0001534120false12/3100015341202023-12-282023-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2023

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-37590 | | 45-0705648 |

| (Commission File Number) | | (IRS Employer Identification No.) |

540 Gaither Road, Suite 400, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (410) 522-8707

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modifications to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information set forth in Item 5.03 is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Avalo Therapeutics, Inc. (the “Company”) filed a Certificate of Amendment to its Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Amendment”), with the Secretary of State of Delaware for the purpose of effecting a reverse stock split (the “Reverse Stock Split”) of the outstanding shares of the Company’s common stock at a ratio of one (1) share for every two hundred forty (240) shares outstanding, so that every two hundred forty (240) outstanding shares of common stock before the Reverse Stock Split represent one (1) share of common stock after the Reverse Stock Split. The Reverse Stock Split, which was approved by our stockholders at the annual meeting of stockholders held on December 20, 2023, was effective at 5:00 p.m. on December 28, 2023.

Immediately prior to the Reverse Stock Split, there were approximately 192,386,419 shares of common stock outstanding. After the Reverse Split, there will be approximately 801,611 shares outstanding. Each stockholder’s percentage ownership interest in the Company and proportional voting power will remain unchanged after the Reverse Stock Split except for minor changes and adjustments resulting from rounding of fractional interests. No fractional shares will be issued in connection with the Reverse Stock Split. Each stockholder who would otherwise be entitled to receive a fraction of a share of the Company’s common stock will instead receive one whole share of common stock. Because the Certificate of Amendment did not reduce the number of authorized shares of common stock, the effect of the Reverse Stock Split was to increase the number of shares of common stock available for issuance relative to the number of shares issued and outstanding. The Reverse Stock Split did not alter the par value of the common stock and the rights and privileges of the holders of common stock are unaffected by the Reverse Stock Split other than any impact on proportional voting power due to rounding up of fractional shares.

The Reverse Stock Split was effected primarily to enable the Company to meet the continued listing criteria for Nasdaq’s Capital Market.

The Company’s transfer agent, Equiniti Trust Company, LLC (“EQ”), will serve as the exchange agent for the Reverse Stock Split and will provide instructions to stockholders of record regarding the Reverse Stock Split. EQ will be issuing, automatically and without the need for stockholder action, all of the post-split shares in paperless, “book-entry” form and EQ will hold the shares in an account set up for the stockholder. Those stockholders holding common stock in “street name” will receive instructions from their brokers.

Pursuant to their terms, a proportionate adjustment will be made to the per share exercise price and number of shares issuable under all of the Company’s outstanding options and warrants, and the number of shares authorized and reserved for issuance pursuant to the Company’s equity incentive plan will be reduced proportionately.

Copies of the Certificate of Amendment and the press release reporting the Reverse Stock Split are attached to this Current Report on Form 8-K as Exhibits 3.1 and 99.1, respectively.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 3.1 | | |

| | |

| 99.1 | | |

| | |

| 104 | | The cover pages of this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | AVALO THERAPEUTICS, INC. |

| | | |

| Date: December 28, 2023 | | By: | /s/ Christopher Sullivan |

| | | Christopher Sullivan |

| | | Chief Financial Officer |

CERTIFICATE OF AMENDMENT

TO

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED

OF

AVALO THERAPEUTICS, INC.

The undersigned, for purposes of amending the Amended and Restated Certificate of Incorporation, as amended (the “Certificate”), of Avalo Therapeutics, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify as follows:

FIRST: Article IV of the Certificate is hereby amended by adding the following Section D:

“D. The issued and outstanding Common Stock of the Corporation, $0.001 par value, shall, at 5:00 p.m., Eastern Standard Time, on December 28, 2023 (the “2023 Effective Time”), be deemed to be “reverse stock split,” and in furtherance thereof, there shall, after the 2023 Effective Time, be deemed to be issued and outstanding one (1) share of the Common Stock of the Corporation for and instead of each two hundred forty (240) shares of the Common Stock of the Corporation issued and outstanding immediately prior to the 2023 Effective Time. Shares of Common Stock that were outstanding prior to the 2023 Effective Time and that are not outstanding after the 2023 Effective Time shall resume the status of authorized but unissued shares of Common Stock. To the extent that any stockholder shall be deemed after the 2023 Effective Time as a result of this Amendment to own a fractional share of Common Stock, such fractional share shall be deemed to be one whole share.

