FALSE00013044923 Garret Mountain PlazaSuite 401Woodland ParkNJ00013044922024-12-262024-12-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 26, 2024

Anterix Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36827 | | 33-0745043 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

| | | | | | | | |

3 Garret Mountain Plaza Suite 401 Woodland Park, NJ | | 07424 |

| (Address of principal executive offices) | | (Zip Code) |

(973) 771-0300

Registrant’s telephone number, including area code

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of Each Exchange on which registered |

| Common Stock, $0.0001 par value | ATEX | The Nasdaq Stock Market LLC |

| | | (NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Executive Chairman Retirement

On December 26, 2024, the Board of Directors (the “Board”) of Anterix Inc. (the “Company”) accepted Morgan E. O’Brien’s retirement as a director, as Executive Chairman of the Board, and as an executive of Anterix, each effective as of December 31, 2024 (the “Retirement”). Mr. O’Brien’s Retirement is not the result of any disagreement with the Company on any matter related to its operations, policies or practices.

The Board also approved a Consulting Agreement with Mr. O’Brien under which he has agreed to provide consulting services to the Company for a minimum of six (6) months or one-hundred eighty-thousand US dollars ($180,000.00) beginning on January 1, 2025 through June 30, 2025 (“minimum term”), and continuing thereafter on a month-to month basis until terminated by either party (the “Consulting Agreement”). The Consulting Agreement provides that Mr. O’Brien will receive cash compensation of $30,000 per month. Either party may terminate the Consulting Agreement at any time upon fifteen (15) days notice, for any or no reason, provided that if the Company terminates the Consulting Agreement before June 30, 2025 without cause, then the Company will be required to pay the remaining balance of the one-hundred eighty-thousand US dollars ($180,000.00) Mr. O’Brien would have received for the minimum term had the Company not terminated the Consulting Agreement before June 30, 2025. The Consulting Agreement contains standard confidentiality, indemnification and intellectual property assignment provisions in favor of the Company. Pursuant to the existing terms of his outstanding equity awards, Mr. O’Brien will continue to vest in his outstanding equity awards as he continues to provide services to the Company pursuant to the Consulting Agreement.

The Consulting Agreement also contains a confirmation by Mr. O’Brien that he is not entitled to any severance benefits under the Company’s Executive Severance Plan as a result of his Retirement, his transition to a consultant or the eventual end of his consulting services. The Consulting Agreement also contains a confirmation by the Company that Mr. O’Brien has satisfied the retirement eligibility provisions in his outstanding stock option awards that automatically extends the exercise periods during which he may exercise his vested option shares to the full term of the applicable stock option award.

The foregoing summary of the Consulting Agreement is not complete and is qualified in its entirety by reference to the full text thereof, which the Company intends to file with the Securities and Exchange Commission as an exhibit to its quarterly report on Form 10-Q for quarter ending December 31, 2024.

Board and Utility Engagement Committee Chair Appointments

On December 26, 2024, the Board also appointed Thomas R. Kuhn, a current director and Vice Chair of the Board, as the Chairman of the Board (“Board Chair”), effective January 1, 2025. The Board also established the Utility Engagement Committee, a new Board committee, and appointed Mr. Kuhn as Chair of this new Board committee (the “Committee Chair”). The Utility Engagement Committee will be responsible for overseeing the Company’s relationships within the utility industry and assisting the Company in strengthening its relationships and commercialization efforts within the utility industry.

As a non-employee director of the Company, Mr. Kuhn will continue to receive compensation for his service as a non-employee member of the Board as described in the “Director Compensation” section of the Company’s 2024 Proxy Statement. In addition, for his service as Board Chair and Committee Chair, the Board, based on the recommendation of the Compensation Committee of the Board, awarded Mr. Kuhn a one-time stock option award to purchase 61,804 shares of the Company’s common stock at an exercise price of $31.25, the closing bid price of the Company’s common stock on the Nasdaq Stock Market on the December 26th grant date. The stock option award will cliff vest in full on December 26, 2027, subject to Mr. Kuhn’s continued service to the Company through such date.

