0000805928false00008059282023-12-042023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2023

AXOGEN, INC.

(Exact Name of Registrant as Specified in Charter)

Minnesota

(State or Other Jurisdiction of

Incorporation or Organization)

001-36046

(Commission File Number)

41-1301878

(I.R.S. Employer Identification No.)

13631 Progress Boulevard, Suite 400 Alachua, Florida

(Address of principal executive offices)

(386) 462-6800

(Registrant's telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, $0.01 par value | AXGN | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Directors.

Appointment of Nir Naor as Chief Financial Officer

On December 6, 2023, Axogen, Inc. (the “Company”) announced the appointment of Nir Naor as Chief Financial Officer, effective December 4, 2023. In connection with Mr. Naor’s appointment as the Company’s Chief Financial Officer, the Company entered into an employment agreement with Mr. Naor effective December 4, 2023 (the “Employment Agreement”). As a material inducement of employment, Mr. Naor will be granted 300,000 non-qualified restricted stock units (the “RSUs”) on January 1, 2024. Shares representing 1/3 of the RSUs will vest on the one-year anniversary of the grant date and shares representing 1/6 of the RSUs will vest on each six-month anniversary thereafter. Pursuant to the Employment Agreement, Mr. Naor’s annual base salary is $475,000 and he is eligible to participate in the Company’s bonus plan with the target bonus being 60% of his annual base salary. Mr. Naor’s employment is at-will but if his employment is terminated without cause prior to March 31, 2025 (the “Initial Term”), Mr. Naor will be entitled to severance benefits, including continuation of his salary through the Initial Term, payment of any annual bonus Mr. Naor would have been entitled to through the Initial Term, subject to the Company achieving all applicable performance metrics under the bonus plan, and any RSUs that would have vested during the Initial Term shall become vested as of the date of such termination. If Mr. Naor is terminated for cause, he would not be entitled to severance benefits. The foregoing description of the Employment Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Employment Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference here.

Mr. Naor, 49, has over 20 years of global work experience in executive finance and accounting activities, primarily focused on the life sciences industry. From October 2022 to November 2023, Mr. Naor held advisory and short-term CFO roles at a number of growth companies. From December 2021 to October 2022, he served as the CFO of HMNC Brain Health while supporting their fund raising and IPO preparedness endeavors. From January 2021 to September 2021, he served as the CFO and supported the sale of Arbor Pharmaceuticals, a private equity backed company. From October 2017 to January 2021, he served as CFO U.S./Americas of Mölnlycke Healthcare. From October 2012 to July 2017, he held various roles with UCB (ENXTBR: UCB) in both Europe and the United States, including founding UCB’s Portfolio Management and Resource Allocation function, and later becoming their U.S. CFO. Earlier in his career, Mr. Naor held several finance leadership positions with AstraZeneca, served as a financial consultant and investment banker, worked as an auditor with KPMG, and practiced commercial law. Mr. Naor currently serves in advisory roles for several emerging life sciences and technology companies, and as a board member and audit committee chair of Brainstorm Cell Therapeutics (NASDAQ: BCLI).

Mr. Naor holds a Master of Business Administration from IMD Business School in Switzerland, a master’s degree in law (LL.M.) from Hamburg University in Germany, and bachelor’s degrees in law (LL.B.) and in accounting from the Tel-Aviv University in Israel. Mr. Naor is also a CFA® charterholder.

Mr. Naor does not have any family relationships with any director or executive officer of the Company, and there are no arrangements or understandings with any persons pursuant to which Mr. Naor has been appointed to his position. In addition, there have been no transactions directly or indirectly involving Mr. Naor that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

Departure of Peter Mariani as Chief Financial Officer

Effective upon Mr. Naor’s appointment, Peter Mariani stepped down from his role as the Executive Vice President and Chief Financial Officer of the Company and Axogen Corporation, a Delaware corporation (“AC”) and wholly owned subsidiary of the Company, at the request of the Board. The terms of Mr. Mariani’s separation remain under discussion but he will remain an employee of the Company for a brief transition period. The Company will file an amendment to this Current Report on Form 8-K once the separation terms are finalized. Mr. Mariani’s departure from the Company is not a result of any disagreement with the Company’s independent auditors or any member of management on any matter of accounting principles or practices, financial statement disclosure or internal controls.

