0001650101

false

--03-31

0001650101

2023-06-30

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act 1934

Date

of Report (Date of earliest event reported): June 30, 2023

ADDENTAX

GROUP CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41478 |

|

35-2521028 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

Kingkey

100, Block A, Room 4805

Luohu

District, Shenzhen City, China |

|

518000 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| |

|

|

| Registrant’s

telephone number, including area code: |

|

+(86)

755 8233 0336 |

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

ATXG |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.03 Material Modifications to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information regarding the Reverse Stock Split (as defined below) contained in Item

5.03 of this Current Report on Form 8-K is incorporated by reference herein.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Charter

Amendment and Reverse Stock Split

On

June 8, 2023, pursuant to the authority granted by the Company’s stockholders’ approval of the reverse stock split proposal

pursuant to the 2023 Annual Meeting of Stockholders on March 20, 2023, the Board determined to effect a reverse stock split of the shares

of the Company’s common stock at a ratio of 1-for-10 (the “Reverse Stock Split”) and authorized the filing of a Certificate

of Amendment to the Company’s Articles of Incorporation (the “Amendment”), to effect the Reverse Stock Split. On June

9, 2023 and June 23, 2023, the Company filed the Certificate of Amendment and Certificate of Correction, respectively, with the Nevada

Secretary of State to effect the Reverse Stock Split. The Amendment became effective at 12:01 a.m. (Eastern Time) on June 30, 2023 (the

“Effective Time”).

As

a result of the Reverse Stock Split, every 10 shares of common stock outstanding immediately prior to the Effective Time were reclassified

and combined into one share of common stock, without any change in the par value of $0.001 per share or the total number of authorized

shares. Beginning with the opening of trading on June 30, 2023, the Company’s common stock was available for trading on the Nasdaq

Capital Market on a Reverse Stock Split adjusted basis with a new CUSIP number, 00653L301.

No

fractional share shall be issued in connection with the foregoing combination of the shares pursuant to the Reverse Stock Split. Stockholders

who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split will receive one whole share of

common stock in lieu of such fractional share.

The

text of the Amendment is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of the

Certificate of Amendment and Certificate of Correction filed stamped by the Nevada Secretary of State is filed as Exhibit 3.2 and 3.3,

respectively, to this Current Report on Form 8-K and is incorporated by reference herein.

The

Company’s transfer agent, Transfer Online, Inc., is acting as the exchange agent for the Reverse Stock Split. Stockholders who

hold their shares in book-entry form or in “street name” (i.e., through a broker, bank or other holder of record) are not

required to take any action. The Reverse Stock Split will affect all shareholders uniformly and will not alter any stockholder’s

percentage interest in the Company’s equity, except to the extent that the Reverse Stock Split would result in a stockholder owning

a fractional share.

The

foregoing description of the Amendment and does not purport to be complete and is qualified in its entirety by reference to the Amendment,

which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein. A copy of the full text of the

Amendment, stamped by the Nevada Secretary of State, is also filed as Exhibit 3.2 and 3.3 to this Current Report on Form 8-K.

Item

7.01 Regulation FD

On

June 29, 2023, the Company issued a press release regarding the Reverse Stock Split. A copy of the press release is furnished as Exhibit

99.1 to this Form 8-K and is incorporated by reference herein.

Item

9.01. Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

Addentax

Group Corp. |

| |

|

|

| |

By: |

/s/

Hong Zhida |

| |

Name: |

Hong

Zhida |

| |

Title: |

Chief

Executive Officer |

Dated:

June 30, 2023

Exhibit 3.1

Exhibit 3.2

Exhibit 3.3

Exhibit 99.1

Addentax

Group Corp. Announces 1-for-10 Reverse Share Split

SHENZHEN,

China, June 29, 2023 /PRNewswire/ — Addentax Group Corp. (“Addentax” or the “Company”) (Nasdaq: ATXG),

an integrated service provider focusing on garment manufacturing, logistics service, property management and subleasing, today announced

that the Company’s board of directors exercised its discretion to effect a 1-for-10 reverse split of its common stock shares (“Reverse

Stock Split”) on June 8, 2023 and is expected to become effective on June 30, 2023.

Upon

the effectiveness of the reverse share split, Addentax shareholders will receive one new common stock share of Addentax for every ten

shares they hold. Addentax’s common stock shares are expected to begin trading on a split-adjusted basis when the market opens

on June 30, 2023.