Each stock certificate that, immediately prior to the 2023 Effective Time, represented shares of Common Stock shall, after the 2023 Effective Time, represent that number of whole shares of Common Stock into which the shares of Common Stock represented by such certificate shall have been reclassified (as well as the right to receive a whole share in lieu of any fractional share of Common Stock as set forth above); provided, however, that each holder of record of a certificate that represented shares of Common Stock prior to the 2023 Effective Time shall receive, upon surrender of such certificate, a new certificate representing the number of whole shares of Common Stock into which the shares of Common Stock represented by such certificate shall have been reclassified, as well as any whole share in lieu of a fractional share of Common Stock to which such holder may be entitled pursuant to the immediately preceding paragraph.”

SECOND: Except as expressly amended herein, all provisions of the Certificate filed with the Office of the Secretary of State of the State of Delaware on May 17, 2018, and amended on April 27, 2017, December 26, 2018, August 26, 2021 and July 5, 2022, shall remain in full force and effect.

THIRD: That said amendment was duly adopted by the Board of Directors and the stockholders of the Corporation in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

FOURTH: That the Corporation’s number of shares of authorized capital stock of all classes, and the par value thereof, shall not be changed or affected under or by reason of said amendment.

FIFTH: That said amendment shall be effective at 5:00 p.m., Eastern Standard Time, on December 28, 2023.

IN WITNESS WHEREOF, the undersigned, being a duly authorized officer of the Corporation, does hereby execute this Certificate of Amendment to the Amended and Restated Certificate of Incorporation, as amended, this 22nd day of December 2023.

| | | | | | | | |

| | AVALO THERAPEUTICS, INC. | |

| | | |

| By: | /s/ Christopher Sullivan | |

| Name: | Christopher Sullivan | |

| Title: | Chief Financial Officer | |

Avalo Therapeutics Announces 1-for-240 Reverse Stock Split

WAYNE, PA and ROCKVILLE, MD, December 27, 2023 — Avalo Therapeutics, Inc. (Nasdaq: AVTX) today announced a 1-for-240 reverse stock split of the Company’s common stock, par value $0.001, which will be effective at 5:00 pm Eastern Time on December 28, 2023. The Company’s common stock will trade on the Nasdaq Capital Market on a split-adjusted basis beginning on December 29, 2023, under the Company’s existing trading symbol “AVTX”.

The Company is implementing the reverse stock split as planned to increase the per share price of its common stock to regain compliance with the listing requirements of the Nasdaq Capital Market. The new CUSIP number following the reverse stock split will be 05338F306.

The reverse stock split will affect all stockholders uniformly and will not alter any stockholder’s percentage ownership interest in the Company, except to the extent that the reverse stock split results in any of the Company’s stockholders owning a fractional share as described below.

The reverse stock split will reduce the number of shares of common stock issued and outstanding from approximately 192,386,419 to approximately 801,611. No fractional shares will be issued in connection with the reverse stock split. Each stockholder who would otherwise be entitled to receive a fraction of a share of the Company’s common stock will instead receive one whole share of common stock.

As of the effective date of the reverse stock split, the number of shares of common stock available for issuance under the Company’s equity incentive plans and issuable upon the exercise of stock options and warrants outstanding immediately prior to the reverse stock split will be proportionately affected by the reverse stock split. The exercise prices of the Company’s outstanding options and warrants will be adjusted in accordance with their respective terms.

There will be no change to the number of authorized shares or the par value per share.

Equiniti, LLC (“EQ”) is acting as the exchange agent for the reverse stock split and will provide instructions to stockholders of record regarding the reverse stock split. EQ will be issuing, automatically and without the need for stockholder action, all of the post-split shares in paperless, “book-entry” form, and EQ will hold the shares in an account set up for the stockholder. Those stockholders holding common stock in “street name” will receive instructions from their brokers.