Item 7.01 Regulation FD Disclosure.

On December 6, 2023, the Company issued a press release announcing the appointment of Nir Naor as the Company’s Chief Financial Officer and Mr. Mariani’s departure. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The Company also reaffirms its previously announced guidance for fiscal year 2023.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| (d) | Exhibits. | See the Exhibit index below, which is incorporated herein by reference. |

| | | | | |

Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AXOGEN, INC. |

| |

| Dated: December 6, 2023 | By: | /s/ Marc Began |

| | Marc Began |

| | Executive Vice President, General Counsel and Chief Compliance Officer |

1 Axogen Announces Transition of Finance Team Leadership Nir Naor Appointed CFO to Replace Peter Mariani as Company Aligns Executive Team with Financial Management Needs for Next Phase of Growth ALACHUA and TAMPA, Fla., Dec. 6, 2023 – Axogen, Inc. (NASDAQ: AXGN), a global leader in developing and marketing innovative surgical solutions for peripheral nerve injuries, today announced the appointment of Mr. Nir Naor as Chief Financial Officer, effective immediately. A senior finance executive with more than 20 years of experience primarily in the life sciences industry, he replaces Peter Mariani, who will depart Axogen following a brief transition period. The move aligns the executive team with the Company’s financial management and investor relations needs going forward as Axogen focuses on continued revenue growth across both business categories while driving toward being cash flow positive and profitable. “We determined with the Board of Directors that a change to our finance team leadership was in Axogen’s best interests as our strategic focus evolves,” said Karen Zaderej, the Company’s Chairman, President, and Chief Executive Officer. “Pete was integral in helping us build Axogen and our platform for product manufacturing and sales growth. We are grateful to him for his contributions as a dedicated member of our team. Looking ahead, we are confident that Nir brings strategic commercial and operational expertise to Axogen that is important to our next phase of growth and commercial execution.” “I am impressed by Axogen’s unique offering, market leadership, and potential. I am excited to join the Company and leverage my experience to support it in its growth and trajectory towards profitability,” said Mr. Naor. Mr. Naor has diverse finance and operations leadership experience with public and private pharma, life sciences, and medtech companies worldwide. In previous roles, he managed global organizations with up to $2.5 billion in sales and built top-performing finance & accounting, IR, legal, contracting & pricing, IT, and big data analytics functions. Mr. Naor has served as the CFO of Arbor Pharmaceuticals and supported its strategic pivot. He was also the CFO U.S. / Americas of Mölnlycke Healthcare, where he played a pivotal role in its growth and profitability improvement and was the founder of UCB’s global Portfolio Management and Resource Allocation function, as well as the company’s U.S. CFO. Earlier in his career, he held several finance leadership positions with AstraZeneca, served as a financial consultant and investment banker, worked as an auditor with KPMG, and practiced commercial law. He continues to advise and serve as a board member for emerging life sciences and technology companies. Mr. Naor holds a Master of Business Administration from IMD Business School in Switzerland, a master’s degree in law (LL.M.) from Hamburg University in Germany, and bachelor’s degrees in law (LL.B.) and in accounting from the Tel-Aviv University in Israel. Mr. Naor is also a CFA® charterholder.