The Company’s form of stock option award agreement for non-employee directors is filed herein as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01 Other Events.

On December 30, 2024, the Company issued a press release announcing Mr. Kuhn’s appointment as Board Chair and Committee Chair and Mr. O’Brien’s Retirement as described above, which is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | Non-employee Director Form of Notice of Grant of Stock Option and Stock Option Agreement under 2023 Stock Plan (filed as Exhibit 10.1 to the Current Report on Form 8-K filed with the SEC on January 4, 2023 and incorporated herein by reference (File No. 001-36827)). |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Anterix Inc. |

| | |

Date: December 30, 2024 | /s/ Gena L. Ashe |

| | Gena L. Ashe |

| | Chief Legal Officer and Corporate Secretary |

`

Anterix Announces Tom Kuhn as Chairman of the Board of Directors

as Morgan O’Brien Retires After More Than 12 Years on the Board

WOODLAND PARK, NJ, December 30, 2024 – Anterix (NASDAQ: ATEX) (“the Company”) announced today utility industry veteran Tom Kuhn as Chairman of the Anterix Board of Directors, effective January 1st, as the end of 2024 marks the anticipated retirement of Morgan O’Brien as Executive Chaiman of the Anterix Board after more than 12 years with the Company. O’Brien will continue as an advisor.

“Anterix and our nation’s utilities have benefited greatly from Morgan’s tremendous leadership and counsel during his tenure and his impact on the Company cannot be overstated," said Tom Kuhn, Vice Chairman of the Board. “I am honored to be named Chairman of the Board during this important time in the Company’s evolution and look forward to supporting the Company’s efforts to drive significant growth and value creation for the benefit of all Anterix stakeholders.”

“Morgan has been a true thought leader in our industry. On behalf of the Board and management team, I want to extend our sincere gratitude to him for his steadfast leadership and innovative vision,” said Scott Lang, Anterix President and Chief Executive Officer. “I also want to congratulate Tom on his new role, and I look forward to working with him and the rest of the Board to realize the next chapter of the Company.”

“The last 12 years have been an amazing journey. As a result of the success Anterix has already achieved, the Company is well positioned to continue in its mission of transforming our nation's energy sector with the power of connectivity,” said Morgan O’Brien. “I am confident that under the leadership of Scott Lang and Tom Kuhn, the Company will achieve great results.”

Kuhn has served on Anterix’s Board of Directors since January 2024 and prior to that spent more than thirty years as President and CEO of the Edison Electric Institute (“EEI”), the trade association representing U.S. investor-owned electric utilities.

O’Brien has served as an executive leader with the company for more than 12 years in roles spanning from President and CEO of the Company to Executive Chairman of its Board of Directors.

About Anterix Inc.

At Anterix, we work with leading utilities and technology companies to harness the power of 900 MHz broadband for modernized grid solutions. Leading an ecosystem of more than 100 members, we offer utility-first solutions to modernize the grid and solve the challenges that utilities are facing today. As the largest holder of licensed spectrum in the 900 MHz band (896-901/935-940 MHz) throughout the contiguous United States, plus Hawaii, Alaska, and Puerto Rico, we are uniquely positioned to enable private LTE solutions that support cutting-edge advanced communications capabilities for a cleaner, safer, and more secure energy future. To learn more and join the 900 MHz movement, please visit www.anterix.com.

Shareholder Contact

Natasha Vecchiarelli

Vice President, Investor Relations & Corporate Communications

Anterix

973-531-4397

nvecchiarelli@anterix.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

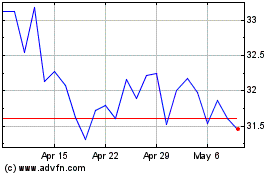

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

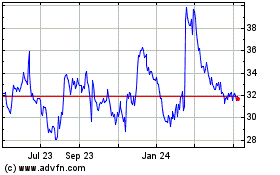

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Jan 2024 to Jan 2025