The

reverse share split is expected to lead Addentax’s common stock shares to trade at approximately ten times the price per share

at which it trades prior to the effectiveness of the reverse share split. Addentax, however, cannot assure that the price of its common

stock shares after the reverse split will reflect the 1-for-10 reverse split ratio, that the price per share following the effective

time of the reverse split will be maintained for any period of time, or that the price will remain above the pre-split trading price.

As

of June 29, 2023, there were 37,395,420 of Addentax’s common stock outstanding. Effecting the Reverse Stock Split will reduce that

amount to 3,739,542.

Treatment

of Restricted Shares

The

number of common stock shares into which Addentax’s outstanding restricted shares will be proportionally adjusted to reflect the

reverse split.

Fractional

Shares

Any

fractional shares that would have resulted because of the Reverse Split will be rounded up to the nearest whole share.

New

Stock Certificates

Addentax

will adopt a new stock certificate in connection with the implementation of the reverse share split. Addentax’s transfer agent,

Transfer Online, Inc., will manage the exchange of share certificates. Shareholders of record will receive a letter of transmittal providing

instructions for the exchange of their old certificates as soon as practicable following the effectiveness of the reverse split. Shareholders

should not send in their old stock certificates until they receive a letter of transmittal from Transfer Online, Inc. Shareholders who

hold their shares through a securities broker or nominee (i.e., in “street name”) will be contacted by their brokers or nominees

with any instructions.

For

more information, shareholders and securities brokers should contact Transfer Online, Inc. at +1 (503) 227-2950.

About

Addentax Group Corp.

Addentax

Group Corp. is an integrated service provider specializing in garment manufacturing, logistics services, property management, subleasing,

and epidemic prevention supplies. Its apparel manufacturing business includes sales to wholesalers and is based in China. The logistics

business, which includes delivery and express services, covers 79 cities in 7 provinces and 2 municipalities in China. The property management

and subleasing business provides relevant services to clothing wholesalers and retailers in the apparel market. The epidemic prevention

supplies business includes manufacturing and distributing quarantine products, as well as reselling supplies purchased from the third

parties in domestic and overseas markets. More information please visit the website: https://www.addentax.com/.

Safe

Harbor Statement

All

statements other than statements of historical fact in this announcement are forward-looking statements in nature within the meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks and uncertainties

and are based on current expectations and projections about future events and financial trends that the Company believes may affect its

financial condition, results of operations, business strategy and financial needs. Words or phrases such as “may,” “will,”

“expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,”

“believe,” “potential,” “continue,” “is/are likely to” or other similar expressions are

intended to identify such forward-looking statements. The Company undertakes no obligation to update forward-looking statements to reflect

subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company

believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations

will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results

and encourages investors to consider risk factors, including those described in the Company’s filings with the SEC, that may affect

the Company’s future results. All forward-looking statements attributable to the Company and its subsidiaries or persons acting

on their behalf are expressly qualified in their entirety by these risk factors. The forward-looking events discussed in this press release

and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially

and are subject to risks, uncertainties, and assumptions about us. We are not obligated to publicly update or revise any forward-looking

statement, whether as a result of uncertainties and assumptions, the forward-looking events discussed in this press release and other

statements made from time to time by us or our representatives might not occur.

Company

Contact:

Addentax

Group Corp.

Phone:

+ (86) 755 86961 405

Investor

Relations Contact:

Sherry

Zheng

Weitian

Group LLC

1-718-213-7386

shunyu.zheng@weitian-ir.com

v3.23.2

Cover

|

Jun. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 30, 2023

|

| Current Fiscal Year End Date |

--03-31

|

| Entity File Number |

001-41478

|

| Entity Registrant Name |

ADDENTAX

GROUP CORP.

|

| Entity Central Index Key |

0001650101

|

| Entity Tax Identification Number |

35-2521028

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Kingkey

100, Block A

|

| Entity Address, Address Line Two |

Room 4805

|

| Entity Address, Address Line Three |

Luohu

District

|

| Entity Address, City or Town |

Shenzhen City

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

518000

|

| City Area Code |

+(86)

|

| Local Phone Number |

755 8233 0336

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

ATXG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

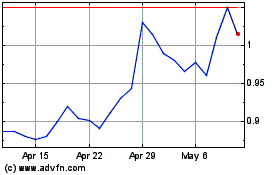

Addentax (NASDAQ:ATXG)

Historical Stock Chart

From Apr 2024 to May 2024

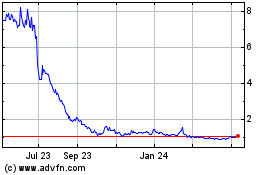

Addentax (NASDAQ:ATXG)

Historical Stock Chart

From May 2023 to May 2024