2 In conjunction with the hiring of Mr. Naor, Axogen announced inducement grants under NASDAQ Listing Rule 5635(c)(4). Specifically, in connection with the commencement of his employment on Dec. 4, 2023, and as a material inducement of employment, he will be awarded an equity grant on Jan. 1, 2024, consisting of non-qualified restricted stock units (“RSUs”) representing 300,000 shares of the Company’s common stock. Shares representing 1/3 of the RSUs will vest on the one-year anniversary of the grant date, and shares representing 1/6 of the RSUs will vest on each six-month anniversary thereafter. The Company is maintaining full-year 2023 revenue guidance in the range of $154 million to $159 million, which represents annual growth of 11% - 15%. The Company anticipates that gross margin will be reduced with the continued transition to the new processing facility in the fourth quarter and continues to expect that gross margin for the full year 2023 will be approximately 80%. About Axogen Axogen (AXGN) is the leading Company focused specifically on the science, development, and commercialization of technologies for peripheral nerve regeneration and repair. Axogen employees are passionate about helping to restore peripheral nerve function and quality of life to patients with physical damage or transection to peripheral nerves by providing innovative, clinically proven, and economically effective repair solutions for surgeons and health care providers. Peripheral nerves provide the pathways for both motor and sensory signals throughout the body. Every day, people suffer traumatic injuries or undergo surgical procedures that impact the function of their peripheral nerves. Physical damage to a peripheral nerve, or the inability to properly reconnect peripheral nerves, can result in the loss of muscle or organ function, the loss of sensory feeling, or the initiation of pain. Axogen's platform for peripheral nerve repair features a comprehensive portfolio of products that are used across two primary application categories: scheduled, non-trauma procedures and emergent trauma procedures. Scheduled procedures are generally characterized as those where a patient is seeking relief from conditions caused by a nerve defect or surgical procedure. These procedures include providing sensation for women seeking breast reconstruction following a mastectomy, nerve reconstruction following the surgical removal of painful neuromas, oral and maxillofacial procedures, and nerve decompression. Emergent procedures are generally characterized as procedures resulting from injuries that initially present in an ER. These procedures are typically referred to and completed by a specialist either immediately or within a few days following the initial injury. Axogen’s product portfolio includes Avance® Nerve Graft, a biologically active off-the-shelf processed human nerve allograft for bridging severed peripheral nerves without the comorbidities associated with a second surgical site; Axoguard Nerve Connector®, a porcine submucosa ECM coaptation aid for tensionless repair of severed peripheral nerves; Axoguard Nerve Protector®, a porcine submucosa ECM product used to wrap and protect damaged peripheral nerves and reinforce the nerve reconstruction while

3 preventing soft tissue attachments; Axoguard HA+ Nerve Protector™, a porcine submucosa ECM base layer coated with a proprietary hyaluronate-alginate gel, a next- generation technology designed to provide short- and long-term protection for peripheral nerve injuries; and Axoguard Nerve Cap®, a porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma. The Axogen portfolio of products is available in the United States, Canada, Germany, the United Kingdom, Spain, South Korea, and several other countries. Cautionary Statements Concerning Forward-Looking Statements This press release contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include the statement maintaining full-year 2023 revenue guidance in the range of $154 million to $159 million, and the statement that the Company anticipates that gross margin will be reduced with the continued transition to the new processing facility in the fourth quarter, and continues to expect that gross margin for the full year 2023 will be approximately 80%. Actual results or events could differ materially from those described in any forward-looking statements as a result of various factors, including, without limitation, the continued impact of COVID-19, global supply chain issues, record inflation, hospital staffing issues, product development, product potential, expected clinical enrollment timing and outcomes, regulatory process and approvals, processing facility transition timing and expense, financial performance, sales growth, surgeon and product adoption, market awareness of our products, data validation, our visibility at and sponsorship of conferences and educational events, global business disruption caused by Russia’s invasion of Ukraine and related sanctions, as well as those risk factors described under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the most recently ended fiscal year and Part II, Item 1A., “Risk Factors,” for our Quarterly Report on Form 10-Q for the most recently ended fiscal quarter. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements.

4 Contact Information Investor Relations Axogen, Inc. Harold D. Tamayo htamayo@axogeninc.com 401-479-3408 Media Relations Russo Partners David Schull david.schull@russopartnersllc.com 858-717-2310

v3.23.3

Cover

|

Dec. 04, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 04, 2023

|

| Entity Registrant Name |

AXOGEN, INC.

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity File Number |

001-36046

|

| Entity Tax Identification Number |

41-1301878

|

| Entity Address, Address Line One |

13631 Progress Boulevard, Suite 400

|

| Entity Address, City or Town |

Alachua

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32615

|

| City Area Code |

386

|

| Local Phone Number |

462-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

AXGN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000805928

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

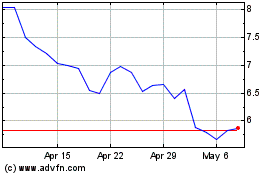

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

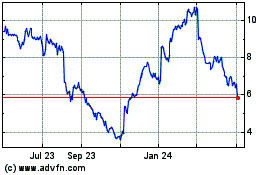

Axogen (NASDAQ:AXGN)

Historical Stock Chart

From Apr 2023 to Apr 2024