0000727207

false

0000727207

2023-07-06

2023-07-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

July 6, 2023 |

Accelerate Diagnostics, Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction

of incorporation)

| 001-31822 |

|

84-1072256 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 3950 South Country Club Road, Suite 470, Tucson, Arizona |

|

85714 |

| (Address of principal executive offices) |

|

(Zip Code) |

(520) 365-3100

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which

registered |

| Common Stock, $0.001 par value per share |

AXDX |

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As previously

reported, on January 5, 2023, the Company received a deficiency letter from the Listing Qualifications Department (the “Staff”)

of The Nasdaq Stock Market (“Nasdaq”) notifying the Company that, for the last 30 consecutive business days, the closing bid

price for the Company’s common stock had been below the minimum $1.00 per share requirement for continued inclusion on The Nasdaq

Capital Market (the “Capital Market”) pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”).

At that time, the Company was granted a period of 180 calendar days, or until July 5, 2023, to regain compliance with the Minimum Bid

Price Requirement.

On July 6,

2023, the Company received a determination letter from the Staff notifying the Company that it had not regained compliance with the Minimum

Bid Price Requirement as of July 5, 2023 in compliance with Nasdaq Listing Rule 5550(a)(2). Accordingly, the Staff has determined that

unless the Company files an appeal of this determination and timely requests a hearing before a Nasdaq Hearing Panel (the “Panel”),

the trading of the Company’s common stock will be suspended at the opening of business on July 17, 2023 and the Company’s

securities will be delisted from the Capital Market.

The Company

has requested a hearing before the Panel to appeal the Staff’s determination and present a plan to regain compliance with the Minimum

Bid Price Requirement. As part of the Company’s compliance plan to regain compliance with the Minimum Bid Price Requirement, the

Company will effect a reverse stock split, as described more fully below. The hearing request has stayed the suspension of the Company’s

securities or delisting actions pending the Panel’s decision and the expiration of any additional extension period granted by the

Panel following the hearing.

Notwithstanding,

there can be no assurance that the Panel will accept the Company’s compliance plan, that the appeal will be successful, that the

Company will be able to regain compliance with the Minimum Bid Price Requirement or that the Company will otherwise be in compliance with

other applicable Nasdaq Listing Rules. If the Company’s appeal is denied by the Panel or if the Company fails to regain compliance

with Nasdaq Listing Rules during any additional compliance period granted by the Panel, the Company’s common stock will be subject

to delisting from the Capital Market.

On July 10, 2023, the Company issued a press release

announcing that its Board of Directors (the “Board”) has approved a 1-for-10 reverse stock split (the “Reverse Stock

Split”) of the Company’s common stock. A copy of the press release is filed herewith as Exhibit 99.1 and is incorporated by

reference into this Item 8.01.

The Reverse Stock Split is expected to become effective

on July 11, 2023 at 5:00 p.m. ET (the “Effective Time”), with shares to begin trading on a split-adjusted basis at market

open on July 12, 2023. In connection with the Reverse Stock Split, every 10 shares of the Company’s common stock issued and outstanding

as of the Effective Time will be automatically converted into one share of the Company’s common stock. The Company’s stockholders

will be entitled to receive cash in lieu of any fractional shares they would otherwise be entitled to receive in the Reverse Stock Split.

As a result of the Reverse Stock Split, proportionate

adjustments will be made to the number of shares of the Company’s common stock underlying the Company’s outstanding equity

awards, warrants and convertible notes and the number of shares issuable under the Company’s equity incentive plans and other existing

agreements, as well as the exercise or conversion price, as applicable.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACCELERATE DIAGNOSTICS, INC. |

| |

(Registrant) |

| Date: July 10, 2023 |

|

| |

/s/ David Patience |

| |

David Patience |

| |

Chief Financial Officer |

Exhibit

99.1

Accelerate

Diagnostics Announces 1-for-10 Reverse Stock Split

TUCSON,

Ariz., July 10, 2023 /PRNewswire/ -- Accelerate Diagnostics, Inc., (NASDAQ:AXDX) (the “Company”) a leading provider

of innovative rapid diagnostic solutions, announced that it will conduct a reverse stock split of its outstanding shares of common stock

at a ratio of 1-for-10. The reverse stock split will become effective at 5:00 p.m. Eastern Time, on July 11, 2023. The Company’s

common stock will begin trading on a post-split basis at the market open on July 12, 2023, under the Company’s existing trading

symbol “AXDX”. The reverse stock split is part of the Company’s plan to regain compliance with the Minimum Bid Price

Requirement of $1.00 per share required to maintain continued listing on The Nasdaq Capital Market, among other benefits.