About Avalo Therapeutics

Avalo Therapeutics is a clinical stage biotechnology company focused on the treatment of immune dysregulation by developing therapies that target the LIGHT-signaling network.

LIGHT and its signaling receptors, HVEM (TNFRSF14), and lymphotoxin β receptor (TNFRSF3), form an immune regulatory network with two co-receptors of herpesvirus entry mediator, checkpoint inhibitor B and T Lymphocyte Attenuator (BTLA), and CD160 (the LIGHT-signaling network). Accumulating evidence points to the dysregulation of the LIGHT network as a disease-driving mechanism in autoimmune and inflammatory reactions in barrier organs. Therefore, we believe reducing LIGHT levels can moderate immune dysregulation in many acute and chronic inflammatory disorders.

Avalo has an experienced leadership team with decades of successful leadership in drug development in the biotech and pharma industry. The team is led by Dr. Garry Neil, MD, Chief Executive Officer and Chairman of

the Board, who brings a wealth of experience leading teams who have successfully brought drugs to the market, including serving as Group President, Pharmaceutical R&D and Corporate VP of Science & Technology at Johnson & Johnson. Additionally, Dr. Neil served as Chairman of the Board of Arena Pharmaceuticals Inc., which was acquired by Pfizer Inc. for $6.7 billion in March of 2022. Dr. Neil currently serves on the board of directors of Celldex Therapeutics.

For more information about Avalo, please visit www.avalotx.com.

Forward-Looking Statements

This press release may include forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond Avalo’s control), which could cause actual results to differ from the forward-looking statements. Such statements may include, without limitation, statements with respect to Avalo’s plans, objectives, projections, expectations and intentions and other statements identified by words such as “projects,” “may,” “might,” “will,” “could,” “would,” “should,” “continue,” “seeks,” “aims,” “predicts,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “potential,” or similar expressions (including their use in the negative), or by discussions of future matters such as: our ability to regain compliance with the listing requirements of the Nasdaq Capital Market; potential financing or other strategic transactions; the future financial and operational outlook; timing and success of trial results and regulatory review; potential attributes and benefits of product candidates; the development of product candidates or products; and other statements that are not historical. These statements are based upon the current beliefs and expectations of Avalo’s management but are subject to significant risks and uncertainties, including: Avalo's cash position and the need for it to raise additional capital in the near future; the results of our clinical and pre-clinical studies; drug development costs, timing and other risks, including reliance on investigators and enrollment of patients in clinical trials, which might be slowed by the COVID-19 pandemic; reliance on key personnel; regulatory risks; general economic and market risks and uncertainties, including those caused by the COVID-19 pandemic and the wars in Ukraine and the Middle East; and those other risks detailed in Avalo’s filings with the SEC. Actual results may differ from those set forth in the forward-looking statements. Except as required by applicable law, Avalo expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Avalo’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For media and investor inquiries

Christopher Sullivan, CFO

Avalo Therapeutics, Inc.

ir@avalotx.com

410-803-6793

or

Chris Brinzey

ICR Westwicke

Chris.brinzey@westwicke.com

339-970-2843

v3.23.4

Cover Page Document

|

Dec. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity Registrant Name |

AVALO THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37590

|

| Entity Tax Identification Number |

45-0705648

|

| Entity Address, Address Line One |

540 Gaither Road, Suite 400

|

| Entity Address, City or Town |

Rockville

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20850

|

| City Area Code |

410

|

| Local Phone Number |

522-8707

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

| Trading Symbol |

AVTX

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001534120

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

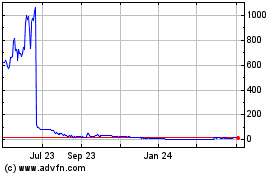

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

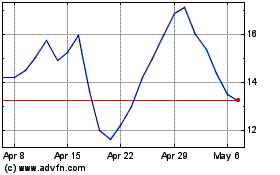

Avalo Therapeutics (NASDAQ:AVTX)

Historical Stock Chart

From Apr 2023 to Apr 2024