange loss (gain), finance income, carbon tax,

changes in fair value of warrant, earnout and share-based

compensation liabilities, transaction costs and share based

compensation related to performance share units. Adjusted EBITDA is

not intended to represent cash flow from operations, as defined by

IFRS, and should not be considered as alternatives to net earnings,

cash flow from operations, or any other measure of performance

prescribed by IFRS. Adjusted EBITDA, as we define and use it, may

not be comparable to Adjusted EBITDA as defined and used by other

companies. We consider Adjusted EBITDA to be a meaningful measure

to assess our operating performance in addition to IFRS measures.

It is included because we believe it can be useful in measuring our

operating performance and our ability to expand our business and

provide management and investors with additional information for

comparison of our operating results across different time periods

and to the operating results of other companies. Adjusted EBITDA is

also used by analysts and our lenders as a measure of our financial

performance. However, Adjusted EBITDA has limitations as an

analytical tool and should not be considered in isolation from, or

as an alternative to, net income, cash flow from operations or

other data prepared in accordance with IFRS. Because of these

limitations, Adjusted EBITDA should not be considered as a measure

of discretionary cash available to invest in business growth or to

reduce indebtedness. We compensate for these limitations by relying

primarily on our IFRS results using Adjusted EBITDA only as a

supplement to such results.

About Algoma Steel Inc.

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. With a current raw steel

production capacity of an estimated 2.8 million tons per year,

Algoma’s size and diverse capabilities enable it to deliver

responsive, customer-driven product solutions straight from the

ladle to direct applications in the automotive, construction,

energy, defense, and manufacturing sectors. Algoma is a key

supplier of steel products to customers in Canada and Midwest USA

and is the only producer of plate steel products in Canada. The

Company’s mill is one of the lowest cost producers of hot rolled

sheet steel (HRC) in North America owing in part to its

state-of-the-art Direct Strip Production Complex (“DSPC”), which is

the newest thin slab caster in North America with direct coupling

to a basic oxygen furnace (BOF) melt shop.

Algoma has achieved several meaningful

improvements over the last several years that are expected to

result in enhanced long-term profitability for the business. Having

upgraded its DSPC facility and recently installed its No. 2 Ladle

Metallurgy Furnace, Algoma is on a transformational journey,

modernizing its plate mill facilities and transitioning to electric

arc steelmaking, securing its future as a leading producer of green

steel.

Today Algoma is investing in its people and

processes, optimizing and modernizing to secure a sustainable

future. Our customer focus, growing capability and courage to meet

the industry’s challenges head-on, position us firmly as your

partner in steel.

For more information, please

contact:

Michael MoracaTreasurer & Investor

Relations OfficerAlgoma Steel Group Inc.Phone: 705.945.3300E-mail:

IR@algoma.com

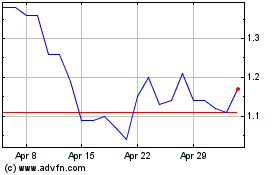

Algoma Steel (NASDAQ:ASTLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

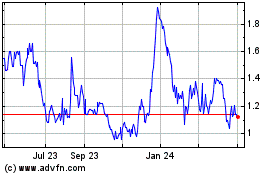

Algoma Steel (NASDAQ:ASTLW)

Historical Stock Chart

From Apr 2023 to Apr 2024