The

reverse stock split was approved by the Company's stockholders at the Company’s Annual Meeting of Stockholders held on May 19,

2023 to be effected in the Board’s discretion within approved parameters. The final ratio was approved by the Company's Board on

July 7, 2023.

The

reverse stock split reduces the number of shares of the Company’s outstanding common stock from approximately 144 million shares

to approximately 14 million shares, subject to adjustment due to the payment of cash in lieu of fractional shares. As a result of the

Reverse Stock Split, proportionate adjustments will be made to the number of shares of the Company’s common stock underlying the

Company’s outstanding equity awards, warrants and convertible notes and the number of shares issuable under the Company’s

equity incentive plans and other existing agreements, as well as the exercise or conversion price, as applicable. There will be no change

to the number of authorized shares or the par value per share.

Information

for AXDX Stockholders

As

a result of the reverse stock split, every ten pre-split shares of common stock outstanding will become one share of common stock. The

Company’s transfer agent, Broadridge Financial Solutions, Inc., will serve as the exchange agent for the reverse stock split.

Registered

stockholders holding pre-split shares of the Company’s common stock electronically in book-entry form are not required to take

any action to receive post-split shares. Those stockholders who hold their shares in brokerage accounts or in “street name”

will have their positions automatically adjusted to reflect the reverse stock split, subject to each broker's particular processes, and

will not be required to take any action in connection with the reverse stock split. Stockholders holding shares of the Company’s

common stock in certificate form will receive a transmittal letter from Broadridge with instructions as soon as practicable after the

effective date.

No

fractional shares will be issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive

fractional shares will receive a cash payment in lieu of such fractional shares.

About

Accelerate Diagnostics, Inc.

Accelerate

Diagnostics, Inc. is an in vitro diagnostics company dedicated to providing solutions for the global challenges of antibiotic

resistance and sepsis. The Accelerate Pheno® system and Accelerate PhenoTest® BC kit combine several technologies

aimed at reducing the time clinicians must wait to determine the most optimal antibiotic therapy for deadly infections. The FDA cleared

system and kit fully automate the sample preparation steps to report phenotypic antibiotic susceptibility results in approximately 7

hours direct from positive blood cultures. Recent external studies indicate the solution offers results 1-2 days faster than existing

methods, enabling clinicians to optimize antibiotic selection and dosage specific to the individual patient days earlier.

“Accelerate

Diagnostics” and diamond shaped logos and marks are registered trademarks of Accelerate Diagnostics, Inc.

For

more information about the company, its products and technology, or recent publications, visit axdx.com.

Forward-Looking

Statements

Certain

of the statements made in this press release are “forward-looking” or may have “forward-looking” implications

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, related to our future stock price, the effect of the reverse stock split on stockholders and compliance with listing

standards. Actual results or developments may differ materially from those projected or implied in these forward-looking statements.

Information about the risks and uncertainties faced by Accelerate Diagnostics is contained in the section captioned "Risk Factors"

in the company's most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 31, 2023,

and in other reports that the company files with the Securities and Exchange Commission. In addition, the company's forward-looking statements

could be affected by general industry and market conditions and regulatory approvals. You are cautioned not to place undue reliance on

these forward-looking statements, which are made only as of the date of this press release. Except as required by federal securities

laws, the company undertakes no obligation to update or revise these forward-looking statements to reflect new events, uncertainties

or other contingencies.

SOURCE

Accelerate Diagnostics, Inc.

For

further information: Investor Inquiries & Media Contact: Laura Pierson, Accelerate Diagnostics, +1 520 365-3100, investors@axdx.com

v3.23.2

Cover

|

Jul. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 06, 2023

|

| Entity File Number |

001-31822

|

| Entity Registrant Name |

Accelerate Diagnostics, Inc.

|

| Entity Central Index Key |

0000727207

|

| Entity Tax Identification Number |

84-1072256

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3950 South Country Club Road

|

| Entity Address, Address Line Two |

Suite 470

|

| Entity Address, City or Town |

Tucson

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85714

|

| City Area Code |

520

|

| Local Phone Number |

365-3100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

AXDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

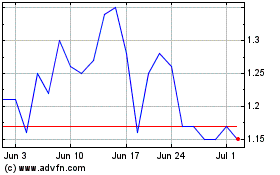

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Apr 2024 to May 2024

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From May 2023 to May 2024